Does Net Include VAT? A Simple Guide for UK Businesses

So, you've seen a price labelled 'net' and you're wondering, does that include VAT? Let's clear this up right away: the answer is a simple no.

The net price is the base cost of something before any taxes, like VAT, are piled on top. Think of it as the price tag on the shelf. The gross price is the final, all-in figure you actually hand over at the till, which is the net amount plus the VAT.

What Net Versus Gross Really Means

Let's use a simple analogy. Imagine you're buying a new laptop.

The net price is the cost of the actual machine itself, including the screen, the keyboard, and all the tech inside. The VAT is an extra amount the government adds on. The gross price, then, is the total you pay, which covers both the laptop and the tax.

Getting your head around this is absolutely fundamental for any UK business. When you look at an invoice, the 'net' total is always the figure excluding VAT. This is super important for keeping your books straight, especially when you're using accounting software like FreeAgent.

And we're not talking about small change here. Total VAT receipts in the UK hit a massive £168 billion for the 2023-2024 period. That's a huge amount of money moving through the system, and you can dive into the numbers yourself in the latest HMRC VAT statistics on GOV.UK.

This basic concept underpins everything from how you bill your clients to how you claim back your expenses. Nail this, and you’re well on your way to keeping your accounts accurate and staying on the right side of HMRC.

To make it even clearer, here’s a quick breakdown.

Net vs Gross at a Glance

| Term | What It Means | Simple Example (£100 Net Item) |

|---|---|---|

| Net Price | The base cost of an item or service, before VAT is added. | £100.00 |

| VAT | Value Added Tax, a percentage added to the net price (standard rate is 20%). | £20.00 (20% of £100) |

| Gross Price | The final, total price you pay, which is the net price plus the VAT. | £120.00 (£100 + £20) |

This little table is a great reference to keep handy. It shows exactly how the numbers build up, turning that initial net price into the final gross figure you see on a receipt.

Decoding Your Invoices: Net, Gross, and VAT

Alright, you've got the basic answer, but let's dig a bit deeper so you can look at any invoice and know exactly what you're seeing. Getting your head around these terms is the first real step to mastering your business finances and keeping your bookkeeping watertight.

When a bill lands in your inbox, you'll almost always spot three core figures. These are the building blocks of pretty much every UK transaction, so it pays to get them straight.

The Three Key Invoice Terms

Think of these terms as a simple story that every invoice tells, starting from the basic price and ending with the final total you actually pay.

- Net Price: This is the starting point. It’s the core cost of the goods or services before any tax has been added.

- VAT (Value Added Tax): This is the tax that gets tacked on top. In the UK, the standard rate is 20%.

- Gross Price: This is the grand total, the final figure. It’s simply the net price with the VAT added on.

Understanding the difference isn't just about tidy bookkeeping. It directly impacts your cash flow and how you report your figures to HMRC. Get it wrong, and things can get messy.

Let's use a quick example. Say you hire a graphic designer for a new logo, and they quote you £1,000. That's the net price.

Because they're VAT-registered, they have to add 20% VAT, which is £200.

So, the final invoice you get will show a gross total of £1,200. Breaking down receipts like this is crucial. Thankfully, tools that offer FreeAgent integration can automate a lot of this headache for you, but knowing the fundamentals is key.

Right, let's get down to the nitty-gritty. Theory is one thing, but what you really need are the actual sums you can use day-to-day. This is the stuff you’ll use when you're knocking up an invoice or trying to figure out an expense receipt.

Getting these two simple formulas under your belt is a game-changer for your finances. It’s all about handling your money confidently and making sure every penny is where it should be.

Adding VAT: Going From Net to Gross

So, you’ve done the work, and now it’s time to send the invoice. You'll start with your price for the job (the net price) and then add the VAT on top.

In the UK, the standard VAT rate has been a solid 20% since way back in 2011, and it applies to most things you'd buy or sell. Just as a heads-up, the current threshold for having to register for VAT is £90,000 of taxable turnover in a year. You can always check the latest UK tax rates over at Trading Economics if you need to.

Here’s the ridiculously simple formula for working it out:

Net Price x 0.20 = VAT Amount

Once you have that VAT amount, you just tack it onto your net price, and that gives you the final (gross) total your client owes you.

Let’s say you’re invoicing for a project that was £500.

- £500 (Net) x 0.20 = £100 (VAT)

- £500 (Net) + £100 (VAT) = £600 (Gross Total)

Simple as that. The final figure on the invoice you send out is £600.

Finding the VAT: Going From Gross to Net

Working backwards is just as crucial. Picture this: you've just bought something for the business and you have a receipt. That total price (gross) has the VAT baked into it, and you need to figure out exactly how much that is so you can claim it back.

To pull the VAT out of a gross price, you just need to divide the total by 1.2. This little trick isolates the original net price before the VAT was added.

For example, imagine you bought some new software for £120. That’s your gross price.

