How to Work Out VAT A Simple Guide for UK Freelancers

Working out VAT doesn't have to be a headache.Once you get the hang of it, the core idea is pretty simple: you add 20% VAT to what you charge your clients (this is your 'output VAT'), and then you subtract the VAT you've paid on your own business expenses (your 'input VAT'). The difference is what you'll either pay to HMRC or, in some cases, claim back from them.

Getting to Grips with VAT Fundamentals

Before we jump into the number-crunching, let's quickly cover what Value Added Tax (VAT) actually is and why it's so important for your business. The easiest way to think about it is that you're acting as a temporary tax collector for the government.

You add VAT to your invoices, your clients pay you, and you hold onto that VAT money until it's time to send it over to HMRC. The good news is, you get to deduct any VAT you’ve already paid on things you bought for your business.

Getting this right is a big deal; it affects your pricing, your cash flow, and your legal standing. But it's totally manageable. It all boils down to two key terms you’ll see pop up again and again:

- Output VAT: This is the VAT you add to your sales invoices. When you bill a client for £1,000, the £200 of VAT on top is your output VAT.

- Input VAT: This is the VAT you pay on your business purchases. The VAT on that new laptop, your accounting software, or your train tickets to a client meeting is your input VAT. You can usually claim this back.

So, the final amount you pay to HMRC is just your total output VAT minus your total input VAT for that quarter.

When Do You Need to Register for VAT?

Here's a crucial point: registering for VAT isn't always optional. It's mandatory once your VAT-taxable turnover hits a specific threshold in any rolling 12-month period. For freelancers and small businesses, keeping an eye on this figure is essential to avoid any nasty surprises.

You can also choose to register voluntarily before you hit the threshold. This can be a smart move if you have high start-up costs or buy a lot of VAT-able goods and services for your business, as it means you can start reclaiming that input VAT sooner. For a deeper dive, check out our guide on the self-employed VAT threshold.

To give you a quick reference, here are the key numbers you need to be aware of.

VAT At a Glance: When to Register and Key Rates

| Metric | Value | What It Means for You |

|---|---|---|

| VAT Registration Threshold | £90,000 | You must register for VAT if your VAT-taxable turnover in the last 12 months (or next 30 days) exceeds this amount. |

| VAT Deregistration Threshold | £88,000 | You can apply to deregister if your taxable turnover is expected to be less than this amount in the next 12 months. |

| Standard VAT Rate | 20% | This is the main rate you'll add to most of your sales and pay on most of your purchases. |

| Reduced Rate | 5% | Applies to specific goods and services, such as home energy and children's car seats. |

| Zero Rate | 0% | VAT is charged at 0% on certain items like most food, books, and children's clothing. You still record it on your return. |

This table covers the basics, but always double-check the specifics for your industry to make sure you're applying the correct rates.

The Standard VAT Rate and Its History

The standard VAT rate you'll be dealing with most of the time in the UK is 20%. It applies to the vast majority of goods and services.

This rate hasn't been around forever, though. When the UK first introduced VAT back in 1973 after joining the European Economic Community, it started at a mere 10%. It’s bounced around a bit since then, hitting a low of 8% in the 70s and being temporarily cut to 15% during the 2008 financial crisis to give the economy a boost.

On 4th January 2011, it was raised to the 20% we have today, and it’s stayed there ever since. This consistency makes financial planning a little easier, but it also really underlines why keeping accurate, detailed records is so important.

Getting to Grips with VAT on Your Sales and Purchases

Right, so you’re VAT-registered. Now for the fun bit: actually calculating what you owe. This is the bread and butter of your quarterly return, figuring out the VAT you’ve added to your sales (that’s output VAT) and the VAT you can claim back on your business expenses (your input VAT).

Let's walk through how this works in the real world.

The basic maths is pretty simple. For anything you sell, you take your price and add the standard VAT rate, which is currently 20%. That’s the amount you stick on your invoice.

