10 Essential Small Business Accounting Tips for UK Freelancers in 2026

Running a small business or freelancing in the UK is a balancing act. Between delivering great work for your clients and finding new projects, the last thing you want to worry about is a mountain of receipts and confusing tax rules. The good news? You don't need to be a financial wizard to get your books in order. With a few smart habits and the right tools, you can transform your accounting from a stressful chore into a streamlined, automated process that actually helps your business grow.

This guide provides 10 practical, no-nonsense small business accounting tips designed specifically for UK sole traders, freelancers, and small company directors. We will move beyond the basics and give you actionable steps to save time, reduce your tax bill, and gain complete control over your financial health. Forget the vague advice you have heard before. We are diving into specific workflows for managing receipts, claiming every eligible expense, and making HMRC compliance a breeze.

From implementing a monthly reconciliation routine that takes minutes, not hours, to mastering invoicing so you get paid faster, each tip is designed for immediate implementation. Think of this as your playbook for financial clarity and efficiency. Let's get started.

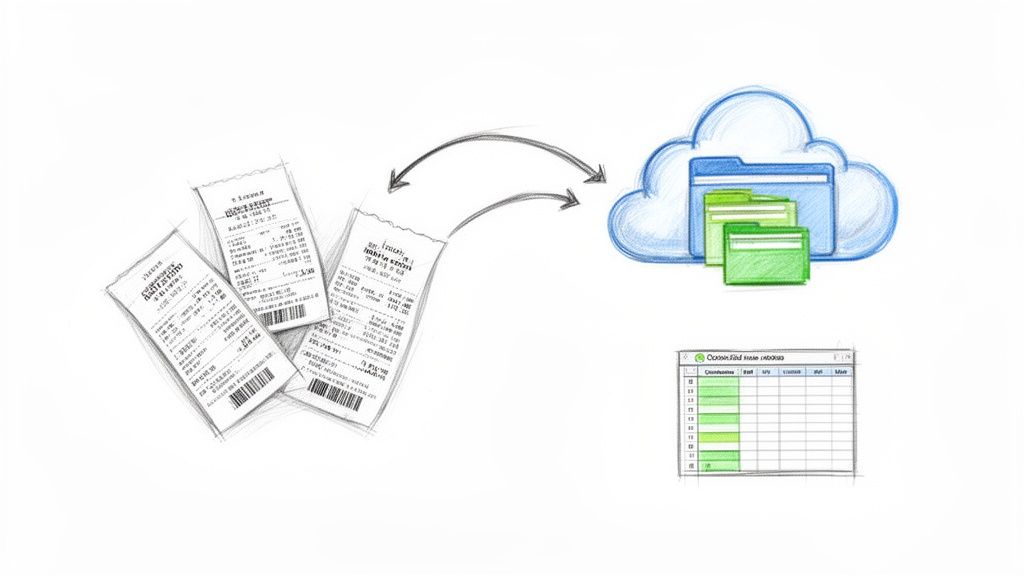

1. Automate Receipt Collection and Management

Tired of that shoebox overflowing with faded paper receipts? It's time to ditch the manual filing. Automating your receipt collection means using a smart system to digitally capture, organise, and store every proof of purchase. This isn't just about being tidy; it's a crucial part of your small business accounting tips toolkit, especially as HMRC requires you to keep expense records for at least six years. An automated workflow ensures nothing gets lost and you're always ready for a tax inspection.

Think of it like having a digital assistant. Instead of you manually entering data, tools like Receipt Router connect directly with your accounting software, such as FreeAgent. When an email receipt lands in your inbox from Adobe or AWS, it's automatically forwarded and logged. A freelance graphic designer can use this to instantly capture software subscriptions, while a UK contractor can forward international client expenses without any fuss. The result is a perfect, centralised audit trail.

How to Implement This Right Now

Ready to get started? Here are some simple, actionable steps:

- Set up auto-forwarding rules in your email client (like Gmail or Outlook). Create a filter that automatically sends any emails containing the word "invoice" or "receipt" from key suppliers to your unique forwarding address.

