A Simple Self Assessment Tax Return Guide for UK Freelancers

If the mere mention of a ‘Self Assessment tax return’ sends a shiver down your spine, you’ve come to the right place. Think of it less as a dreaded chore and more like your annual financial check-in with HMRC, where you lay out your income and expenses to figure out exactly what tax you owe. For millions of us, including freelancers, sole traders, and small business owners across the UK, it's a non-negotiable part of the year.

Your No-Stress Introduction to Self Assessment

It’s completely normal to feel a bit lost in all the tax jargon. But when you boil it down, Self Assessment is just the system HM Revenue & Customs (HMRC) uses to collect Income Tax. If you earn money that isn't taxed automatically through a regular payroll (like PAYE), it’s up to you to report your earnings, calculate what you owe, and get your return filed on time.

You're certainly not alone in this. For the 2024 to 2025 tax year, a staggering 11.48 million people in the UK got their tax returns in before the 31 January deadline. It’s a massive, shared experience for the self-employed community, as you can see from the official government filing statistics.

Who Actually Needs to File a Self Assessment Tax Return?

It's a common myth that Self Assessment is only for high-flying business owners. While freelancers and sole traders make up the bulk of filers, you might be surprised who else needs to complete one.

You’ll definitely need to send a tax return if, during the last tax year (which always runs from 6 April to 5 April), you fit any of these descriptions:

- You were a self-employed sole trader and earned more than £1,000.

- You were a partner in a business partnership.

- You made over £2,500 from renting out property or from other income that hasn't been taxed yet.

- You were claiming Child Benefit and either you or your partner had an income over £50,000.

The Shift to Digital Filing is Your Friend

Thankfully, the days of battling with paper forms and licking envelopes are almost behind us. HMRC is pushing hard for everyone to file online, which is genuinely great news because it makes the whole thing much easier.

Of those nearly 11.5 million returns filed on time last year, a massive 97.25% were sent in online. This digital-first world is a game-changer.

When you file online, you unlock the power to connect your bookkeeping software, automate tedious data entry, and slash the risk of making simple mistakes. It turns tax season from a mad scramble for receipts into a calm, organised process.

When you have the right tools in your corner, like a system that automatically snaps up every digital receipt with a tool like Receipt Router and pings it straight into your FreeAgent account, you stay on top of things all year. This guide is here to walk you through it, helping you swap tax-time anxiety for genuine confidence. A little bit of prep goes a very long way.

Getting Registered and Finding Your UTR Number

First things first: before you can even think about filing, you need to tell HMRC you exist. This means officially registering for Self Assessment. It's a step that trips up a lot of new freelancers who leave it until the last minute, so let's get it sorted now.

Think of it as getting your name on the list for the tax party; you can’t just show up unannounced.

The crucial bit here is the deadline. It's not the same as the one for filing your actual tax return. You need to register by 5 October following the end of the tax year you became self-employed. For example, if you started your freelance hustle in July 2024 (which is in the 2024-25 tax year), you've got until 5 October 2025 to register.

What's This UTR Number All About?

Once you’ve registered, HMRC will pop a letter in the post containing your Unique Taxpayer Reference (UTR). It’s a ten-digit number that's basically your ID for anything and everything tax-related. You'll need it to file your return and chat with HMRC, so keep it somewhere safe.

The UTR usually lands on your doormat within 10 working days if you're in the UK (it can take up to 21 days if you’re abroad). Honestly, don't leave this to chance. You literally can't file without it.

Your UTR is the master key to your Self Assessment account. Losing it can cause delays, but you can usually find it on previous tax returns, payment reminders, or through your HMRC online account if you have one set up.

The Step-by-Step on Getting Registered

Ready to get it done? The whole process is pretty straightforward, but a little bit of prep makes it a breeze. To get the full picture, this Register For Self Assessment Tax A Clear Guide is a fantastic resource that walks you through every detail.

Here’s a quick look at what you’ll need to have handy:

- Your Details: Full name, date of birth, address, and your National Insurance number.

- Your Business Details: The date you officially started trading, your business name, and a brief description of what you do.

You'll also set up a Government Gateway account. This is your secure login for all of HMRC's online services, and it’s where you'll eventually file your return, view statements, and pay your bill. Getting this sorted early on saves a world of stress when the deadlines start looming.

And as your business grows, it’s also a good idea to get familiar with the self-employed VAT threshold and registration to stay ahead of the game.