Picture this: you're a freelance consultant and you’ve just finished a project for £1,500.

- Your fee (the net amount): £1,500

- The VAT bit: £1,500 x 0.20 = £300

- Total on the invoice (the gross amount): £1,500 + £300 = £1,800

Your client pays you the full £1,800. That £300 isn't yours to keep; you just hang onto it until it’s time to pay HMRC.

Claiming Back VAT on What You Buy

The flip side of this is reclaiming the VAT you've paid on things for your business. This is your input VAT, and it’s brilliant because you get to subtract it from the VAT you’ve collected, which means a smaller bill from the taxman.

Let's say you splashed out on a new office chair for £300 (VAT included). To figure out how much VAT you can reclaim, you need to isolate the VAT from that total price. A quick and easy way to do this is to divide the gross amount by 6.

- Total you paid: £300

- VAT to reclaim: £300 / 6 = £50

- The actual cost to your business: £250

You can claim that £50 back. If you also bought a software subscription for £60 (which included £10 of VAT), you’d add that to your reclaim pot. If you want to dive deeper into working backwards from a gross price, our guide on how to calculate net of VAT is a great resource.

Of course, to claim anything, you need proof. Knowing what receipts to keep for taxes is absolutely fundamental, as HMRC won't just take your word for it.

The Bottom Line: Your VAT payment to HMRC is simply your total Output VAT (from sales) minus your total Input VAT (from purchases). If you’ve spent more on VAT than you've collected, you'll get a refund. Simple as that.

Not Everything is 20%

Just to keep things interesting, not everything is taxed at the standard 20% rate. The goods or services you sell can fall into a few different buckets, and you need to know which is which.

- Standard-Rated (20%): This is the default for most things. Think freelance consulting, graphic design, or software development for your UK clients.

- Zero-Rated (0%): Some things have a VAT rate of 0%. This includes stuff like most food (but not a sandwich from Pret), books, and kids' clothes. You don't add any VAT, but you still have to report these sales on your return.

- Exempt: A few services are completely exempt from VAT, like postage stamps, insurance, and some financial services. The catch? You can’t reclaim any input VAT on expenses that relate to making these exempt sales.

Getting this right is a big deal. If you’re an author selling your own books (zero-rated) but also offering copywriting services (standard-rated), you need to handle the VAT for each one correctly on your return.

Tackling International Clients and the Reverse Charge

Working with clients and suppliers outside the UK throws another spanner in the works. The rules can feel a bit tangled at first, but there's a logic to them.

When you sell your services to a business client based outside the UK, that sale is usually considered 'outside the scope' of UK VAT. You don't charge them VAT. Simple. You do, however, still need to log the sale on your VAT return.

It gets a bit more complex when you buy services from an overseas supplier, like paying for a software subscription from a company in the US. This is where you'll bump into something called the reverse charge mechanism.

Instead of your supplier charging you VAT, you effectively charge it to yourself. On your VAT return, you act as both the supplier and the customer. You declare the VAT as output tax, but then you immediately claim it back as input tax (as long as it’s a legit business expense). The two entries cancel each other out perfectly.

For example, you pay £100 for that US-based design tool:

- First, you calculate the VAT you would have paid if it was a UK purchase (£100 x 20% = £20).

- Next, you declare £20 as output VAT on your return.

- Then, at the same time, you declare £20 as input VAT.

The final impact on your VAT bill is zero, but you must report it. Getting this wrong is an easy way to attract unwanted attention from HMRC.

Choosing the Right VAT Accounting Scheme

Once you're VAT registered, HMRC automatically pops you onto the standard accounting scheme. But that’s not your only choice, and it might not be the best one for your business. Think of it like a mobile phone plan: the default one works, but a different one could save you a ton of cash and administrative headaches.

Getting this right can make a huge difference to your cash flow, so let's walk through the main contenders.

