A Guide to Sole Trader Tax Deductions in the UK

As a sole trader, pretty much every penny you spend on running your business has the potential to lower your tax bill. Think of sole trader tax deductions as all the legitimate business costs you can subtract from your total income before working out what you owe HMRC. It means you’re only taxed on your profit, not your total turnover, which can make a huge difference to your final tax payment.

Your Guide to How Sole Trader Tax Deductions Work

Starting out as a sole trader throws you into a new world of managing your money, and getting your head around tax deductions is the first big hurdle.

Imagine your business income is a big bucket of water. Before HMRC comes along to take its share, you get to scoop out all the water you used just to keep the business running, things like fuel for the van or the cost of your website. The tax is only calculated on what’s left in the bucket.

That leftover amount is your taxable profit. The process of removing all those business costs is what we call claiming 'allowable expenses'. The more legitimate expenses you claim, the smaller your taxable profit gets, and the less tax you end up paying. It’s a simple but powerful idea that helps you keep more of your hard-earned cash where it belongs: with you.

The Golden Rule of Business Expenses

So, what makes an expense “allowable”? HMRC has one core principle that covers everything. To be deductible, the cost must be "wholly and exclusively" for business purposes. This is the ultimate test for every single purchase you think about claiming.

It's pretty straightforward for some things. A delivery driver buying diesel for their van is a classic example. A graphic designer paying for an Adobe Creative Cloud subscription is another. The entire reason for those costs is the business.

The impact of proper expense tracking can be massive. For instance, by carefully logging and deducting allowable expenses like software, home office costs, and marketing fees totalling £20,000, a sole trader with an £80,000 turnover could drop their taxable profit to just £60,000. That simple step could save them thousands in Income Tax and National Insurance Contributions, which you can read more about in this guide to sole trader tax.

Why Good Records are Non-Negotiable

Knowing the rules is one thing, but proving it is another. To successfully claim your tax deductions, you need solid proof, which is why brilliant record-keeping is your best friend. Without organised receipts, invoices, and bank statements, you’ve got nothing to back up your claims if HMRC decides to take a closer look.

From the very first day you start trading, get a simple system in place to capture every business expense. It’s a foundational step that makes sure when it’s time to file your Self Assessment tax return, you can confidently claim every deduction you're entitled to. It turns tax time from a mad, stressful scramble into a calm, straightforward job.

What You Can Actually Claim as a Business Expense

Alright, now that we’ve got the official "wholly and exclusively" rule out of the way, let's get down to the good stuff: what can you actually put on your tax return? The best way to make sure you're not leaving money on the table is to get familiar with all the potential tax deductions available to you.

Think of it like this: your business expenses are a collection of tools. Some, like office supplies, are the obvious ones you use every day. Others are more specialised and easy to forget about, but just as important. My goal here is to help you fill up that toolbox so you know exactly what to claim when you spend money on your business.

Let’s break down the most common (and a few often-missed) allowable expenses into simple, logical groups. This way, you can start spotting claimable costs as they happen, turning a tedious chore into a money-saving habit.

Office, Property and Equipment Costs

This is the bread and butter of your day-to-day operations. It covers all the nuts and bolts you need to get your work done, whether you’re in a swanky office, working from your van, or set up at the kitchen table.

Here’s a quick rundown of what usually falls into this bucket:

- Office Supplies: We're talking about everything from pens and notebooks to printer ink and stamps. If you buy it to help run the admin side of your business, it’s almost certainly an allowable expense.

- Business Premises: If you have a dedicated workspace, things like office rent, business rates, and utility bills (gas, electricity, water) are fully deductible.

- Phone and Broadband: You can claim for the business-use portion of your phone and internet bills. A good rule of thumb: if you reckon 50% of your internet use is for work, you can claim 50% of the monthly bill.

- Software and Subscriptions: Any software that’s essential for your business counts. This could be your accounting software like FreeAgent, project management tools like Trello, or specialised design software if you’re a creative.

These costs are the engine room of your business. Don't underestimate them, as every small purchase adds up, and tracking them properly can make a big difference to your tax bill at the end of the year.