Your Step-by-Step Walkthrough for Filling Out a Tax Return

Right, you’ve registered with HMRC and your UTR number has landed on your doormat. Now for the main event: actually filling out your Self Assessment tax return.

This can feel like the most daunting part of the whole process, but I promise it's more manageable than it looks. The trick is to break it down section by section. Think of it less like a scary legal document and more like a detailed questionnaire about your business's year.

The main online form is called the SA100. If you're a freelancer or sole trader, you'll also need to fill out a supplementary page called the SA103. This is where you get into the nitty-gritty of your self-employed income and expenses.

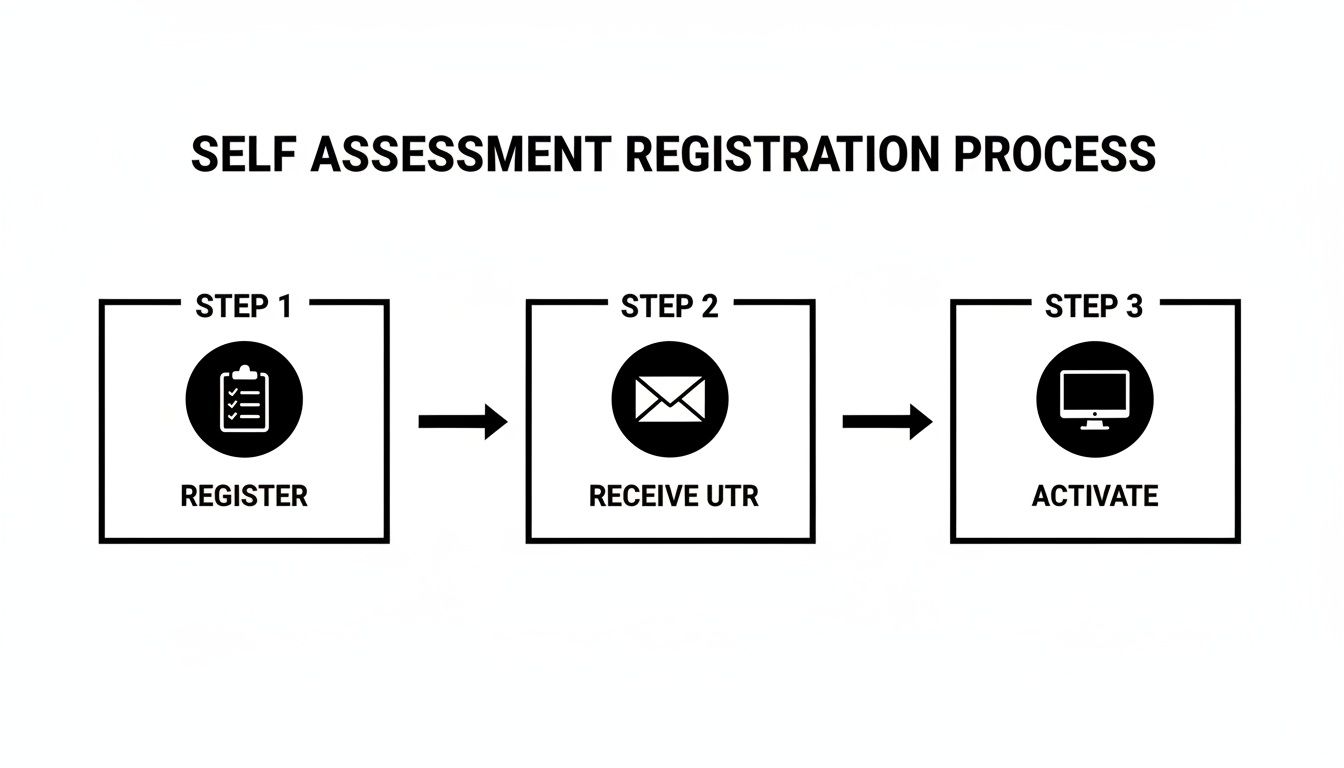

To get started, you first need to be officially in HMRC's system. This is a simple, three-stage registration process.

Getting this done early means you have your UTR number and online login details ready to go, long before you even think about the forms themselves.

Getting to Grips With the Lingo

Before we start plugging in numbers, let's clear up some of the jargon you’ll see on the forms. Nailing these definitions is the first step to an accurate return.

- Turnover: This is simply the total amount of money your business brought in from sales during the tax year. Don't mix this up with profit! It's your top-line, gross income before any costs are taken off.