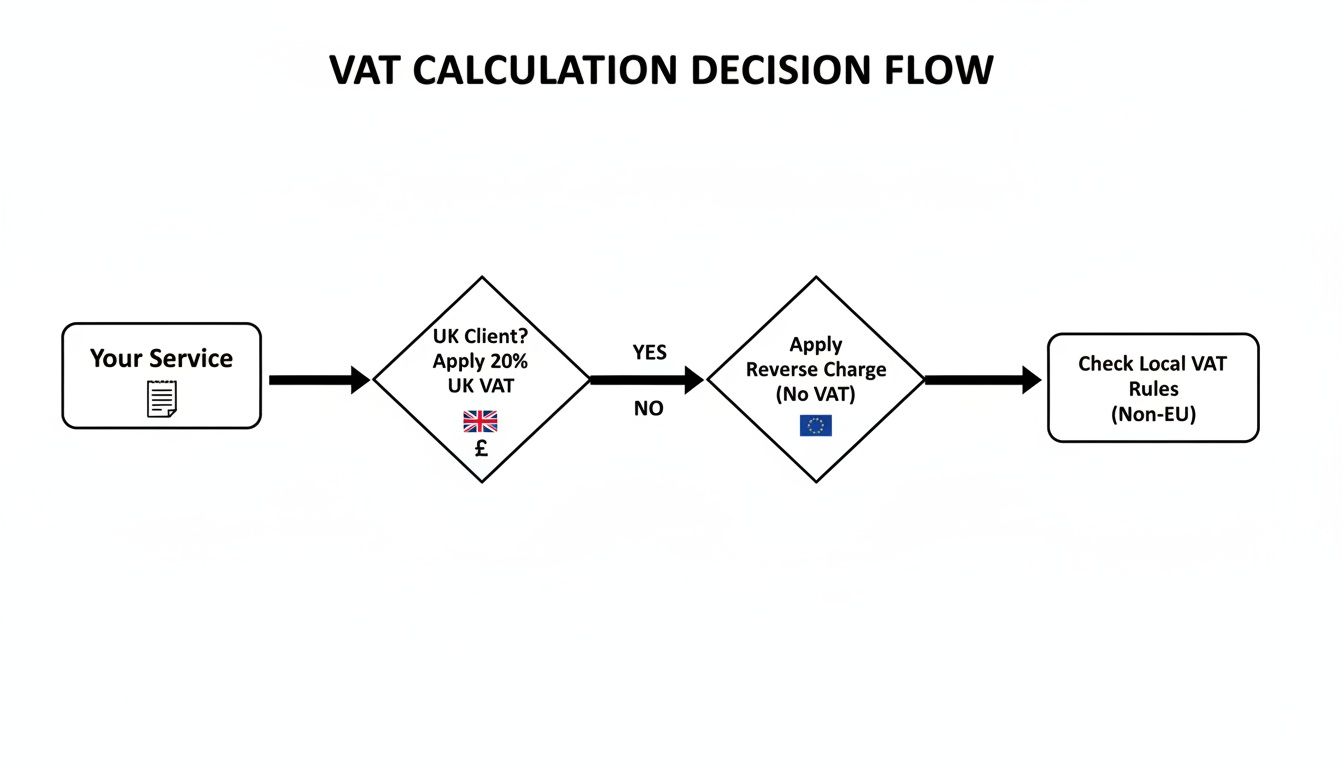

First, where you do business matters. This quick flowchart shows how your client's location can change your VAT responsibilities, which is a key piece of the puzzle when you're weighing up different schemes.

As you can see, selling to someone in the UK is different from selling to someone abroad. This distinction can really influence which accounting scheme will work best for you.

Standard vs Cash Accounting

For most freelancers and small business owners, the biggest decision is whether to stick with the default standard scheme or jump over to cash accounting. The whole thing boils down to timing.