- Snap and send on the go. Just bought a client coffee or paid for parking? Take a quick photo of the paper receipt with your phone and immediately email it to your system. Don't let it get crumpled in your pocket.

- Categorise as you go. When forwarding receipts, add a quick note about the expense category. This small step makes bank reconciliation in FreeAgent a breeze later on.

By adopting this habit, you transform a tedious quarterly task into a simple, real-time process. You'll find a deeper dive into how this works in our guide to automation in accounting.

2. Separate Business and Personal Finances

Mixing your personal coffee run with a business software subscription is a recipe for accounting chaos. Separating your business and personal finances means having completely distinct bank accounts and credit cards for each. This is one of the most fundamental small business accounting tips, as it creates a clear, professional financial boundary. For UK sole traders and freelancers, this practice is essential for simplifying tax returns, ensuring HMRC compliance, and providing a clean audit trail if ever needed.

Think of it as drawing a distinct line in the sand. When all your business income and expenses flow through one dedicated account, tracking your financial health becomes straightforward. A self-employed consultant using a dedicated business credit card for all client-related travel and software immediately gains clarity on their outgoings. This separation makes it far easier to calculate profits, identify tax-deductible expenses, and avoid raising red flags with the tax authorities.

How to Implement This Right Now

Ready to untangle your finances? Here are the key steps to take:

- Open a dedicated business bank account. Look for accounts from providers like Starling or NatWest that offer strong integration with accounting software like FreeAgent for automatic bank feeds.

- Get a business credit or debit card. Use this card exclusively for all business-related purchases, from office supplies to online advertising. This helps automate expense tracking.

- Reimburse yourself properly. If you must use personal funds for a business expense, create a formal expense claim and transfer the exact amount from your business account back to your personal one.

- Review your bank reconciliation weekly. Spend 15 minutes each week in FreeAgent checking your bank feeds. This helps you spot any accidental mixing of funds early and keep your records accurate.

3. Track Mileage and Travel Expenses Religiously

Are you leaving money on the table by forgetting to claim for business travel? For many UK freelancers and contractors, mileage is one of the most significant tax-deductible expenses. Tracking every business-related journey religiously is a non-negotiable part of our small business accounting tips. HMRC allows you to claim a flat rate of 45p per mile for the first 10,000 miles and 25p thereafter, so every trip to a client or supplier directly reduces your taxable profit. This isn't just for mileage; it includes parking, tolls, and other travel costs too.

A UK consultant visiting clients across the country could easily rack up 1,500 miles a month, translating to a £675 tax deduction. A field service engineer can use a tool like Receipt Router to forward fuel and parking tickets directly to their accounting software, creating an instant and organised record. Guessing your mileage at the end of the tax year is a recipe for an HMRC enquiry; accurate, real-time tracking is the only way to claim what you're owed with confidence.

How to Implement This Right Now

Ready to turn your car into a tax-saving machine? Here are some simple, actionable steps:

- Use a GPS-tracking app. Tools like MileIQ or your accounting software's built-in tracker can automatically log journeys. You just need to classify them as business or personal.

- Keep a logbook as a backup. A simple notebook in your glovebox is a great low-tech backup. Note the date, start/end postcodes, total mileage, and the purpose of the journey.

- Photograph your odometer regularly. Take a quick snap of your car's odometer reading at the start of each month or quarter. This provides a credible baseline for your mileage claims.

- Forward all travel receipts. Paid for parking or a train ticket? Snap a photo and forward it to your receipt management system immediately to ensure it's captured and categorised.

4. Implement a Monthly Reconciliation Routine

Leaving bank reconciliation until your tax deadline is a recipe for stress and mistakes. Implementing a monthly routine means regularly checking that the transactions in your accounting software, like FreeAgent, perfectly match the statements from your bank accounts and credit cards. This isn't just a box-ticking exercise; it’s one of the most critical small business accounting tips for maintaining accurate financial records, which is a legal requirement set by HMRC. A consistent monthly check-up ensures everything is in order and prevents a frantic year-end scramble.

