Self Employed VAT Threshold: When to Register

Right then, let's get into the nuts and bolts of the VAT threshold. If you're self-employed, the magic number you need to keep in your head is £90,000. This is the current self-employed VAT threshold.

Cross this figure in any rolling 12-month period, and you're legally required to register for VAT with HMRC. Simple as that.

Understanding The Current VAT Threshold

For a lot of freelancers and sole traders, figuring out VAT registration can feel a bit like trying to hit a moving target. It’s crucial to remember that it has nothing to do with your profit, nor does it line up neatly with the standard tax year. Instead, you have to constantly keep an eye on your total sales income over the last 12 months to make sure you're staying on the right side of the rules.

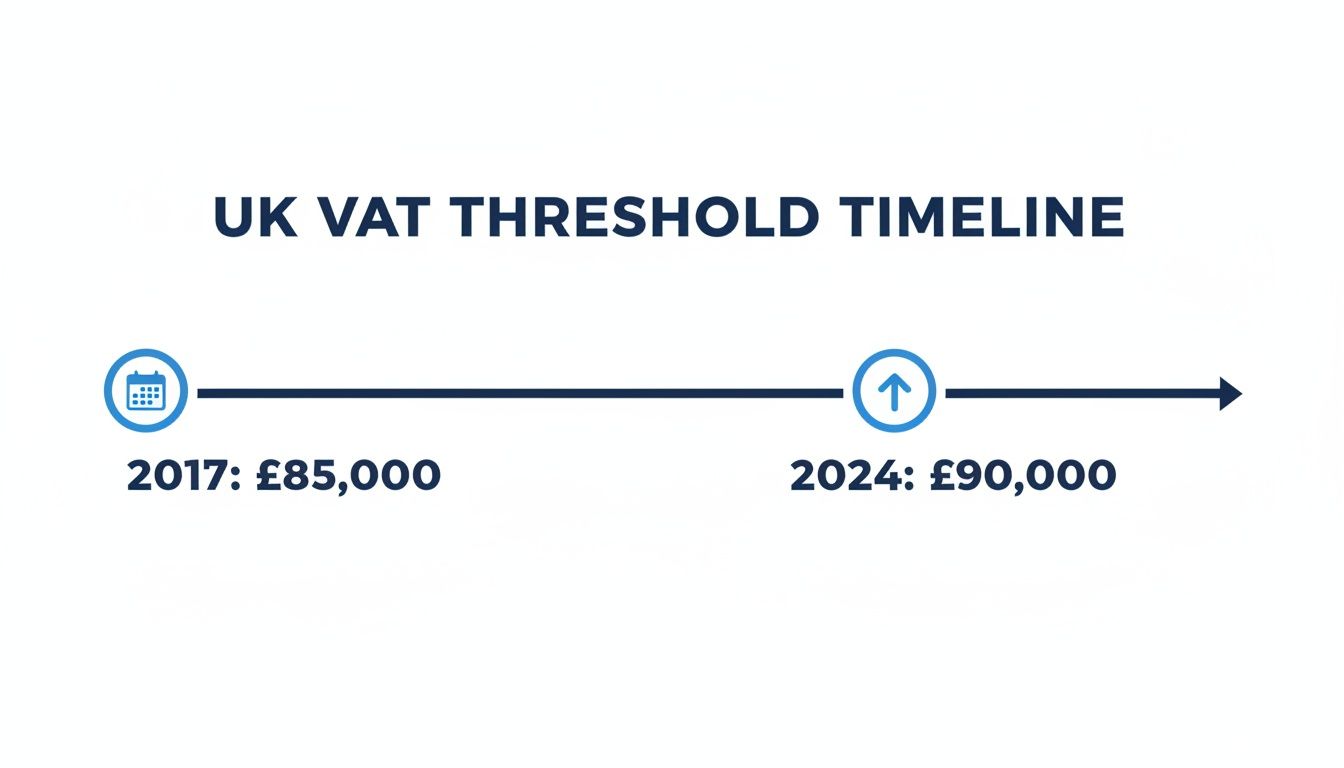

As of 1 April 2024, the government bumped the registration threshold up from £85,000 to £90,000. This was a pretty big deal. It was the first increase since 2017, in fact, and it put the UK's threshold at the joint highest in the OECD. The change was expected to let about 28,000 small businesses off the VAT hook. You can read the full details in the official government guidance on VAT thresholds.