With the Standard (Accrual) Scheme, you have to account for VAT based on invoice dates. That means you owe HMRC the VAT as soon as you send your client the bill, even if they take 60 days to pay you. The same goes for your purchases; you can reclaim VAT as soon as you receive a supplier's invoice.

The Cash Accounting Scheme, on the other hand, is much more intuitive. It’s all about when the money actually hits or leaves your bank account. You only pay VAT to HMRC once your client has paid you, and you only reclaim it on your expenses once you’ve paid the supplier.

For freelancers, cash accounting is often a game-changer for cash flow. You’ll never have to dip into your own funds to pay a VAT bill while you’re still chasing an unpaid invoice.

You’re eligible to use the Cash Accounting Scheme as long as your estimated VAT-taxable turnover is £1.35 million or less.

The Flat Rate Scheme Simplified

If you really want to keep things simple, there’s the Flat Rate Scheme. It does away with the whole output-minus-input VAT calculation. Instead, you just pay a single, fixed percentage of your total turnover (that’s your sales including the VAT) to HMRC.

The percentage varies depending on your trade. A graphic designer might be on 11%, while an IT consultant could be on 14.5%. The trade-off is that you generally can’t reclaim any VAT on your day-to-day purchases and expenses. The flat rate is designed to factor this in. The only real exception is for big-ticket capital assets costing over £2,000.

But there’s a massive catch you need to be aware of: the ‘limited cost business’ test.

Are You a Limited Cost Business?

This is a crucial check you have to do every single quarter if you’re on the Flat Rate Scheme. HMRC will class you as a 'limited cost business' if your spending on goods is either:

- Less than 2% of your turnover in that period.

- More than 2%, but less than £250 for the quarter.

If you trip this wire, you’re forced to use a much higher flat rate of 16.5%. For most service-based freelancers who don't buy much physical 'stuff', like writers, coaches, or consultants, this is almost a certainty, and it usually wipes out any benefit of being on the scheme.

A Practical Example: Freelance Graphic Designer

Let’s put some numbers to this. Imagine a freelance graphic designer has a decent quarter, bringing in £10,000 (excl. VAT). They also spent £600 (£500 + £100 VAT) on things like software subscriptions and stock images.

Under the Standard Scheme

- Output VAT (on sales): £10,000 x 20% = £2,000

- Input VAT (on purchases): £100

- VAT Payable to HMRC: £2,000 - £100 = £1,900

Under the Flat Rate Scheme (11%) First, we need their gross turnover: £10,000 (net) + £2,000 (VAT) = £12,000.

- VAT Payable to HMRC: £12,000 x 11% = £1,320

- Savings: £1,900 - £1,320 = £580

Looks like a no-brainer, right? But wait. We have to do the limited cost business test. Their spending on goods was £500 (we use the net amount). Is that less than 2% of their £12,000 gross turnover? Well, 2% of £12,000 is £240. Since £500 is more than £240, they are not a limited cost business. Phew! They can use the 11% rate and bank the savings.

But what if their costs were only £150? They’d fail the test and be forced to use the 16.5% rate. Their VAT bill would suddenly rocket to £1,980 (£12,000 x 16.5%), making the standard scheme the better option. It really pays to run the numbers for your own business.

VAT Scheme Comparison: Standard vs Cash vs Flat Rate

Choosing the right VAT scheme feels complicated, but it's all about matching the rules to how your business actually operates. This table breaks down the key differences to help you see which one might be the best fit.