This proactive habit turns a mammoth annual task into a manageable 30-minute monthly one. For example, a freelance consultant can spend the first Monday of each month using FreeAgent's dashboard to quickly verify transactions. If they use a tool like Receipt Router, most of their expenses will already be matched, leaving only a handful of items to review manually. This simple process catches errors, spots duplicate charges, and gives you a crystal-clear, real-time view of your business's financial health.

How to Implement This Right Now

Ready to make reconciliation a painless habit? Here’s how to start:

- Schedule it. Block out 30-60 minutes in your calendar for the first week of every month. Treat this appointment with the same importance as a client meeting.

- Use automated matching. Connect your business bank feeds to FreeAgent. The software will automatically suggest matches for most of your income and expenditure, saving you significant time.

- Create a simple checklist. List all the accounts you need to reconcile: your main business current account, credit cards, PayPal, or Stripe. Tick them off one by one to ensure nothing is missed.

- Investigate discrepancies quickly. If a transaction doesn't match or you find an error, look into it immediately while the details are still fresh in your mind. Don’t let small issues snowball.

Adopting this routine provides peace of mind and ensures your records are always accurate and tax-ready. You can find out more by reading our guide on how to reconcile your bank statements.

5. Master Invoicing and Payment Terms

Getting paid on time is the lifeblood of any small business, and it all starts with professional invoicing. Mastering your invoicing process means creating clear, consistent, and legally compliant documents that leave no room for confusion. This is a fundamental small business accounting tip that directly impacts your cash flow. By establishing firm payment terms, you not only look more professional but also provide your accounting software, like FreeAgent, with the clean data it needs for accurate forecasting and reconciliation.

Think of each invoice as a clear instruction to your client. Vague terms lead to late payments. A freelance consultant, for example, can dramatically improve their monthly cash position by shifting from a standard Net 30 to a Net 14-day payment term. Similarly, a UK contractor using FreeAgent’s numbered invoice system can automatically track which payments are due and which are overdue, eliminating manual chasing and guesswork. A clear system ensures money flows into your business predictably.

How to Implement This Right Now

Ready to tighten up your invoicing and get paid faster? Here are some simple, actionable steps:

- Invoice immediately. Send your invoice as soon as the work is completed or the product is delivered. This capitalises on the client's satisfaction and keeps the transaction fresh in their mind.

- Be explicit with terms. Clearly state your payment terms (e.g., "Payment due within 14 days"), your bank details, and a unique invoice number on every document. If you're VAT-registered, ensure your VAT number and the correct tax breakdown are included.

- Automate reminders. Use your accounting software to send automated payment reminders for overdue invoices. A polite nudge at 7 and 14 days past the due date often works wonders without any manual effort from you.

- Consider incentives. To accelerate payments, you could offer a small discount for early settlement, such as 2% off for payment within seven days. This can be a powerful motivator for clients.

6. Leverage Multi-Currency Support for International Expenses

Dealing with international clients or vendors? Managing transactions in different currencies can feel like a headache, but it’s a crucial skill for modern UK businesses. One of the most important small business accounting tips for global operators is to handle multi-currency expenses correctly. HMRC requires all tax returns to be filed in GBP, which means you need to accurately convert foreign currency transactions using the exchange rate from the date of the transaction.

Getting this wrong can lead to inaccurate profit reporting and potential tax issues. An automated system that handles this conversion for you is a game-changer. For example, a UK freelancer billing a US client in dollars can use a tool like Receipt Router to automatically convert the invoice to GBP in their FreeAgent account. Similarly, a contractor paying for an AWS subscription in USD can capture the expense in its true GBP value without touching a calculator. This ensures your financial records are always accurate and compliant.

How to Implement This Right Now

Here’s how to get a grip on your international finances:

- Automate your conversions. As soon as an invoice from an international supplier hits your inbox, forward it to your receipt management tool. This ensures the transaction is converted to GBP using the correct, timely exchange rate.

- Invoice in GBP where possible. To completely remove your own foreign exchange risk when getting paid, consider invoicing international clients in GBP. This puts the responsibility of conversion on them.

