UK Guide to Reimbursement of Expenses

Ever had to pay for a client coffee or a train ticket for work out of your own pocket? That's where expense reimbursement comes in. It's simply the process of your company paying you back for business-related costs you've covered yourself.

Think of it this way: you're essentially giving the business a short-term, interest-free loan. A proper reimbursement process makes sure you get that money back, and you're not left out of pocket for doing your job.

Understanding Expense Reimbursement and Why It Matters

At its heart, the idea is dead simple. Whether you're a self-employed contractor buying materials for a project or an employee travelling for a conference, you often have to pay for things upfront. The system for claiming those expenses back is what makes you financially whole again.

This isn't just about admin, though. It's fundamental to trust and financial wellbeing. For freelancers and contractors especially, getting that money back quickly is a massive deal for managing cash flow. Having to wait weeks, or even months, puts a real strain on your finances.

The Real Cost of Slow Reimbursements

Let's be honest, delays are more than just an inconvenience; they create genuine financial stress. When you're waiting on money you're owed, you might have to dip into your savings or whack it on a credit card, racking up interest while you wait. Suddenly, a standard business cost becomes your personal financial burden.

This isn't a rare problem, either. A recent survey found that slow reimbursement is a major source of financial strain for 43% of UK workers. It gets even worse for those who claim monthly, with a huge 66% feeling the pinch. Given the average employee spends £4,255 a year on business costs, these delays can force people to borrow from family or rely on credit. You can read the full research about these expense system failings to see just how big the issue is.

For both individuals and the businesses they work with, an efficient expense reimbursement system is a sign of a healthy financial relationship. It shows respect for the individual's contribution and ensures that business operations don't come at a personal cost.

Why a Smooth Process Is a Win-Win

When a business has a clear, fast, and reliable way of handling expenses, everyone wins. Employees and freelancers feel valued and aren't financially punished for doing their jobs. It's a huge morale booster and lets them focus on their actual work, not on chasing payments.

And for the business? An organised approach gives them a crystal-clear view of operational spending and makes bookkeeping a doddle. It puts an end to the last-minute scramble for receipts and ensures the records are spot-on for HMRC. At the end of the day, a great reimbursement process isn't just good admin; it's just good business.

Getting to Grips with HMRC's Rules on Business Expenses

Figuring out what you can and can't claim is the cornerstone of a good expense system here in the UK. Get it right, and you'll keep your tax affairs nice and tidy. Get it wrong, and you could be looking at a headache and potential penalties down the line. HMRC calls the shots, and while the rulebook can look a bit daunting, it all really boils down to a couple of core ideas.