| Feature | Standard (Accrual) Scheme | Cash Accounting Scheme | Flat Rate Scheme |

|---|---|---|---|

| When VAT is due | On the date of your invoice (paid or not). | When your customer pays you. | When your customer pays you. |

| VAT on purchases | Reclaim VAT based on the date of your supplier's invoice. | Reclaim VAT when you pay the supplier. | You generally cannot reclaim VAT on purchases (except certain capital assets). |

| Best for | Larger businesses or those who get paid very quickly. | Freelancers and small businesses with slow-paying clients. | Businesses with very few expenses who want maximum simplicity. |

| Cash flow impact | Can be negative if clients pay late. | Excellent. You only pay VAT you've actually received. | Good, as it's based on cash received. |

| Admin level | Highest. Requires tracking all input and output VAT. | Medium. Simpler than accrual but still needs tracking. | Lowest. No need to record VAT on individual purchases. |

| Eligibility | All VAT-registered businesses. | Turnover up to £1.35 million. | Turnover up to £150,000. |

| Key consideration | You might pay VAT to HMRC before your client pays you. | Protects your cash flow. | Watch out for the 'limited cost business' 16.5% rate. |

Ultimately, the goal is to find a system that doesn't put a strain on your cash flow and doesn't give you an administrative nightmare every quarter. For many new freelancers, the Cash Accounting Scheme often hits that sweet spot.

Common VAT Mistakes and How to Avoid Them

Even the most organised freelancer can take a wrong turn with VAT. Let's be honest, it's complex stuff. Think of this section as a friendly heads-up on the most common pitfalls I've seen trip up countless small business owners. Getting VAT right isn’t just about ticking a box for HMRC; it's about keeping your business financially healthy.

Simple oversights can easily snowball into stressful letters from the taxman, surprise bills, and even hefty penalties. So, let’s walk through the frequent slip-ups and I’ll give you some straightforward advice to keep your records clean and your mind at ease.

Late Registration and the Painful Consequences

This is the big one. It's so easy to get caught up in the thrill of growing your business that you completely miss your turnover creeping over the £90,000 threshold in a rolling 12-month period.

Trust me, this isn’t a mistake HMRC takes lightly. If you register late, they’ll expect you to pay all the VAT you should have collected from the day you were meant to be registered. That can be a gut-wrenching bill to receive, especially as it’ll likely have to come straight out of your own pocket.

My Proactive Tip: Pop a recurring reminder in your calendar for the first of every month to check your 12-month rolling turnover. Your accounting software can run this report in seconds. This five-minute habit can literally save you thousands in backdated VAT.

Getting the Numbers Wrong on Invoices

You'd be surprised how often this happens. Whether it's using an old rate, a simple typo, or adding VAT to a zero-rated service, these little mistakes create a domino effect of problems for both you and your clients.

Remember, your client can't reclaim their input VAT if your invoice has the wrong details on it. That can make you look unprofessional and leads to awkward emails and a load of corrected paperwork. Always, always double-check your maths before hitting send.

- Net Amount: The price of your work before VAT.

- VAT Amount: The net amount multiplied by the correct VAT rate (usually 20%).

- Gross Amount: The net plus the VAT, the final total your client pays.

Every single VAT invoice you send must show these three figures clearly. Accuracy here is completely non-negotiable.

Missing Out on Reclaimable VAT

Every time you forget to claim the VAT back on a business expense, you’re basically handing over your own money to the taxman. This happens all the time with small, fiddly purchases or those receipts that get buried in a chaotic inbox.

Think about it: all those software subscriptions from overseas companies, train tickets for meetings, or even the coffee you bought for a client. Each receipt has reclaimable VAT on it. Over a year, these small amounts can add up to a seriously significant sum that belongs in your bank account, not HMRC’s. This is exactly why a rock-solid system for capturing every single receipt is a game-changer.

The sheer scale of VAT collection shows why getting it right is so important. The UK's "VAT gap", the difference between tax owed and tax collected, shrank from 13.8% in 2005 to just 5.0% in 2023. This is largely because HMRC is cracking down on errors. For us small business owners, it highlights the need for precision. Every unclaimed expense or miscalculation contributes to this gap, but tools that automate receipt capture make sure you get back every penny you’re entitled to. For a deeper dive into recent tax policies, you can explore Deloitte's analysis on UK tax rates.