- Reconcile foreign transactions carefully. In your accounting software, keep a close eye on your foreign currency bank accounts. Regularly reconciling them will help you track any gains or losses from exchange rate fluctuations.

7. Categorize Expenses Properly for Maximum Tax Deductions

Simply having a record of your expenses isn't enough; you need to file them correctly. Proper categorisation means assigning each business cost to an appropriate HMRC-recognised category, ensuring you claim every legitimate deduction and maintain a defensible audit position. This is one of the most vital small business accounting tips because miscategorising expenses can lead to disallowed claims and even tax penalties down the line.

Think of it as giving every pound a specific job. When you correctly categorise a Zoom subscription as 'software' instead of 'miscellaneous', you create a clear, organised record that simplifies tax preparation. For a UK contractor, this means documenting home office costs with a clear calculation methodology (e.g., 15% of utilities) as a distinct category, guaranteeing no deductions are missed when it’s time to file your Self Assessment.

How to Implement This Right Now

Ready to get your expenses in perfect order? Here are some simple, actionable steps:

- Categorise as you go. Instead of facing a mountain of uncategorised expenses at year-end, get into the habit of assigning a category the moment you log an expense in FreeAgent. This turns a massive task into a minor, daily habit.

- Create rules for recurring costs. For regular payments like software subscriptions or cloud services, set up rules in your accounting software to automatically categorise them. This saves time and ensures consistency.

- Document your methodology. For mixed-use expenses like home office or vehicle costs, keep a simple note explaining how you arrived at your figures. This provides a clear justification if HMRC ever asks.

- Run monthly category reports. A quick review each month helps you spot miscategorised items or duplicates, allowing you to fix errors before they become a bigger problem.

8. Maintain Organised Digital Records for HMRC Compliance

HMRC isn't just interested in your final tax figures; they want to see the proof. UK businesses are legally required to keep organised financial records for at least six years. This isn't about hoarding paperwork, it's about creating a clear, accessible digital archive that proves your income and expenses. A well-organised system not only ensures you meet your legal obligations but also makes responding to any tax authority enquiry a quick and painless process.

This is where integrating tools like Receipt Router with FreeAgent becomes a game-changer. It automatically creates a searchable, compliant archive of all your business transactions. A freelancer can instantly retrieve all their Adobe subscription receipts from the last 12 months, while a small business owner can respond to an HMRC request within hours, not days. This level of organisation transforms a potential compliance headache into a simple administrative task, giving you one of the most vital small business accounting tips for peace of mind.

How to Implement This Right Now

Ready to build a future-proof digital archive? Here’s how to get started:

- Create a logical folder structure. In your cloud storage (like Google Drive), set up folders by financial year, then by month, and finally by expense category (e.g.,

2024/04-April/Software/). - Use a consistent naming convention. When you save a digital receipt, name it clearly:

YYYY-MM-DD_Vendor_Amount.pdf(e.g.,2024-04-15_AWS_£55.90.pdf). This makes specific documents instantly searchable. - Back up your records. Don't rely on a single location. Keep your primary records in your accounting software and a secondary backup in the cloud or on a local drive.

By making digital organisation a core habit, you ensure your records are always tidy and compliant. For a deeper look into structuring your files, check out our guide to building a document management system.

9. Monitor Cash Flow and Maintain Emergency Reserves

Profitability is great, but it doesn't pay the bills. Cash flow, the actual movement of money into and out of your business, is what keeps the lights on. Many profitable businesses fail because they run out of cash when clients delay payments while expenses are still due. Actively monitoring your cash flow is one of the most vital small business accounting tips for survival and growth, as it helps you anticipate shortfalls and make smarter decisions.

This is where an emergency reserve becomes your safety net. Aim to hold three to six months of operating expenses in an accessible savings account. A freelance copywriter, for instance, could maintain a £4,000 reserve to cover their average £1,300 in monthly expenses. This buffer allows them to comfortably manage a six-week payment delay from a major client without panicking. It transforms potential crises into manageable bumps in the road.

How to Implement This Right Now

Ready to build your financial resilience? Here are some simple, actionable steps:

- Use FreeAgent’s cash flow tools. Check the forecasting feature monthly to predict potential shortfalls two or three months in advance. This gives you time to act.