Travel and Subsistence Expenses

If you have to travel for work, a whole new world of tax deductions opens up. The crucial thing here is that the trip must be for a specific business purpose, like visiting a client, meeting a supplier, or heading to a temporary workplace.

Common travel expenses you can claim include:

- Vehicle Running Costs: This covers the essentials like fuel, insurance, repairs, and servicing for your car or van. You claim a portion of these based on how much you use the vehicle for business.

- Public Transport: Train tickets, bus fares, and taxi rides for business journeys are all fair game.

- Accommodation: If you have to stay overnight for a business trip, the cost of your hotel or B&B is an allowable expense.

- Subsistence: You can also claim for the cost of meals while you're on that overnight business trip. Just be aware, you can’t claim for your daily lunch when you're working at your usual spot.

It's so important to get your head around the difference between commuting and business travel. Driving from your home to your permanent office every day? That's commuting, and you can't claim it. Driving to a client’s site for a one-off project? That's a business trip, and you absolutely can.

Marketing and Professional Development

Spending money to grow your business and sharpen your skills comes with some handy tax benefits, too. Think of these as investments in your future, both in getting more customers and in becoming better at what you do.

Here’s what you can claim:

- Advertising: The cost of running Google or Facebook ads, putting an advert in the local paper, or printing flyers is fully deductible.

- Website Costs: Anything you spend on your online presence counts, from domain names and web hosting to paying a developer to build your site.

- Professional Subscriptions: Your membership fees for trade bodies or subscriptions to industry magazines relevant to your work are allowable.

- Training Courses: You can claim for training that helps you maintain or update your existing skills. For instance, a photographer attending a workshop on advanced lighting techniques. What you can't claim for are courses that teach you a completely new skill for a new line of business.

Keeping your business in the public eye and your skills up to date isn't just good practice; it’s a tax-efficient way to invest in your long-term success. And if you have staff or use subcontractors, our guide on the reimbursement of expenses is a must-read for handling those payments correctly.

Legal and Financial Costs

Last but not least, don't forget the professionals you pay to keep your business running smoothly and legally. These are often forgotten but are perfectly legitimate deductions.

- Accountancy Fees: The money you pay your accountant to handle your books and file your tax return is a deductible expense.

- Professional Indemnity Insurance: Premiums for business insurance policies are allowable.

- Bank Charges: Those monthly fees and transaction charges on your business bank account can also be claimed.

By getting comfortable with these categories, you'll start to build a solid system for spotting and recording every single pound you spend. It’s this discipline that ensures you’re not only maximising your claims but doing it legally and effectively.

Simplified vs Actual Expenses: Which Route Should You Take?

As a sole trader, you'll inevitably face this classic crossroads, especially if you work from home or use your car for business. HMRC offers two distinct paths for claiming these expenses: the actual costs method (the traditional, detailed approach) and the much newer simplified expenses method (the quick-and-easy option).

So, what’s the difference? Think of it like this: one path involves meticulously tracking every single penny for a potentially larger tax deduction. The other is a straightforward, fixed-rate calculation that saves you a mountain of paperwork. Neither is inherently "better," as the right choice for you boils down to a simple trade-off between your time and the potential tax savings.