The Reverse Charge Mix-Up

Ah, the reverse charge. This one causes a world of confusion, especially when buying services from suppliers outside the UK. Many freelancers either don’t know it exists or forget to apply it, which is an immediate red flag for HMRC.

Here’s the deal: if you buy a service from an overseas supplier (like that American software you use), you have to account for the VAT yourself. You do this by recording it as both a sale and a purchase on your VAT return. The two entries cancel each other out so you don’t owe anything, but failing to report it at all is a compliance error. It tells HMRC you might not have a firm grip on your obligations, and that’s a position you don’t want to be in.

Let Automation Handle Your VAT Workflow

Let’s be honest, manually tracking receipts and calculating VAT is a soul-crushing chore. It's that nagging task that eats into your evenings and weekends, time you’d much rather spend on, well, anything else.

But what if you could put the whole thing on autopilot? By connecting a couple of smart tools, you can turn your VAT workflow from a painful manual slog into a smooth, automated process. This isn’t just about clawing back time; it’s about making sure your numbers are spot-on so you reclaim every penny you're owed.

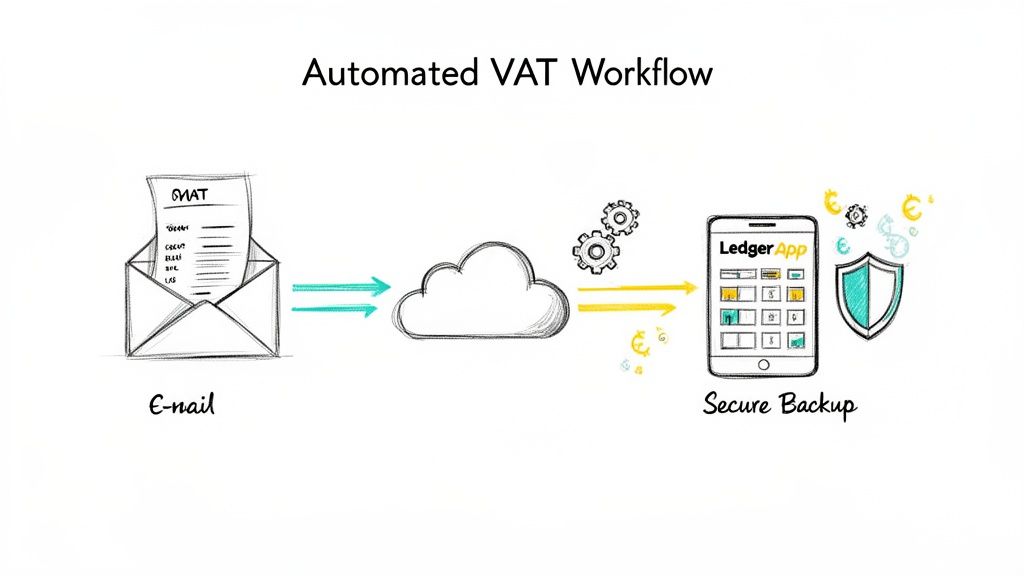

A Smarter Way to Handle Receipts

Picture this: you've just paid for a new software subscription, and the receipt lands in your inbox. Instead of letting it get lost in the digital clutter, you simply forward the email to a special address.

That one little action kicks off a whole chain of events behind the scenes:

- It finds the right transaction: The system automatically hunts down the matching payment in your accounting software, like FreeAgent. No more scrolling through bank statements trying to pair things up.

- It nails multi-currency: If you bought something in US dollars or Euros, the tool sorts out the currency conversion and works out the correct VAT for your UK return. This is a lifesaver if you buy services or ads from overseas companies.

- It creates a perfect backup: A copy of that receipt is instantly saved to a specific folder in your Google Drive. Now you have a digital, audit-proof paper trail without even thinking about it.

Suddenly, you have a flawless record of all your business expenses, giving you complete peace of mind when your VAT return is due.