- £120 (Gross) / 1.2 = £100 (Net Price)

- £120 (Gross) - £100 (Net) = £20 (VAT Amount)

And there you have it. You now know that your £120 purchase included £20 of VAT, which you can reclaim on your next VAT return. Nailing this bit of maths is key to making sure you're not leaving money on the table with HMRC.

How To Spot If A Price Includes VAT

Let's be honest, not every receipt or invoice you get is a masterpiece of clarity. Sometimes you have to do a bit of detective work to figure out if the price you're looking at includes VAT.

Getting good at this is a non-negotiable part of solid bookkeeping. It's how you ensure you have the proper proof HMRC demands when you want to reclaim VAT, which is a big deal for your cash flow.

Your Invoice Inspection Checklist

Start by giving the document a quick scan for a few key details. A legitimate VAT invoice has to include certain information by law, so what's there (or what’s missing) tells you everything you need to know.

Here’s what you're looking for:

- A VAT Registration Number: This is a 9-digit number, usually with a "GB" in front of it. If a supplier is registered for VAT, this number absolutely must be on their invoice.

- A Specific 'VAT' Line: Look for a line item that’s clearly labelled "VAT". This will show the tax amount separately from the subtotal (the net amount).

- Clear Wording: Hunt for phrases like "Total including VAT" or "VAT at 20%". This kind of language is a dead giveaway that the final figure is the gross price.

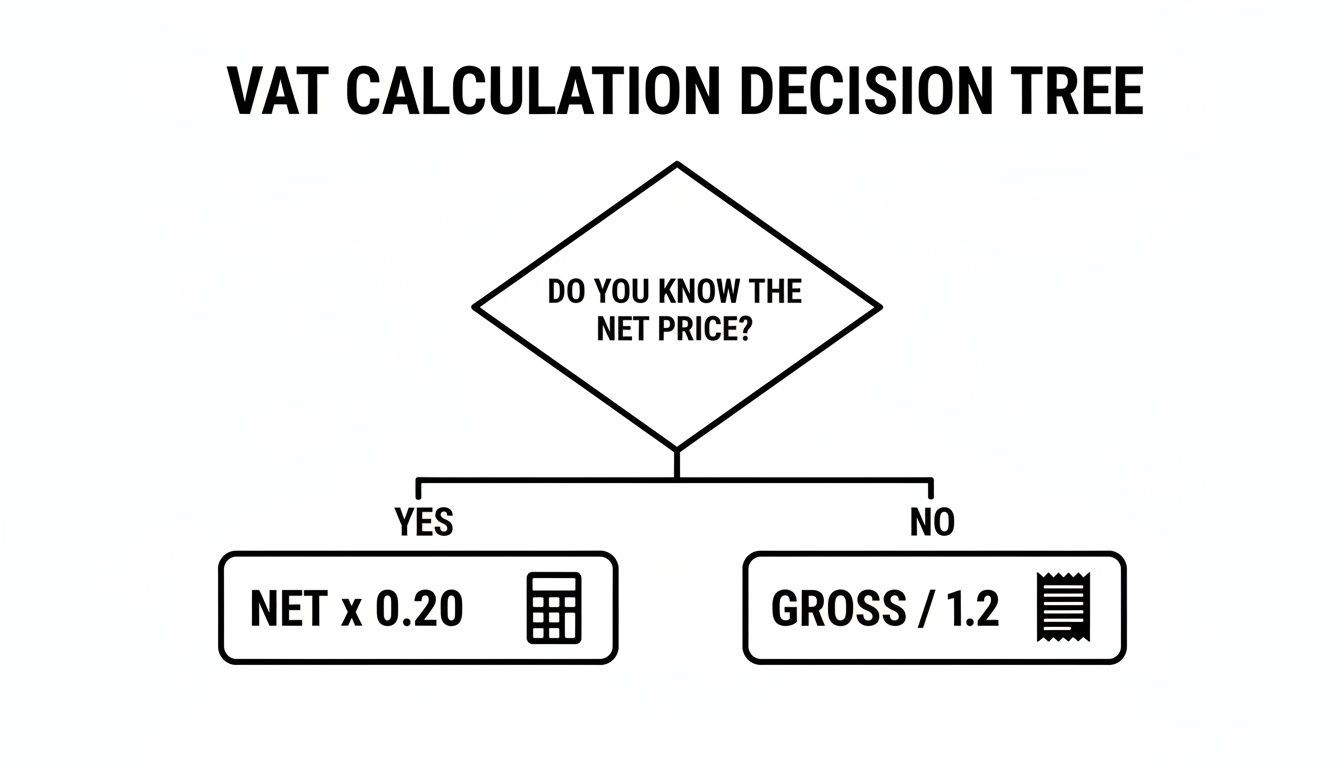

This handy little flowchart breaks down the two main calculations you’ll be doing, depending on what the invoice tells you.

As you can see, if you know the net price, adding the VAT is straightforward. If you only have the gross price, you just have to work backwards to find the VAT amount.