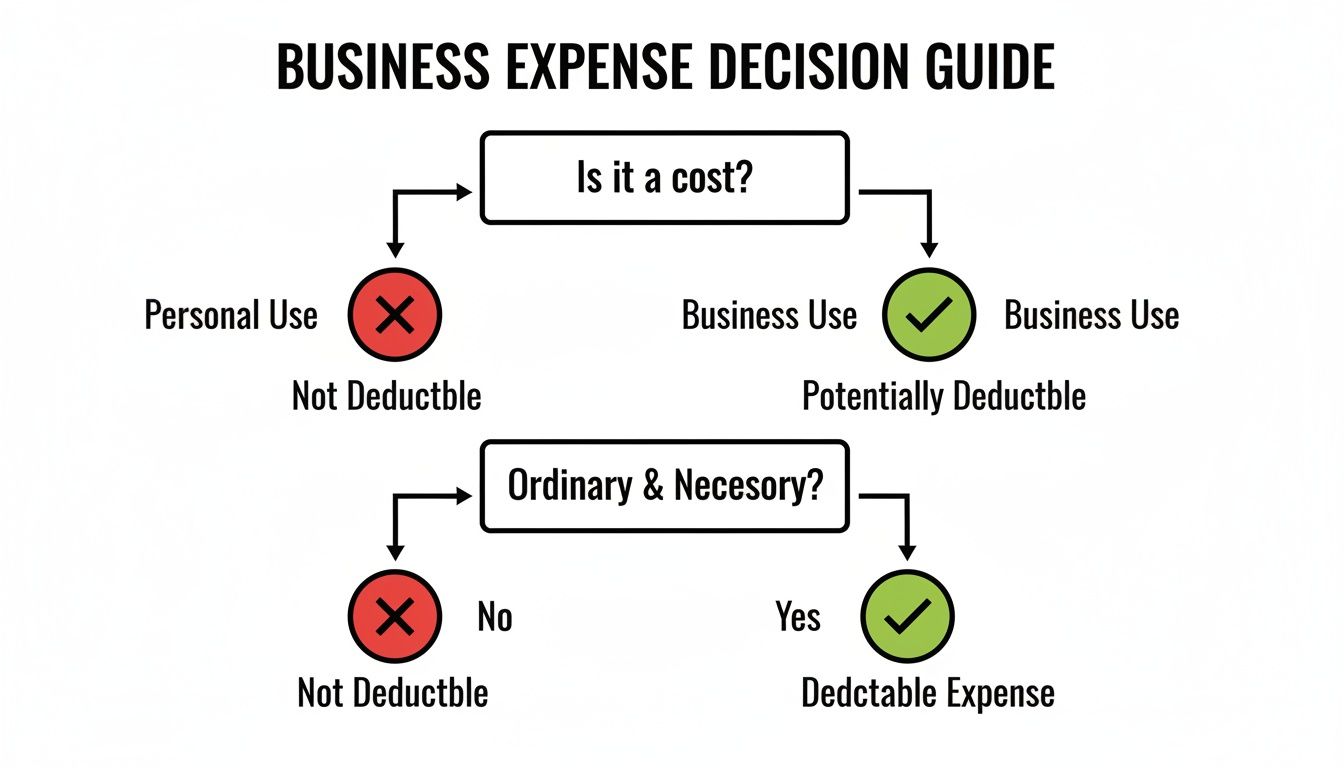

Before you can claim anything, though, you need to be sure it's a legitimate business cost. The first test is always the "wholly and exclusively" rule, which this flowchart breaks down nicely.

This is the fundamental question to ask yourself for every single purchase. It’s the gatekeeper that decides whether a cost can even be considered for a tax deduction.

What Are Simplified Expenses?

Simplified expenses are basically HMRC's way of saying, "Look, we know it's a faff to calculate the business use of your home WiFi, so here's a flat rate you can use instead." It’s a shortcut.

Instead of digging out utility bills or tracking every car repair, you just use a pre-agreed flat rate. It's designed to make life easier for the millions of sole traders out there by slashing the time spent on admin. For many, that time saved is far more valuable than the few extra quid they might have claimed by going the long way round.

Here are the current flat rates for using your home for business:

- £10 a month if you work 25 to 50 hours from home

- £18 a month if you work 51 to 100 hours from home

- £26 a month if you work 101 or more hours from home

And for vehicles, it’s all about mileage:

- 45p per mile for the first 10,000 business miles in your car or van

- 25p per mile after the first 10,000 miles

- 24p per mile for motorcycles

These mileage rates are designed to cover everything, including fuel, insurance, servicing, the lot. All you need is a clear log of your business journeys. Simple as that.

Getting to Grips with the Actual Costs Method

The other path is the actual costs method. This is the old-school approach where you track every relevant cost and then calculate the specific percentage that was for business.

For your home office, that means tallying up the year's gas, electricity, council tax, and mortgage interest bills. Then comes the tricky part: you have to work out a reasonable way to split the total between personal and business use. A common way is by using the number of rooms in your house or the floor area of your office.

It's the same principle for your vehicle. You'd add up all your real-world running costs, such as fuel, insurance, repairs, and MOTs, and then figure out the business portion based on your mileage log (e.g., if 40% of your total mileage was for business, you can claim 40% of the costs).