- Allowable Expenses: These are the legitimate running costs you can subtract from your turnover. This is your chance to lower your taxable profit, which ultimately lowers your tax bill.

- Payments on Account: Think of these as advance payments towards your next year's tax bill. If your last Self Assessment tax bill was over £1,000, HMRC will usually ask you to make two of these payments each year.

At its heart, the tax return calculation is really simple: Your Turnover minus your Allowable Expenses equals your Profit. This final profit figure is what HMRC uses to work out what you owe.

Tackling the SA103: Your Self-Employment Page

For most freelancers, the SA103 form is where the action happens. Let's walk through a quick example to see it in practice.

Meet Alex, a freelance graphic designer. Alex has had a pretty solid year. Here’s how they would fill out a few key boxes on the SA103S (the 'short' version for businesses with a turnover below £85,000).

-

Your business's turnover (Box 9): Alex adds up every single invoice that was paid by clients between 6 April and 5 April. The grand total comes to £45,000. That’s the number that goes in this box.

-

Total allowable business expenses (Box 20): Alex has been keeping organised records all year. They tally up all their costs: software subscriptions, office supplies, marketing spend, and a percentage of their home bills. The total comes to £8,500.

-

Net profit (Box 21): Now for the easy bit. Alex just subtracts the expenses from the turnover (£45,000 - £8,500). The result is a net profit of £36,500. This is the figure that their income tax and National Insurance will be calculated on.

The Real Secret Weapon? Consistent Record-Keeping

Following Alex's example makes one thing crystal clear: you can only fill out those boxes accurately if you have the numbers to hand. A shoebox stuffed with crumpled receipts in January is a one-way ticket to stress, panic, and probably a few missed deductions.

This is why good, consistent, year-round record-keeping isn't just a nice-to-have; it's your secret weapon.

Imagine if every time a digital receipt from Adobe landed in Alex's inbox, or a payment notification from Stripe popped up, it was automatically forwarded, processed, and filed away. No more manual data entry. No risk of it getting buried in a cluttered inbox. That's what a good automated system can do for you.

Tools like Receipt Router were built to solve this exact problem. You get a unique email address, set up a few auto-forwarding rules in your inbox, and that's it. Every important receipt is captured and sorted without you lifting a finger. It turns a massive year-end headache into a simple, ongoing habit.

When all your expenses are neatly categorised and reconciled against your bank transactions, filling out the "allowable expenses" box becomes a simple case of pulling a report from your accounting software. It’s even better if you use one of the many accounting packages that integrate with automation tools, as this creates a beautifully seamless flow of information from purchase to tax return.

Alright, let's talk about the best part of doing your taxes: legally paying less of them. This is where knowing your allowable expenses inside out can genuinely put money back in your pocket.

Think of it like this: HMRC doesn't want to tax your turnover (all the money you invoiced). They only want to tax your profit. Allowable expenses are all the legitimate costs you rack up while running your business, and you get to subtract them from your income before the taxman takes his cut. Simple as that.

So, What Actually Counts as an Allowable Expense?

The golden rule from HMRC is that an expense must be "wholly and exclusively" for your business. It’s a bit of a mouthful, but it just means you can’t claim for something that’s a mix of personal and business use, unless you can clearly and fairly split the cost.

It’s easy to remember the obvious stuff like stationery and postage. But so many freelancers leave money on the table because they don’t realise just how much they can actually claim.

Here are some of the big categories people often use:

- Office Costs: This isn't just pens and paper. Think bigger. It includes your business phone bills, software subscriptions (like Adobe Creative Cloud or your project management tools), and even postage for sending out products or invoices.

- Travel Costs: If you have to travel for work, you can claim for it. That means fuel for your car (using mileage rates), train tickets, bus fares, and even the odd taxi. This doesn't cover your daily commute to a regular office, but a trip to meet a client or visit a temporary work site? Absolutely.

- Marketing and Advertising: Anything you spend to get your name out there is usually fair game. This could be anything from running Facebook ads and printing flyers to paying for your website hosting and domain name.

- Professional Subscriptions and Memberships: Are you a member of a professional body in your field? Do you subscribe to trade magazines to stay on top of your game? You can claim for those costs.

- Business Insurance: Things like professional indemnity or public liability insurance are essential for many freelancers, and thankfully, they're fully deductible.