What if an invoice is vague or missing these details? Simple, just get in touch with the supplier. Just politely ask them to send over a full VAT invoice. You can't legally reclaim the VAT without it, so don't feel awkward about asking for what you need. If you're tired of chasing paperwork, you can automate a lot of this; check out the different Receipt Router pricing plans to see how tech can handle the grunt work.

Why This Matters For Your Business

Getting your head around net and gross prices isn't just a box-ticking exercise for your accountant. It genuinely affects your cash flow, your profit margins, and your final tax bill. This is true whether you’re VAT-registered or not, but how it impacts you is slightly different.

If your business is VAT-registered, splitting out these numbers correctly is absolutely fundamental. When you get a purchase invoice, you need to pinpoint the exact VAT amount on it. Why? Because that’s the money you can claim back from HMRC.

Every pound of VAT you properly identify and reclaim is a pound you don't have to pay in tax, which means more cash in your business's bank account. Simple as that.

How It Works in Practice

The game changes depending on your VAT status. What's a reclaimable tax for one business is just a straightforward cost for another.

-

For VAT-Registered Businesses: You claim back the VAT on things you buy. This means the net price is the real cost to your business, because you'll eventually get the VAT part back from the taxman.

-

For Non-VAT-Registered Businesses: You can't reclaim any VAT. So, for you, the gross price (the full amount you paid) is the actual cost. You have to record this total figure in your books to keep your expense records straight.

If you mix these up, your accounts will be wrong. A VAT-registered business that records the gross price is overstating its costs, while a non-registered business might get a nasty shock when they realise their profit margins aren't what they thought.

For lots of small businesses, especially those getting close to the registration limit, keeping an eye on the self-employed VAT threshold is a massive part of financial planning. It’s the trigger point for when you have to start charging and reclaiming VAT.

VAT rates themselves have changed over the years, from Geoffrey Howe’s big jump to 15% back in 1979, all the way to the 20% standard rate we’ve had since 2011. The one constant rule is that 'net' always means 'before tax'. It’s a simple principle that helps UK businesses stay on the right side of the rules. For a bit of background, you can read a brief history of VAT in the United Kingdom on Wikipedia.

Put Your Receipts on Autopilot and Ditch the Guesswork

Look, you can sit there and manually split the net and VAT on every single receipt. But honestly, who has the time for that? It's a fiddly job, and it’s ridiculously easy to make a mistake that could come back to bite you later.

A much better way to handle it is to simply automate the whole process. Forget about mind-numbing data entry and let technology do the heavy lifting for you.

This is exactly what tools like Receipt Router are built for. The idea is wonderfully simple: you just forward an email receipt from somewhere like Stripe, or snap a quick picture of a paper one on your phone. That's it. The tech takes over from there.

It scans the receipt, intelligently figures out the net, VAT, and gross amounts, and then pushes all that clean data straight into your accounting software, like FreeAgent. Just like that, the whole "does net include VAT?" headache disappears.

The real win here is the time you get back and the confidence that your numbers are spot on. You save yourself hours of tedious admin work and ensure every claimable expense is perfectly recorded and ready for your next VAT return. No more guesswork, no more errors.

Got a Question?

We get a lot of questions from freelancers and small business owners trying to get their heads around net, gross, and VAT. Here are a few common ones we hear all the time.

What Happens If I Accidentally Record the Gross Price as a Net Expense?

Ah, the classic mix-up. If you’re VAT-registered and you log a gross price (the full amount you paid) as a net expense, you're essentially inflating your business costs in your books.

This throws everything out of whack. It means you’ll calculate your VAT reclaim incorrectly, your profit figures will be wrong, and you could end up in a pickle with HMRC. It’s super important to split out the net and VAT amounts accurately from the get-go.

Do I Really Need a VAT Receipt for Every Single Expense?

In a word, yes. If you want to reclaim the VAT on a purchase, you absolutely must have a valid VAT receipt or invoice for it. It's not just good practice; it's the law.

The receipt needs to show the supplier's VAT number, the date, what you bought, and a clear breakdown of the net price, the VAT, and the gross total you paid.

Without that proper paper trail, you can't legally reclaim the VAT. This is exactly why staying on top of your receipts is one of the most important things you can do for your business finances.

Can I Charge VAT If I’m Not VAT Registered?

Nope, definitely not. It's illegal to charge VAT or even show a VAT amount on your invoices if your business isn't registered for VAT with HMRC. You should only ever bill your clients for the price of your work.

Once your turnover hits the VAT registration threshold, which is currently £90,000 in any 12-month period, you're legally required to register. Only then can you start adding VAT to your invoices.

Tired of squinting at receipts to separate net from gross? Let Receipt Router handle it. Our tool automatically pulls the right figures and pops them straight into FreeAgent, saving you a ton of time and keeping expensive mistakes at bay. Get started with Receipt Router today.