The actual costs method is definitely more work. There's no getting around it. But if your running costs are high, or a big chunk of your home is dedicated to your business, it can lead to a much bigger tax deduction. It’s a classic case of more effort for a potentially greater reward.

Simplified vs Actual Costs: Which Is Right for You?

So, how do you choose? It’s a head-versus-heart decision, really. Simplified expenses are fast, easy, and require very little proof. Actual costs demand forensic record-keeping but could genuinely slash your tax bill.

To make it clearer, let's put them side-by-side.

Simplified vs Actual Costs: Which Is Right for You?

Deciding between these two methods comes down to balancing convenience against potential tax savings. This table breaks down the key differences to help you figure out which approach best fits your business.

| Factor | Simplified Expenses | Actual Costs |

|---|---|---|

| Record-Keeping | Minimal effort. You just need to log your hours worked at home or your business miles. | High effort. You'll need to keep every relevant bill and perform detailed calculations. |

| Claim Amount | A fixed flat rate. This might be less than what you actually spent. | Based on your real spending. This could lead to a significantly larger deduction. |

| Best For | Sole traders who are short on time, have relatively low running costs, or just hate paperwork. | Anyone with high running costs or who uses a substantial part of their home or vehicle for business. |

My advice? If you're just starting, it's worth running the numbers for both methods in your first year. See which one leaves you better off. The great thing is that you aren't locked in; you can switch between the two from one year to the next, giving you the flexibility to pick the most valuable option for each tax return.

Capital Allowances vs. Day-to-Day Costs

Right, so far we’ve been talking about the everyday running costs, the stuff you spend money on just to keep the lights on and the business moving. But what about the bigger purchases? I’m talking about the assets you buy that are going to last you a good few years, like a powerful new laptop for your design work, a van for deliveries, or that specialist bit of kit for your workshop.

HMRC sees these larger items differently. You can’t just lump the full cost in with your regular expenses in the year you buy them. Instead, you get your tax relief through something called capital allowances.

Here’s a simple way to think about it. A regular expense is like buying a coffee to fuel your morning; you use it, it's gone. A capital asset is like buying the coffee machine itself. It’s going to serve you for years, slowly wearing out over time. Capital allowances are basically HMRC’s way of letting you deduct that depreciation against your profits.

How Do Capital Allowances Actually Work?

For most sole traders, the main thing you need to know about is the Annual Investment Allowance (AIA). Honestly, this is a brilliant bit of tax relief that makes life much simpler.

The AIA lets you write off 100% of the cost of most business assets in the year you buy them, up to a massive annual limit (currently £1 million). So, if you splash out £2,000 on a new camera for your photography business, you can almost always deduct the full £2,000 from your profits for that tax year.

This means you get the full tax benefit straight away, rather than having to spread it out. For the vast majority of sole traders, the AIA is more than enough to cover all their asset purchases.

The Other Side of the Coin: What You Can't Claim

Knowing what you can claim is only half the battle. Knowing what you can’t is just as important, and getting this wrong is a surefire way to get a query from HMRC. These are often called disallowed expenses.

The main reason something gets disallowed is that it fails that "wholly and exclusively" test we keep mentioning. It either has a personal element that you can't separate out, or it’s simply not seen as a true business cost.

Here are the usual suspects to watch out for:

- Client Entertaining: This is a big one. Taking a client for lunch or a coffee to talk business? Not claimable. HMRC views this as hospitality, and it’s a strict no-no for tax deductions.

- Everyday Clothing: You can't claim for a suit or normal clothes you wear for work, even if you only wear them for work. The only exceptions are proper uniforms or protective gear you wouldn't be seen dead in outside of your job.

- Your Normal Commute: The daily trip from your home to your main place of work is just commuting, not a business journey. You can’t claim the mileage or train fare for it.

- Fines and Penalties: Got a parking ticket on a job? Or a fine for filing your tax return late? Sorry, you can't claim for those.

- Charity Donations: While a fantastic thing to do, most donations aren't a business expense. The only slight exception is if it’s a small, local donation that could genuinely be argued as advertising.