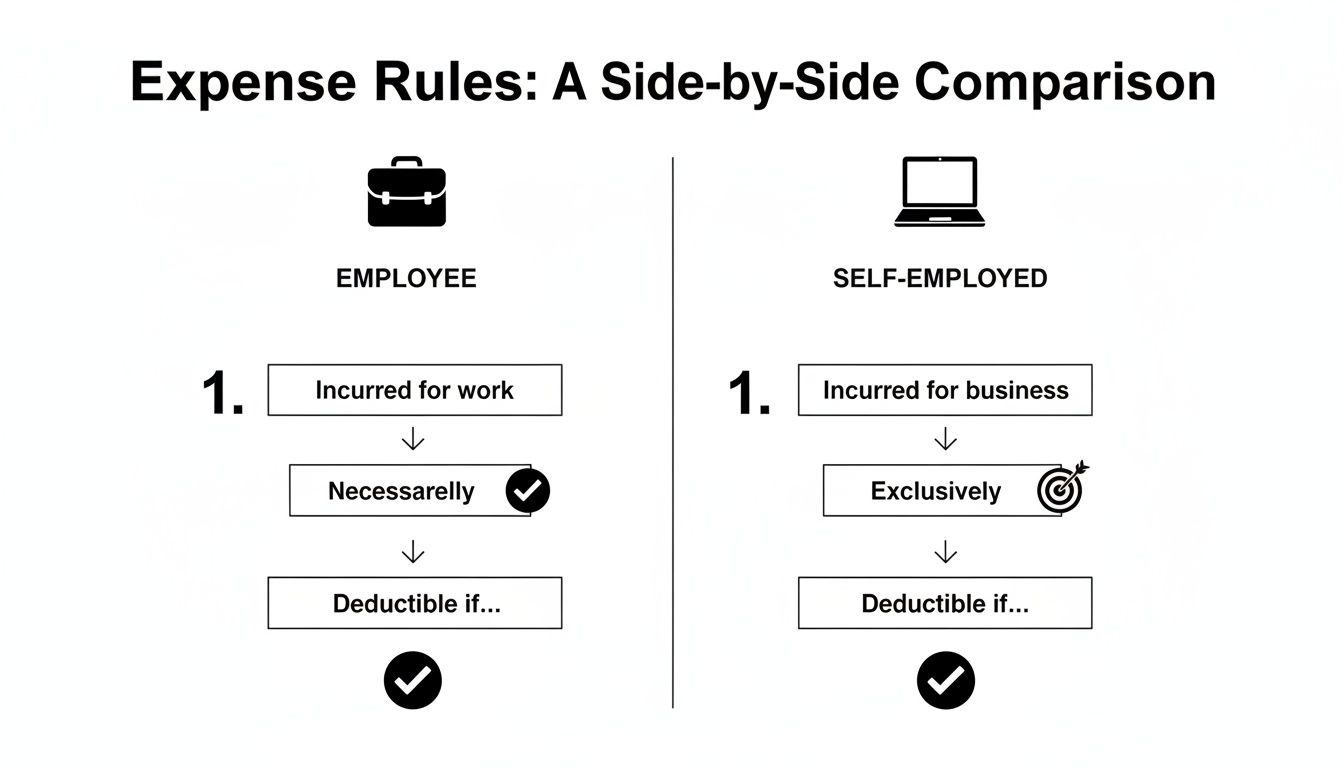

At the heart of it all are two slightly different tests, and which one applies depends on who you are. For employees, an expense has to be ‘wholly, exclusively, and necessarily’ for doing their job. For the self-employed crowd including freelancers and contractors, the rule is a bit more relaxed. The expense just needs to be ‘wholly and exclusively’ for the business.

That one little word, ‘necessarily’, changes the game completely. It means an employee can only claim for something they absolutely had to buy to do their job. A freelancer has a bit more breathing room, as long as the spend was purely for business.

The ‘Wholly and Exclusively’ Test for the Self-Employed

If you're a freelancer, contractor, or sole trader, this is your mantra. It simply means you can't claim for something that has a dual purpose that is partly for business, partly for you.

Think about it like this: you buy a brand new laptop. You use it 90% of the time for your freelance work, but that other 10% is spent binge-watching the latest series on Netflix. Technically, HMRC sees that as a dual-purpose expense. The good news is you can usually claim for the business portion of the cost, but you have to be ready to show your working out.

Here are a few classic examples of things that pass the test with flying colours:

- Office Supplies: Pens, paper, printer ink, and that software subscription you only use for work are all fair game.

- Travel Costs: That train ticket you bought to go and meet a client? A perfect example of a 'wholly and exclusively' business expense.

- Marketing: Paying for your website hosting, getting business cards printed, or running some online ads all fit neatly into this box.

The big question to ask yourself is, "Did I spend this money only for my business?" If the answer is a clear "yes," you're probably on solid ground. If there's a personal element involved, you need to tread carefully and be prepared to split the cost.

The Stricter ‘Wholly, Exclusively, and Necessarily’ Test for Employees

Employees have a tougher hurdle to clear. That word ‘necessarily’ means you literally couldn't do your job without it. It's not enough for an expense to be useful or make your life easier; it has to be an absolute must-have for your role.

For instance, an employee who buys a textbook to brush up on their skills is being proactive, but it’s probably not 'necessary' unless their boss specifically told them they had to buy it to perform their duties. On the flip side, if a staff photographer is told to travel to a specific location for a shoot, that travel cost is definitely necessary.

Common Scenarios and How HMRC Sees Them

This is where the theory meets reality, and things can get a bit blurry when business and personal life mix.

Working from Home Costs If you’re self-employed and your home is your office, you can claim for a slice of your household bills. You've got two options: use HMRC’s simplified flat rate (a fixed amount based on how many hours you work from home a month) or do the maths yourself and work out the actual business percentage of your bills like electricity, heating, and council tax.

Client Entertainment This one catches a lot of people out. Taking a client out for a coffee or lunch to talk business feels like a legitimate expense, right? Well, it is, but HMRC won't let you claim tax relief on it. It’s classed as client entertainment, which is a big no-no for tax deductions. You can still pay for it out of the business account, but you just won't get any tax back on it.

It's also super important to get the VAT on these expenses right. For a bit more on that, you'll need to know whether to record your costs as net or gross figures. Our guide on whether NET includes VAT breaks it down clearly and could save you a lot of hassle when logging your receipts.