To make things crystal clear, here’s a quick rundown of the key figures you need to know.

UK VAT Threshold Quick Reference

This table gives you a snapshot of the main VAT thresholds that apply to most self-employed people.

| Threshold Type | Turnover Amount | What It Means |

|---|---|---|

| VAT Registration | £90,000 | You must register if your taxable turnover in the last 12 months goes over this amount. |

| VAT Deregistration | £88,000 | You can ask to deregister if you're certain your turnover will stay below this for the next 12 months. |

Think of these numbers as the key markers on your business journey. Hitting the £90,000 mark means it's time to register, while dipping below £88,000 might give you an exit route if you choose to take it.

Getting Your VAT Taxable Turnover Calculation Right

Working out your VAT taxable turnover is the first, and most important, step to staying on the right side of HMRC. It’s simply the total value of everything you sell that isn't exempt from VAT. A common trip-up here is forgetting to include zero-rated items. Things like children's clothes or most food still count towards your total turnover, even though you don't actually charge VAT on them.

Don't make the mistake of aligning this with your business's financial year. VAT turnover works on a rolling 12-month basis. This means at the end of every single month, you need to look back over the previous 12 months and add up your sales. This is often called the 'historic' or 'backward look' test.

The VAT registration threshold is the magic number you're tracking against. It’s changed over the years, as you can see below.

For a long time, the threshold was frozen at £85,000. But in 2024, it finally got a little bump up to £90,000, giving small businesses a bit more breathing room before registration becomes a legal must.

The Two Key Tests You Can't Ignore

There are two main ways you can find yourself needing to register for VAT. You need to keep a close eye on your income for both.

-

The Backward Look Test: This is the most common trigger. You have to register if your total VAT taxable turnover for the last 12 months creeps over the £90,000 threshold. Once you cross that line, you have 30 days from the end of that month to get yourself registered.

-

The Forward Look Test: This one is about the near future. You must register if you have good reason to believe your taxable turnover will exceed £90,000 in the next 30 days alone. This often happens when you land a single, massive contract that pushes you over the limit in one go.

Let's say you're a freelance graphic designer. At the end of October, you sit down and calculate your total sales from the beginning of last November right up to the end of this October. The total comes to £91,000. That means you've officially crossed the VAT threshold and you have until the 30th of November to register.

One of the biggest pitfalls for freelancers is only checking these figures at their year-end. By then, it's usually far too late, and penalties can follow. The best advice is to set a recurring reminder in your calendar to check your rolling 12-month turnover at the end of each month.

Keeping your records tidy is absolutely essential for this. Tools that help automate the boring stuff, like capturing receipts, can be a lifesaver. Our Google Drive integration, for example, makes pulling your numbers together much less of a chore. Being proactive like this means you’ll always know exactly where you stand and can register on time, keeping you out of trouble with HMRC.

How the VAT Threshold Shapes Your Business Growth

The self-employed VAT threshold isn’t just a number; it’s a real strategic crossroads for your business. For a lot of freelancers and sole traders, getting close to this figure forces a big decision: do you keep growing and take on the admin that comes with VAT, or do you deliberately pump the brakes to stay under it?

This is such a common headache it even has a name: ‘bunching’. It’s what happens when a whole cluster of businesses purposely keeps their turnover just shy of the registration limit. That might mean turning down that extra project or even pausing work for a bit, all to avoid tipping over the edge. In effect, they’re putting a cap on their own success.

The Squeeze of a Frozen Threshold

For a long time, this decision has been getting tougher. The VAT threshold was stuck at £85,000 from 2017 all the way to 2024. With inflation marching on, that freeze effectively lowered the bar in real terms year after year, pulling more and more businesses into the VAT net, ready or not.

An IMF working paper actually found that small business turnover growth slows by about 1 percentage point per year as they approach the threshold. This isn't just theory; it’s a clear pattern of people carefully managing their income to avoid the VAT jump.