Getting your head around this list helps you draw a firm line in the sand between what’s a business cost and what’s personal. It’s also vital when you’re dealing with VAT because if an expense is disallowed for tax, you generally can’t reclaim the VAT on it either. If you're ever unsure, our guide explains in detail if net figures should include VAT when you're logging your expenses.

Staying on the right side of HMRC’s rules isn’t about being clever; it’s about being clear. Once you understand that disallowed expenses are simply those that fail the "wholly and exclusively" test, you can avoid the common traps and file your tax return with a lot more confidence.

Making Tax Time Less Painful: A Guide to Keeping Great Records

Knowing what you can claim is only half the battle. The real trick to maximising your tax deductions is having the proof to back everything up. Honestly, great claims start with great records.

Let's be real: without a simple, repeatable system for tracking your expenses, your Self Assessment can quickly turn into a nightmare of lost receipts and missed savings. It’s time to ditch the overflowing shoebox. A digital-first approach isn't just a fancy trend; it's safer, faster, and will save you a massive headache come January.

What HMRC Actually Wants From You

HMRC isn't trying to catch you out, but they do have clear expectations. To prove the figures on your tax return are legitimate, you need to keep the evidence for every business transaction.

This proof usually boils down to:

- Records of all your business sales and income.

- Evidence for all your business expenses.

- Your VAT records if you’re VAT registered.

- PAYE records if you have any employees.

- Details of any other personal income you have.

For your expenses, the proof is typically a receipt, an invoice, or a bank statement. The golden rule is simple: if you want to claim it, you need proof you actually spent it.

HMRC requires you to keep your business records for at least five years after the 31st January submission deadline for that tax year. So, for the 2023-24 tax year (which you file by 31st Jan 2025), you need to hang onto those records until at least the end of January 2030.

That long retention period is exactly why the shoebox method is such a liability. Paper receipts fade, get lost, or end up as coffee coasters. A digital archive, on the other hand, is secure, searchable, and will be there when you need it.

Shifting to a Digital-First Mindset

Going digital with your records is the single best thing you can do to make tax season easier. It's also getting you ready for the future, as HMRC's Making Tax Digital (MTD) rules continue to roll out for more self-employed people.

Getting started is surprisingly simple. The aim is to create a digital copy of every receipt and invoice the moment it lands in your hands (or your inbox). This immediately cuts the risk of losing it and makes organising everything a doddle.

Modern tools can do all the heavy lifting for you, pulling out the important details automatically. This means less manual data entry and fewer chances for human error to creep in.

How Automated Tools Can Change the Game

Imagine a world where your receipts sort themselves out. That’s what automated tools do. They move you away from that last-minute, year-end panic and towards a state of calm, real-time organisation.

Here’s a quick look at how they typically work:

- Forward Your Receipts: You’re given a unique email address. When a digital receipt from Amazon or a software subscription hits your inbox, you just forward it on. You can even set up rules in Gmail or Outlook to do this automatically. It’s a set-it-and-forget-it system.

- The Magic Happens: The tool scans the email or PDF, intelligently extracts the key data such as the supplier, date, total, and VAT, and organises it for you. No more squinting at tiny print or typing things out.

- Safe and Sound: A digital copy of the receipt is stored securely in the cloud (think Google Drive), creating a searchable, HMRC-compliant archive.

- Links to Your Accounts: The best tools connect directly with accounting software like FreeAgent. The data and receipt image are pushed straight into your accounts and matched to the right bank transaction, just waiting for your quick approval.

This workflow takes the most boring parts of bookkeeping completely off your plate. A modern receipt scanning app can completely handle this, ensuring you capture every single claim you're entitled to.

By letting a tool do the work, you make sure no allowable expense ever gets missed because of a forgotten email or a crumpled bit of paper. It turns a job you dread into something that just happens in the background, giving you more time to focus on actually running your business.

Right, let’s get this tax return over the line. As the deadline looms, turning that mountain of receipts and invoices into a neatly filed Self Assessment can feel like a mammoth task. But a bit of last-minute organisation can make all the difference.

Think of this as your final pre-flight check before you hit that big ‘submit’ button on the HMRC website. It’s about making sure you’ve squeezed every last drop of tax relief you’re entitled to.