How to Claim and Manage Your Expenses

Knowing the rules is one thing, but putting them into practice is where the real work begins. Let's get practical and walk through the different ways you can handle expense reimbursements, from old-school spreadsheets to slick, automated tools. The best choice for you will really come down to the size of your business, how many expenses you're juggling, and frankly, how much time you want to spend on admin.

The goal here is to find a system that makes claiming and managing expenses as painless as possible. A messy process isn't just a headache; it's a genuine business risk. A recent analysis highlighted just how slow manual systems can be: only 2.6% of claims were approved instantly, while a whopping 27% took over 30 days. It's no surprise that 87% of CFOs are now looking at automation to get things right. Late claims and missing receipts can throw your financial planning completely off course. You can dig into more of these expense management trends on CaptureExpense.com.

The Traditional Route: Working with an Accountant

For many freelancers and small business owners just starting out, the first step into proper expense management involves an accountant and a trusty spreadsheet. It’s the classic, manual approach that has worked for decades.

The process usually looks something like this:

- Collect Paper Receipts: You hang on to every single physical receipt for your business purchases, from train tickets to client lunches.

- Log in a Spreadsheet: You (or someone on your team) manually type the details of each expense into a spreadsheet, adding categories, dates, vendors, and amounts.

- Submit for Review: At the end of the month or quarter, you send off the spreadsheet along with a shoebox or envelope full of the matching receipts to your accountant.

- Accountant Reconciles: Your accountant then wades through everything, matching the receipts to your bank statements before filing it all correctly in your accounts.

While this method gets the job done, it's incredibly time-consuming and riddled with opportunities for human error. A single typo or a lost receipt can create a world of pain, turning the year-end reconciliation into something you dread.

Using Accounting Software: FreeAgent, Xero, and QuickBooks

Modern accounting software has completely changed the game for handling expenses. Platforms like FreeAgent, Xero, and QuickBooks bring the whole process into a slick, digital home.

Instead of a shoebox overflowing with receipts, you have a mobile app. The workflow is a breath of fresh air:

- Snap a Photo: The moment you get a receipt, you just take a picture of it with your phone using the accounting software’s app.

- Automatic Data Capture: Most apps use smart tech (Optical Character Recognition, or OCR) to automatically read the important details from the receipt. The vendor, date, and amount are all pulled out for you.

- Categorise and Submit: You give the details a quick once-over, pop the expense into the right category (like 'Travel' or 'Office Costs'), and hit submit.

This approach massively cuts down on manual data entry and keeps all your records neatly organised in one place. It gives you a real-time view of your spending, which means you can be much more proactive with your financial management.

Fully Automated Workflows with Receipt Router

The next step up in expense management is using tools that pretty much eliminate manual work altogether. This is where services like Receipt Router come in, and they're an absolute game-changer for freelancers and small businesses who get a lot of their receipts via email.

Just think about all those digital receipts that land in your inbox from suppliers like Amazon, Stripe, or your web hosting company. Instead of manually saving PDFs or forwarding emails one by one, an automated tool does all the heavy lifting for you.

The process is dead simple: You forward your receipt emails to a unique, dedicated address. The tool then automatically pulls out all the important data, finds the matching transaction in your accounting software (like FreeAgent), and attaches the receipt.

This "set it and forget it" approach means you never have to worry about a digital receipt getting lost in your inbox again. It’s especially brilliant for recurring subscriptions or frequent online purchases, making sure every single claim is captured accurately without you having to lift a finger. Having an organised digital system also makes it much easier to reconcile your bank statements, as every transaction already has its proof of purchase attached.

This image really highlights the different HMRC rules for employees versus the self-employed. The key thing to remember is the stricter 'necessarily' test for employees, which is a crucial detail to consider when picking the right management tool for your business setup.

Comparing Expense Management Methods

So, which path should you take? The right answer really boils down to your specific needs, how many expenses you handle, and what you value most including time, money, or simplicity. To help you decide, here’s a quick breakdown of the options.

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Accountant & Spreadsheet | Personalised advice from an expert; low initial tech cost. | Time-consuming; high risk of manual errors; slow process. | Very small businesses or freelancers with very few monthly expenses. |

| Accounting Software | Digital records; reduces errors; faster submission and approval. | Monthly subscription fee; requires setup and learning. | Most small to medium-sized businesses and active freelancers. |

| Fully Automated Tools | Saves the most time; eliminates manual entry; captures all digital receipts. | Additional subscription cost; works best with specific accounting platforms. | Businesses with high volumes of digital receipts or those wanting maximum efficiency. |

Ultimately, taking a step away from manual spreadsheets and towards a digital solution is a huge leap forward. Whether you go for an all-in-one platform like Xero or a specialised automation tool like Receipt Router, the end goal is the same: to make managing your expenses a smooth, accurate, and stress-free part of running your business.