- Generate ageing reports. Regularly review these reports to identify which clients consistently pay late. This data helps you decide whether to adjust payment terms or follow up more proactively.

- Set up automatic reminders. Use your accounting software to automatically chase overdue invoices. This simple automation saves time and improves your collection speed.

- Negotiate shorter payment terms. When starting with new clients, try proposing Net 14 or Net 21 instead of the standard Net 30. Getting paid faster is a direct boost to your cash flow.

10. Schedule Regular Reviews with an Accountant or Bookkeeper

Even the most organised DIY accounting system benefits from a professional’s touch. Scheduling regular reviews with a qualified accountant or bookkeeper provides expert oversight that automated tools alone can't offer. Think of them as a strategic partner who translates your tidy records into powerful financial insights. This is one of the most vital small business accounting tips because it helps ensure you are not just compliant, but also tax-efficient. A professional can spot errors, identify deduction opportunities you might miss, and offer guidance on complex HMRC rules.

These check-ins are where the real value is unlocked. For instance, a freelance consultant might discover they can claim an extra £2,000 in home office deductions after a quarterly review. Or a contractor, on their accountant's advice, could restructure as a limited company and reduce their annual tax liability by £4,000. These sessions transform your raw accounting data, neatly organised by tools like Receipt Router and FreeAgent, into a forward-looking financial strategy.

How to Implement This Right Now

Ready to get expert oversight? Here’s how to make it happen:

- Find the right fit. Look for an accountant or bookkeeper who is proficient with cloud accounting software like FreeAgent. Ask if they are familiar with integrations like Receipt Router to ensure seamless collaboration.

- Set a recurring schedule. If your business is growing or has complex transactions, schedule quarterly reviews. For simpler businesses, a bi-annual or at least annual check-in before the tax deadline is crucial.

- Prepare for your meetings. Use your organised digital records to prepare a list of specific questions. Ask them directly about tax-saving opportunities relevant to your industry and how to best categorise tricky expenses in FreeAgent.

- Grant appropriate access. Discuss letting your accountant have direct, real-time access to your FreeAgent account. This allows them to monitor things proactively and makes review sessions quick verifications instead of lengthy audits.

10-Point Small Business Accounting Tips Comparison

| Title | 🔄 Implementation Complexity | ⚡ Resources & Effort | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Automate Receipt Collection and Management | 🔄 Medium (initial setup & rules) | ⚡ Moderate (subscription + setup time) | 📊 High (saves 5–10 hrs/month; better compliance) ⭐⭐⭐⭐ | 💡 Freelancers, sole traders, FreeAgent users | ⭐ Centralized audit trail; automatic matching; remote access |

| Separate Business and Personal Finances | 🔄 Low (open accounts & maintain discipline) | ⚡ Low ongoing (possible account fees) | 📊 High (simplifies bookkeeping & audits) ⭐⭐⭐⭐ | 💡 All freelancers, contractors, new business owners | ⭐ Clear separation; easier reconciliation; liability protection |

| Track Mileage and Travel Expenses Religiously | 🔄 Medium (continuous logging & documentation) | ⚡ Moderate (daily tracking apps or logbook) | 📊 High (significant tax savings potential e.g., £1,500+/yr) ⭐⭐⭐⭐ | 💡 Consultants, field service providers, sales | ⭐ Defensible HMRC deductions; captures travel costs accurately |

| Implement a Monthly Reconciliation Routine | 🔄 Low–Medium (recurring disciplined process) | ⚡ Low monthly (~30–60 min with automation) | 📊 Very high (catches errors early; reduces year‑end work) ⭐⭐⭐⭐⭐ | 💡 All business owners; contractors with multiple income streams | ⭐ Early error detection; accurate P&L; reduced audit risk |

| Master Invoicing and Payment Terms | 🔄 Low (set templates and payment rules) | ⚡ Low ongoing (invoice tooling may incur fees) | 📊 High (improved cash flow & fewer disputes) ⭐⭐⭐⭐ | 💡 Freelancers, consultants, service providers | ⭐ Faster payments; VAT-compliant records; professional presentation |