First up, a final sweep of your bank statements. Go through them month by month, with a fine-tooth comb. Match every payment going out of your business account to an expense you’ve already logged. You'd be amazed what you might have missed; that small software subscription, a professional membership renewal, or even just postage costs. They all add up.

Tidy Up and Finalise Your Claims

Once you're confident you’ve got everything, it's time to get organised. Sort all your costs into the right categories, like office supplies, travel, marketing, and so on. This isn't just about making the tax form easier to fill in; it gives you a brilliant snapshot of where your money is actually going.

Now’s the time to make a final call on a couple of key areas:

- Simplified vs Actual Costs: If you’ve been working from home or using your car for business, do the maths one last time. Work out what you can claim using HMRC’s simplified flat rates, then calculate it again using your actual costs (a portion of your bills, mileage logs, etc.). Which one saves you more money this year? Go with that one.

- Double-Check the No-Go Zone: Have a quick scan of your expenses for anything that’ll get a big red flag from HMRC. Remember, things like entertaining clients or buying your everyday work clothes are almost always disallowed. It’s far better to pull these out now than to have to explain them later.

It’s worth remembering that a little time spent checking everything now can save you a world of pain and potentially a fair bit of cash. The aim is to feel totally confident in the figures you’re about to send off.

The Final Once-Over Before Filing

Before you even think about submitting, do yourself a favour and pop a reminder in your calendar for the 31st January deadline. Missing it means an instant penalty, so don't get caught out.

Finally, give the whole tax return one last read. Are there any daft typos in your figures? Have you accidentally missed a section? This tiny step is your last chance to make sure all your hard work pays off and you’ve claimed every single penny back that you're legally entitled to. Job done.

Got Questions About Sole Trader Tax? We've Got Answers.

When you're self-employed, getting your head around tax deductions can feel a bit like learning a new language. It's totally normal to have questions. Here are some of the most common ones we hear, with straightforward answers to help you out.

Can I Claim For My Mobile Phone Bill?

Yes, definitely! But there’s a small catch: you can only claim for the business part. If you have a separate phone just for work, you can claim 100% of the contract and call costs. Easy.

Most people, though, use the same phone for everything. If that’s you, you’ll need to figure out what percentage of your use is for business. Have a look at your bills over a few months. If you reckon about 60% of your calls and data are for work, you can claim 60% of your monthly bill. Just be sure to jot down how you worked it out, in case HMRC ever wants to see your logic.

What's The Difference Between Capital Expenditure and a Regular Expense?

This one trips a lot of people up, but it's simpler than it sounds. A regular expense is just the day-to-day cost of keeping your business running, for example things like printer ink, postage, or your software subscriptions. You claim the full cost of these in the same tax year you buy them.

Capital expenditure is for the big stuff. It’s when you buy a major asset that will last your business for a while, like a new laptop, a van, or some specialised equipment. You don't just deduct the whole cost straight away. Instead, you claim tax relief over time through 'capital allowances'. That said, most sole traders can use the Annual Investment Allowance (AIA), which often lets you deduct the full value in the year you buy it anyway.

Think of it like this: a regular expense is like the fuel you put in your van (used up quickly), while the van itself is a capital asset (an investment that lasts for years). Getting this right is key to sorting your expenses correctly.

Do I Really Need to Keep Every Single Paper Receipt?

You absolutely need to keep proof of every expense, but that proof doesn't have to be a shoebox full of crumpled paper. HMRC is completely fine with digital copies.

In fact, going digital is much smarter. A clear photo or scan of a receipt is all you need. It’s safer too, as paper receipts fade and get lost, which means you lose out on a tax deduction. Using a digital system gives you a secure, searchable record of everything, which not only keeps HMRC happy but also makes your life a whole lot easier when it's time to do your tax return.

Stop drowning in a sea of unsorted emails and lost receipts. Receipt Router gives you a unique forwarding address to instantly digitise and organise every business expense. Forward a receipt, and our tool automatically extracts the data, archives the proof, and even syncs it with FreeAgent. Try it today and make tax time simple at https://receiptrouter.app.