Why UK Businesses Are Ditching the Shoebox for Digital Expenses

Let’s be honest, the days of stuffing faded receipts into a shoebox or a bulging wallet are thankfully numbered. Across the UK, businesses of all sizes, from solo freelancers to growing teams, are finally moving their expense management online. And for good reason.

This isn't just about being tidy. It’s a smart move to claw back precious time, cut out frustrating human errors, and get a crystal-clear, up-to-the-minute view of where the money is actually going. When your financial data is live and accurate, you can make better decisions, simple as that.

What’s Fuelling the Digital Switch?

So, what’s behind this big push? A massive driver is HMRC's Making Tax Digital (MTD) initiative. This requires most businesses to keep digital records and use compatible software for tax submissions. Suddenly, going digital with expenses isn't just a "nice-to-have", it's a core part of being compliant.

But it goes beyond just keeping the tax man happy. There's a widespread realisation that the old manual ways are just painfully inefficient. Think about it: typing up receipts in a spreadsheet, chasing your boss for approval, and then trying to match it all up with bank statements. It’s a soul-destroying time-sink that could be spent winning new clients or improving your services. Digital tools automate this entire headache.

This shift is turning the reimbursement of expenses from a dreaded administrative chore into a slick, data-led process. Staff get their money back faster, and the business gets a perfectly organised, real-time financial snapshot. Everyone wins.

Getting on Board with Modern Accounting Tools

Leading the charge are modern accounting platforms like FreeAgent, Xero, and QuickBooks. These have become the command centre for a company's finances, and expense claims are a huge part of that. Their mobile apps are brilliant. You can just snap a picture of a receipt the second you get it, and the software often uses clever tech to pull out the key details for you.

This approach brings some serious perks:

- See Everything in Real-Time: Know exactly what’s being spent, who’s spending it, and when. No more nasty surprises at the end of the month.

- Fewer Mistakes: Automation drastically cuts down on typos and the classic "lost receipt" drama.

- Quicker Payouts: Digital claims and approvals mean money gets back into your team's bank accounts much faster.

This move towards self-service digital tools is picking up speed. A recent Findity report found a 17% jump in UK employees managing their own expenses, the biggest increase in the world. At the same time, the use of expense apps grew by 4% as manual methods faded. It’s clear people want tools that are easy and efficient. You can dig into the details in the 2025 State of Expense Management report.

If you're thinking of making the switch, it’s a good idea to see what’s out there. Our guide on the best apps that track spending is a great place to start comparing the top options.

At the end of the day, going digital is about more than just tidying up your receipts. You're building a smarter, more efficient, and more resilient business that’s ready for the future.

Getting an Expense Policy Down on Paper

A clear, written expense policy is your secret weapon against confusion, arguments, and those dreaded compliance headaches. Think of it as the official rulebook for spending company money. If you don't have one, you're basically inviting inconsistent claims, overspending, and a whole lot of frustration for everyone involved.

This isn't about micromanaging people's every move. It’s about being upfront and fair, so everyone knows exactly what's what. It means every reimbursement of expenses is treated the same way, which protects the business and ensures your team feels they're on a level playing field. Honestly, a good policy is non-negotiable if you want things to run smoothly.

Why You Absolutely Need a Written Policy

When you write the rules down, there's no room for guesswork. When a team member is about to book a hotel or a contractor is eyeing up a new piece of software, they shouldn't have to wonder if it'll get signed off. A policy they can quickly check gives them the answer straight away.

That clarity is also your best friend when it comes to fairness. It makes sure every claim is measured against the same yardstick, so you don't accidentally end up favouring one person over another or getting into squabbles over what's "reasonable". It also gives the business a layer of protection by making sure every claim is above board with HMRC and fits within your budget.

The Key Ingredients of a Great Expense Policy

Creating a policy from scratch can feel like a bit of a slog, but it really just comes down to answering a few straightforward questions. You want to be specific enough to be helpful, but not so rigid that you can't handle the odd curveball real life throws at you.

Here’s a quick rundown of the must-haves for any decent expense policy:

- A Solid List of What's Covered: Spell out exactly what the company will pay for. Think travel (flights, trains, mileage), accommodation, meals out with clients, software subscriptions, and maybe even training courses.