Claiming for Working From Home

This is a huge one for most of us, but it’s also where a lot of confusion comes in. No, you can't just claim your entire mortgage payment. But you can claim for a portion of your household running costs.

You’ve got two main ways to tackle this:

- Simplified Expenses: This is the no-fuss option. HMRC gives you a flat monthly rate based on how many hours you work from home. It's dead easy to calculate and you don't need a mountain of paperwork to back it up.

- The Actual Costs Method: This takes a bit more maths. You figure out what proportion of your home you use for business (say, one room out of six) and then claim that percentage of your bills, like electricity, gas, council tax, and even your mortgage interest.

The key is you have to pick one method and stick with it for the whole tax year. The simplified route is faster, but if you have a dedicated office, crunching the actual numbers might lead to a much bigger deduction.

Common Mistakes to Sidestep

Knowing what you can't claim is just as important. HMRC has seen it all, so don't fall into these common traps:

- Client Entertainment: Taking a client for a coffee or a nice lunch to seal a deal feels like a business cost, right? Unfortunately, HMRC disagrees. It’s not an allowable expense.

- Everyday Clothing: That smart suit you bought for big client meetings? Not deductible. The rule is that if it could reasonably be part of an everyday wardrobe, you can't claim for it. The only exceptions are for genuine uniforms or essential protective gear.

- Certain Legal Fees: You can't claim for legal costs associated with buying property or big pieces of equipment. However, you can claim for other professional fees, like paying your accountant to sort all this out for you.

Why Flawless Records Are Non-Negotiable

Getting the most out of your expenses comes down to one thing: perfect record-keeping. Honestly, every receipt you lose or purchase you forget to log is you just handing free money over to the taxman.

And the stakes are getting higher. HMRC's compliance efforts raked in a record £48 billion in 2024-25 from chasing down tax errors. Yet, for small businesses, they only recovered less than 30% of the tax they think is going unpaid, which shows just how many mistakes are slipping through the cracks. With Income Tax, which is mostly Self Assessment, projected to hit a massive £330.7 billion for 2025-26, it's crystal clear why you need to claim every single penny you're entitled to. If you want to dive deeper, you can learn more about the state of UK tax administration and see why getting it right is so critical.

This is exactly where having an automated system stops being a "nice-to-have" and becomes an absolute must. Tools like Receipt Router are built for this, snapping up every purchase, even those tricky international ones, so you have a complete, audit-proof trail of every single allowable expense.

The Smart Way to Manage Your Receipts and Records

A calm, stress-free tax season doesn't start with a frantic search for paperwork in January. It begins today, with the small, smart habits you build into your daily routine. Let's be honest, the old "shoebox method" of stuffing paper receipts into a box and hoping for the best is a recipe for missed deductions and last-minute panic.

That shoebox is less of a filing system and more of a time capsule of financial anxiety. By switching to an automated, digital system, you can turn a year-end chore into a simple background task you barely have to think about. This is where you go from just knowing what to do, to actually mastering how to do it without the headache.

Say Goodbye to the Shoebox Forever

Imagine having a unique email address dedicated solely to your business receipts. Every time an invoice from a supplier or a payment confirmation from a client lands in your main inbox, you just forward it. Better yet, you set up a rule so it forwards automatically.

This isn't some far-off dream; it's exactly how modern receipt management works with tools like Receipt Router. The process is brilliantly simple:

- Get Your Unique Address: You get a private email address that acts as your digital filing cabinet.

- Set Up Auto-Forwarding: Create a simple rule in Gmail or Outlook to automatically forward any emails with invoices or receipts from your key suppliers.

- Sit Back and Relax: The system takes over. Receipts are captured, processed, and filed away without you lifting a finger.

This "set it and forget it" approach means nothing slips through the cracks. Your record-keeping transforms from a reactive scramble into a proactive, organised process.

The goal is to make capturing an expense as effortless as making the purchase itself. When your system is automatic, you guarantee every single allowable expense is recorded, giving you a complete and accurate financial picture come tax time.

Knowing how to organize receipts for taxes is the bedrock of a smooth Self Assessment, and a solid system is the best way to do it.