If the threshold had actually been adjusted for inflation, the Chartered Institute of Taxation reckons it would have hit around £103,000 by April 2023. Knowing this really puts the pressure that so many small businesses feel into perspective. You can dig into more of these VAT threshold findings and their effects on how people run their businesses.

Ultimately, deciding whether to cross the threshold comes down to your own goals, who your clients are, and how much admin you can handle. The important thing is to make an active choice about your growth strategy, rather than letting the tax rules dictate it for you.

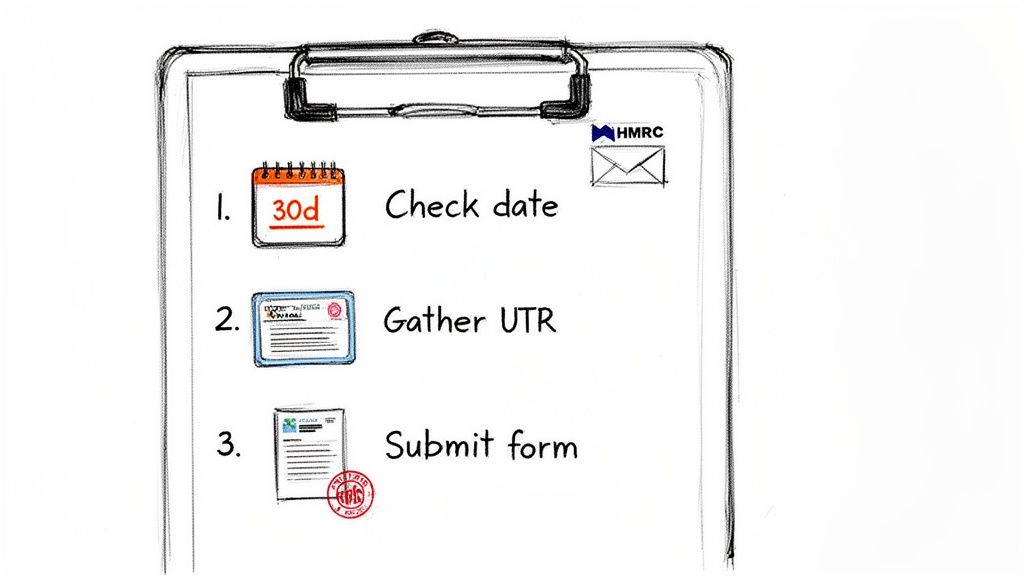

Your Step-by-Step Guide to Getting VAT Registered

So, you’ve hit the VAT threshold, or maybe you've decided registering voluntarily makes sense for your business. What's next? Time to get the official stuff sorted with HMRC. It might sound daunting, but it's actually a pretty smooth process if you get your ducks in a row and don't delay.

The first thing to burn into your memory is the deadline. You have exactly 30 days from the end of the month you went over the threshold to get your application in. Let's say your turnover tipped over the £90,000 mark on the 10th of May. The clock starts at the end of May, meaning your deadline is the 30th of June. Miss it, and you could face penalties.

Getting Your Information Ready

Before you even think about heading to the government website, do yourself a favour and gather all the necessary bits and pieces. It’ll save you a world of headache and stop you from having to pause the application to dig through your files.

Here’s what you’ll need to hand:

-

Your Unique Taxpayer Reference (UTR): That's the number you use for your Self Assessment tax return.

-

Your National Insurance number: A must-have if you're operating as a sole trader.

-

Business details: This includes your official trading name, address, and contact info.

-

Your business bank account details: Essential for HMRC to process any VAT repayments you might be due.

-

Turnover figures: Be ready with your current taxable turnover and a realistic estimate of what you expect it to be over the next 12 months.

Once you’ve got all that, you can submit your application online through your Government Gateway account. HMRC will then get to work processing it. All being well, you should receive your VAT registration certificate within about 30 working days. This crucial document will show your official VAT number and, just as importantly, your effective date of registration, which is the day from which you must start charging VAT on your sales.

Choosing To Register For VAT Voluntarily

You don't actually have to wait until you hit the £90,000 turnover mark to register for VAT. In fact, for some self-employed people, getting in there early and registering voluntarily can be a really smart business move. It all boils down to whether the benefits outweigh the hassle for your specific circumstances.