| Leverage Multi-Currency Support for International Expenses | 🔄 Medium (FX rules and reporting) | ⚡ Moderate (conversion tools and possible fees) | 📊 High (accurate GBP reporting; fewer conversion errors) ⭐⭐⭐⭐ | 💡 International contractors; freelancers with global clients | ⭐ Automated FX conversion; audit trail for exchange rates |

| Categorize Expenses Properly for Maximum Tax Deductions | 🔄 Medium (HMRC rules knowledge required) | ⚡ Moderate (setup of categories and ongoing review) | 📊 Very high (maximizes legitimate deductions avg £3k–£8k+) ⭐⭐⭐⭐⭐ | 💡 All business owners; freelancers; sole traders | ⭐ Maximizes deductions; simplifies tax prep; better spend insights |

| Maintain Organized Digital Records for HMRC Compliance | 🔄 Medium (archive structure & maintenance) | ⚡ Low–Moderate (storage and upkeep costs) | 📊 High (6‑year compliance; fast audit response) ⭐⭐⭐⭐ | 💡 All businesses; high audit‑risk or international firms | ⭐ Searchable, backed‑up archive; rapid retrieval for HMRC |

| Monitor Cash Flow and Maintain Emergency Reserves | 🔄 Low–Medium (forecasting discipline required) | ⚡ Moderate (time + capital reserves 3–6 months) | 📊 High (prevents cash‑short failures; planning insights) ⭐⭐⭐⭐ | 💡 Freelancers, contractors, seasonal businesses | ⭐ Financial resilience; proactive planning; early warnings |

| Schedule Regular Reviews with an Accountant or Bookkeeper | 🔄 Low (scheduled reviews; prep required) | ⚡ Moderate (professional fees £150–£400 per review) | 📊 High (tax savings & compliance assurance) ⭐⭐⭐⭐ | 💡 All business owners; complex tax situations; growing firms | ⭐ Expert tax planning; error detection; representation for HMRC |

Your Next Step Towards Financial Clarity

Navigating the world of small business accounting can feel like a mammoth task, especially when you are also trying to run the business itself. We have covered a lot of ground, from automating your receipt management and separating your finances to mastering multi-currency transactions and preparing for HMRC. The key takeaway is that you do not need to become a certified accountant overnight. Instead, building a strong financial foundation is about implementing small, consistent habits that pay massive dividends over time.

Think of each of these small business accounting tips not as a chore, but as a lever. Each one you pull gives you more control, more insight, and ultimately, more freedom. For instance, creating a simple monthly reconciliation routine might only take an hour, but it can prevent months of stress and confusion down the line. Similarly, getting your expense categories right from day one transforms tax time from a frantic scramble into a straightforward process.

Turning Knowledge into Action

The goal is not to implement all ten tips by tomorrow. The real secret to success lies in starting small and building momentum.

- Pick one or two high-impact habits: Choose the tips that address your biggest pain points right now. If you are constantly losing receipts, focus on automating that process. If cash flow is a constant worry, start there.

- Set a realistic schedule: Dedicate a specific time each week or month to your finances. Put it in your calendar and treat it like a non-negotiable client meeting. This consistency is what turns good intentions into powerful routines.

- Leverage technology: Modern accounting is not about manual data entry in dusty ledgers. Tools like FreeAgent are designed to do the heavy lifting for you. Explore their features, from smart bank feeds to automated tax forecasts, and let the software work its magic.

By embracing these practices, you are doing far more than just organising numbers. You are building a resilient, transparent, and profitable business. You are making informed decisions based on real data, not guesswork. This financial clarity is one of the most powerful assets a business owner can possess, giving you the confidence to plan for the future, invest in growth, and enjoy the rewards of your hard work. You have got the knowledge; now it is time to take that first simple step.

Ready to eliminate the most time-consuming part of your bookkeeping? See how Receipt Router can automatically collect, process, and forward all your email receipts directly into your FreeAgent account, saving you hours every month. Take control of your finances by visiting Receipt Router and start your free trial today.