The Magic of Seamless Integration

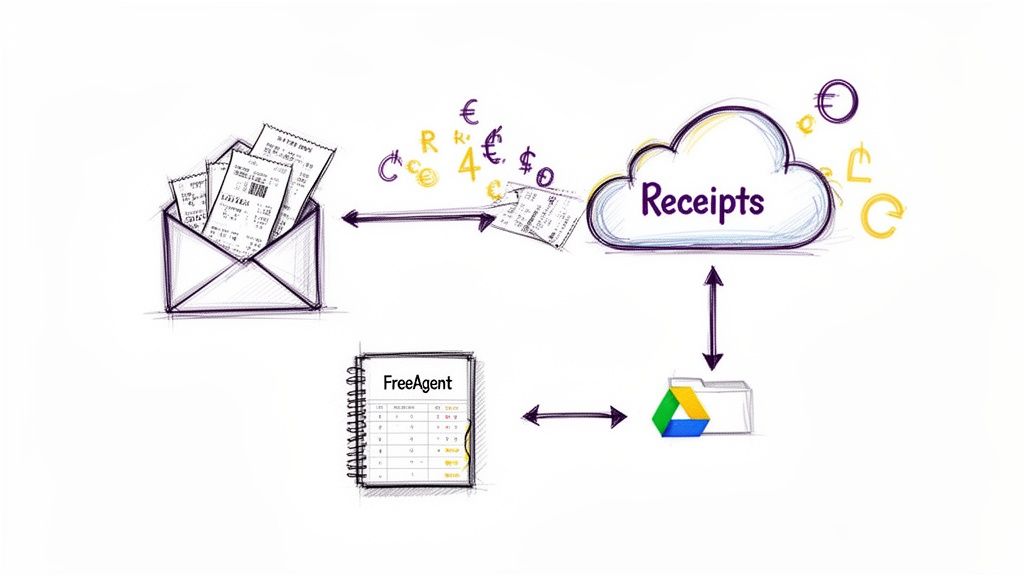

Capturing receipts is only half the battle. The real power comes when those receipts automatically link up with your accounting software. This is where a seamless integration between a tool like Receipt Router and your accounting platform, like FreeAgent, makes all the difference.

When you forward that bill, the system doesn't just save a copy. It reads the key info, finds the matching transaction in your FreeAgent account, and attaches the receipt directly to it. Your bookkeeping is constantly being updated in near real-time, giving you an accurate, up-to-the-minute view of your business finances.

This solves a few major headaches, especially for freelancers with international clients:

- Multi-Currency Conversion: Paid for a software subscription in US dollars? The tool can automatically convert it to GBP and match it perfectly with the transaction in your UK bank feed. No more manual currency calculations.

- Organised Cloud Backups: Every processed receipt can be automatically backed up to a dedicated folder in your Google Drive. They’re organised by year, month, and supplier, creating an instantly searchable, HMRC-compliant digital archive.

If you're dealing with a mix of paper and digital, our guide on the best receipt scanner app can help you digitise everything accurately.

Manual vs Automated Receipt Management

Still on the fence? Let's break down the difference between the old shoebox method and a modern, automated workflow. The time, stress, and even financial costs add up quickly.

| Task | The Old Way (Manual) | The Smart Way (Receipt Router) |

|---|---|---|

| Receipt Capture | Hoarding paper, finding it later, manually scanning or entering data. | Forward an email or snap a photo. Done in seconds. |

| Data Entry | Hours spent typing out supplier names, dates, and amounts into a spreadsheet. | Key data is extracted automatically. No typos, no hassle. |

| Reconciliation | Manually matching each receipt to a bank transaction. Tedious and error-prone. | Receipts are automatically matched and attached to transactions in your accounting software. |

| Storage & Retrieval | Boxes of paper taking up space. Finding a specific receipt is a nightmare. | Secure, searchable cloud storage. Find any receipt in an instant. |

| Time Spent | 10-20+ hours per year. | Under 1 hour per year (after initial setup). |

| Stress Level | High. Constant worry about missing paperwork and looming deadlines. | Low. Everything is organised and up-to-date, all year round. |

The choice is pretty clear. The time you save can be reinvested into your business, and the peace of mind is priceless.

Building an automated workflow like this is one of the smartest things you can do for your business. It saves you countless hours, ensures your tax return is built on solid data, and gives you the confidence that you're claiming every single deduction you're entitled to. You'll be trading January panic for year-round peace of mind.

Common Tax Return Mistakes and How to Avoid Them

Even with the best of intentions, it's surprisingly easy to slip up on your Self Assessment tax return. A simple typo or forgotten detail can trigger a penalty from HMRC, adding a layer of stress you just don't need. Think of this section as your final pre-flight check, pointing out the common pitfalls so you can steer clear of them.