The single biggest perk is that you can start reclaiming the VAT you spend on business purchases. Think about it. If you have hefty start-up costs or regularly buy a lot of VAT-able goods and services like software, stock, or professional fees, getting that VAT back can be a serious cost-saver. For many, this is the main reason they jump in early.

It can also give your business a more professional sheen. When you're dealing mostly with other VAT-registered businesses (your B2B clients), a VAT number on your invoices can make your operation look bigger and more established. It just adds a layer of credibility.

The Downsides of Early Registration

Of course, it's not the right move for everyone. The main drawback is the extra admin that lands on your plate. You'll suddenly be responsible for keeping proper digital VAT records, creating compliant VAT invoices, and filing regular returns with HMRC, which is a commitment.

On top of that, if your customers are mainly the general public or small businesses that aren't VAT-registered, you'll have to add 20% VAT to your prices. This could instantly make you more expensive than your competitors. It's a tricky balancing act between reclaiming VAT on your own costs and potentially pricing yourself out of your market. The key is to take a good, hard look at who your clients are and what your business expenses look like before you make the leap.

Accounting Schemes Can Make VAT a Lot Simpler

Once you're over the self-employed VAT threshold, managing your VAT doesn't have to be a nightmare. HMRC has a few different schemes specifically to make life easier for small businesses, simplifying how you track and pay what you owe.

Getting on the right scheme can genuinely slash the time you spend on bookkeeping, so it’s well worth getting your head around the main options out there for freelancers and sole traders.

The Most Popular VAT Schemes for the Self-Employed

Two schemes, in particular, are a great fit for many self-employed people: the Cash Accounting Scheme and the Flat Rate Scheme. They work differently and have their own rules, so let's break them down.

-

Cash Accounting Scheme: This one is a real game-changer for your cash flow. You only have to pay VAT to HMRC once your client has actually paid you, not when you send the invoice. The same goes for your expenses; you can only reclaim VAT on purchases after you've paid for them.

-

Flat Rate Scheme: This scheme massively simplifies your calculations. You pay a single, fixed percentage of your total turnover to HMRC. That percentage is based on your specific industry, but the trade-off is that you can't reclaim VAT on most of your purchases (with some exceptions for big-ticket capital assets).

Whichever scheme you pick, using tools that connect with your accounting software makes a massive difference. For example, our own Receipt Router integration with FreeAgent automates the whole process of matching receipts to transactions, which is a huge help come filing time.

It’s always a good idea to chat through these schemes with your accountant to figure out which one really fits your business best.

Got Questions About the Self-Employed VAT Threshold?

Working out the VAT threshold can feel like a bit of a minefield. It’s no surprise that a few common questions pop up time and time again. Let's clear up some of the most frequent queries.

What Happens If I Register for VAT Late?

First off, don't panic. But you do need to act fast. If you miss your registration deadline, HMRC can hit you with a penalty.

The penalty is calculated as a percentage of the VAT you owe from the date you should have registered. The good news is that if you have a solid reason for the delay and you get in touch with them to sort it out quickly, they might reduce or even cancel the penalty. The key is to be proactive.

Does Income From International Clients Count Towards the Threshold?

This is where it gets a bit tricky, and the answer is usually "it depends".

For the most part, if you're selling services to businesses based outside the UK, that income is considered 'outside the scope' of UK VAT and won't count towards your £90,000 threshold. However, the rules can get complicated, especially for digital services or goods. It all comes down to the 'place of supply' rules, so it’s crucial to understand where your service is officially consumed.

Can I Deregister If My Turnover Drops?

Absolutely. If your business takes a dip and you expect your taxable turnover to fall below the deregistration threshold (currently £88,000), you can apply to cancel your VAT registration.

This can be a smart move if most of your customers aren't VAT-registered, as you'll no longer have to charge them VAT, potentially making your prices more competitive.

Staying on top of your VAT means keeping meticulous records of every single sale and expense. Receipt Router takes the headache out of this by automatically capturing and organising your receipts right into your accounting software. It keeps you organised and ready for every VAT return. Find out how to make your bookkeeping a whole lot simpler at https://receiptrouter.app.

Article created using Outrank