- Sensible Spending Limits: Put clear caps on common expenses. For instance, you might set a per-night limit for hotels or a budget per person for team lunches. This avoids any awkward chats about a surprisingly fancy dinner after it's already been paid for.

- What Counts as Proof: Make it crystal clear what you need to see to pay a claim. This is almost always an itemised receipt showing who was paid, the date, and the total amount. Let people know if a photo from their phone is good enough.

- Deadlines for Claiming and Paying: Map out the whole process. How quickly do you expect claims to be submitted after the money is spent? And when can your team expect the cash back in their account? A 30-day window for submissions is a pretty common standard.

Keeping It Simple and Easy to Use

Look, the most brilliantly written policy in the world is useless if nobody reads it. Ditch the corporate jargon and complicated legal-speak. Use simple headings, bullet points, and plain English so people can find what they need in seconds.

Your expense policy shouldn't be a dusty document you write once and forget. It needs to be a living, breathing guide. Give it a once-over at least once a year to make sure it still makes sense for your business and is fair to your team.

And finally, for goodness sake, make it easy to find! Don't bury it in a random folder on the company server. Pop it in the employee handbook, link to it from your accounts software, and give new starters a heads-up during their first week. The easier it is to access, the more likely people are to follow it, making life simpler for everyone.

Got Questions About Expenses? We've Got Answers

When you're dealing with expenses, the same questions tend to pop up again and again. Getting the right answers is key to keeping your books clean and staying on the right side of HMRC. Let’s clear up some of the most common queries we hear from UK freelancers and small business owners.

How Long Do I Need to Hang Onto My Receipts?

This is a big one, and thankfully, HMRC's guidance is pretty clear. If you run a limited company, you must keep your records for six years from the end of the financial year they relate to.

For sole traders and partnerships, the rule is a little different. You need to keep records for at least five years after the 31st of January tax return deadline. So, for the 2023/24 tax year, you’d need to keep everything safe until at least 31 January 2030.

A quick tip from us: always digitise your receipts. A quick photo on your phone or using a tool like Receipt Router gives you a secure backup that won’t fade, get lost, or end up as a crumpled mess at the bottom of a bag.

What Are the Official HMRC Mileage Rates Right Now?

If you use your own car, van, or even bike for business journeys, you can claim a set amount per mile, completely tax-free. These are called Approved Mileage Allowance Payments (or AMAPs).

For the current tax year, the rates are:

- Cars and Vans: 45p per mile for the first 10,000 business miles, then it drops to 25p for every mile after that.

- Motorcycles: A flat rate of 24p per mile.

- Bicycles: 20p per mile (yes, you can claim for cycling!).

It's important to remember that these rates are designed to cover everything including fuel, insurance, servicing, and general wear and tear. You can't claim for those running costs separately if you're using the AMAP rates.

Can I Expense My Lunch When I'm Working From Home?

Ah, the classic WFH question! Unfortunately, the answer is almost always a no. HMRC’s stance is that you can’t claim for the cost of food and drink you have at home, even if you’re in the middle of a workday.

Their logic is pretty simple: you would have had to eat anyway, whether you were working or not. Because of that, the cost isn't considered "wholly and exclusively" for business. This is completely different from claiming for a meal when you're travelling for business away from your usual workplace, which is generally fine.

Is There a Time Limit for Submitting an Expense Claim?

While there's no law from HMRC that dictates when an employee must submit a claim, pretty much every company will have its own rules. It's common practice to set an internal deadline, often within 30 or 60 days of the money being spent.

This just helps the business keep its accounts accurate and up-to-date. If you’re a freelancer, your real "deadline" is your self-assessment tax return, but trust us, logging expenses as you go is a whole lot less stressful than a frantic scramble in January!

What's the Difference Between Reimbursable Expenses and a "Benefit in Kind"?

Getting this right is absolutely crucial for tax. A reimbursable expense is straightforward: the business is just paying you back for money you spent on its behalf. When it's a legitimate business cost, there’s no tax for you to pay on that money.

A benefit in kind, however, is something entirely different. It’s a non-cash perk that has a monetary value, like a company car you can use personally or private health insurance. These are treated as part of your income, so both you and your employer will likely have to pay tax and National Insurance on their value.

Tired of your inbox overflowing with receipts and invoices? Let Receipt Router take care of the admin for you. Forward your emails, and we'll automatically extract the data, match it in FreeAgent, and back everything up to your Google Drive. Stop chasing paper and start saving hours. Get started with Receipt Router today.