Knowing where others go wrong is the best way to get it right yourself. This isn't about scaremongering; it's about making sure you can file an accurate, penalty-proof return with confidence. And the number one mistake? Leaving it all until the very last minute.

The annual scramble to file says it all. As the 31 January 2025 deadline loomed this year, a staggering 5.65 million UK taxpayers still hadn't filed, putting them on the verge of an instant £100 penalty. While plenty of people get organised early, the New Year's panic is very real. Over 54,000 returns were filed on New Year's Eve and New Year's Day alone. It just goes to show how many people cut it fine. If you want to see the scale of this last-minute dash, you can discover more about HMRC's deadline statistics.

Forgetting to Declare All Your Income

One of the most frequent errors is simply forgetting to declare a source of income. It's so easy to get caught up in your main freelance work and completely overlook that small side-hustle, the interest you earned on a savings account, or the income from a rental property.

Trust me, HMRC has clever systems for spotting these gaps, so it's vital you declare every penny. Before hitting submit, just take a final look back over the tax year and tick off all your income streams.

- Freelance and contract work: Double-check every invoice against your bank statements.

- Rental income: Any money you've earned from property needs to be included.

- Savings and investment interest: Don't forget to declare any interest that hasn't already had tax taken off.

- Other untaxed income: This could be anything from casual eBay sales to royalties from a book you wrote years ago.

Claiming for Things You Shouldn't

We've already explored the wonderful world of allowable expenses, but claiming for something you're not entitled to can land you in a spot of bother. A classic mistake is trying to claim for taking a client out for lunch or buying everyday work clothes that aren't a uniform.

Your best defence against mistakes is a solid, year-round record-keeping system. When every receipt is captured and categorised as it comes in, you build a clear, accurate picture of your finances. There's simply no room for guesswork or errors when it's time to file.

Getting Muddled with Payments on Account

Finally, getting confused by payments on account is a common headache. These are basically advance payments towards your next tax bill. If your last bill was over £1,000, you'll almost certainly have to make them. Forgetting the 31 July deadline for the second payment is a frequent slip-up that can quickly lead to interest charges.

The common thread running through all these issues is proactive organisation. A reliable system like Receipt Router makes sure every bit of income and every single expense is accounted for throughout the year. It gives you total peace of mind and, ultimately, a mistake-free tax return.

Got a Self Assessment Question? We've Got Answers

Even with the best guide in hand, a few head-scratchers are bound to pop up. Let’s tackle some of the most common questions that trip up freelancers and sole traders.

What Happens If I Miss the Self Assessment Deadline?

Let's not sugarcoat it: HMRC isn't very forgiving. The second the clock ticks past midnight on 31 January, you're hit with an instant £100 penalty if you haven't filed online. This stings, especially because it applies even if you don't owe any tax or have already paid it.

And it gets worse. If you leave it for three months, they can start adding a daily penalty of £10 for up to 90 days. The key takeaway? Always, always file on time. Even if you can't pay the bill right away, just getting the return submitted stops those late-filing penalties from snowballing.

Do I Really Need an Accountant to File My Tax Return?

Honestly, not necessarily. If your business finances are fairly straightforward, you can absolutely handle this yourself. Loads of freelancers do it every year. The game has changed now that we have smart bookkeeping software.

When you use a system like FreeAgent and connect it with an automatic receipt-capturing tool, you're in a really strong position to manage your own taxes with confidence. That said, if your finances are getting complicated, maybe you've got property income or investments, an accountant's advice can be worth its weight in gold.

What on Earth Are 'Payments on Account'?

Think of these as a down payment on next year's tax bill. HMRC asks you to make 'payments on account' if two things are true: your last tax bill was over £1,000, and less than 80% of your tax was already collected for you (through a PAYE job, for instance).

They're split into two chunks:

- The first payment is due by 31 January.

- The second follows on 31 July.

Each payment is usually half of your previous year's tax bill. But here's a pro tip: if you know your income is going to be lower this year, you don't have to just pay it. You can actually ask HMRC to reduce your payments on account to reflect your new situation.

Stop drowning in digital receipts and start automating your bookkeeping. Receipt Router seamlessly connects to FreeAgent, capturing and reconciling your expenses without you lifting a finger. Get your free time back and file your next tax return with total confidence. Learn more and sign up today at https://receiptrouter.app.