Getting this right is a big deal. In the 2024-25 financial year, HMRC collected a mind-boggling £171 billion in VAT. That figure has jumped by 49% in the last ten years alone. With that kind of money changing hands, every single receipt you reclaim really does count.

Your Automated System: Receipt Router + FreeAgent

This kind of slick automation isn't just for big businesses with deep pockets. Tools like Receipt Router are built for UK freelancers and small businesses who use FreeAgent, acting as the missing link between your inbox and your accounts.

It’s surprisingly simple. You get a unique email address. Any time a receipt shows up in your email, whether it's from Stripe, Amazon Web Services, or your local supplier, you just forward it. You can even set up auto-forwarding rules in Gmail for those regular bills, making the whole thing completely hands-off. Got a paper receipt? Just snap a quick photo and email it to the same address.

This 'set it and forget it' approach is where the magic happens. It takes human error out of the equation and makes sure no claimable expense gets missed, which is absolutely crucial when you need to accurately work out VAT.

To get your finances truly sorted, pairing a clever receipt tool with the right accounting platform is key. It's worth exploring the best free accounting software to see what fits your business, as this combination creates a seriously robust system.

When you automate your receipt handling, you can get back to doing what you do best, confident that your books are always accurate and ready for HMRC. If you want to dive deeper, our guide on how to automate your accounts payable process has even more practical tips to get you started.

Your VAT Questions Answered

Even when you think you’ve got a handle on the main rules, VAT has a way of throwing up tricky situations that can leave you scratching your head. Let’s run through some of the most common questions we hear from freelancers and small business owners.

Think of this as your quick-fire round to clear up any lingering confusion. Getting these specific scenarios right is just as important as the basics; a small slip-up on an unusual transaction can be just as costly as getting your day-to-day sums wrong.

Can I Reclaim VAT on Expenses from Before I Registered?

Yes, you absolutely can! This is a fantastic, and often overlooked, way to get a bit of a cash boost right after you register. HMRC has some clear time limits, though.

You can go back and reclaim VAT on:

- Goods you bought for your business up to four years before you registered, as long as you still have them.

- Services you paid for up to six months before your registration date.

The catch? You must have the original, valid VAT receipts, and the purchases must clearly relate to the business you’ve now registered. It’s a perfect example of why hanging onto your receipts, even before you think you’ll need them for VAT, is such a smart move.

What Happens If I Accidentally Charge VAT Before I Am Registered?

This is a real banana peel, so be careful. If you add VAT to an invoice before your registration is official and you have your VAT number, that money doesn't belong to you; it belongs to HMRC. You are legally required to hand it over to them.

It’s crucial not to jump the gun and charge VAT until your registration is fully confirmed. If you do make an honest mistake, get in touch with HMRC straight away. Explain what happened, and they’ll tell you how to pay them the amount you collected.

A much better way to handle this is to issue a standard invoice without VAT. Then, once your number arrives, you can send your client a proper VAT invoice to replace it.

How Does Making Tax Digital for VAT Affect Me?

Making Tax Digital, or MTD, has completely changed how we file VAT returns. It's no longer optional. All VAT-registered businesses, regardless of turnover, must now keep digital records and submit their returns using MTD-compatible software.

That means you can no longer just log into the old government gateway portal to key in your return manually.

The whole point of MTD is to cut down on the simple errors that creep in with manual bookkeeping. This shift makes having good digital tools for your finances more important than ever. Your records have to be accurate and stored digitally, which is where having an automated way to manage receipts really comes into its own.

What Is a VAT Invoice and What Must It Include?

A VAT invoice is more than just a bill; it's a specific legal document. For it to be valid, it needs to tick a few boxes and include certain pieces of information. If you miss any of these details, your client won't be able to reclaim the VAT you’ve charged them, which can lead to payment delays and a lot of unnecessary back-and-forth.

A valid VAT invoice has to show:

- A unique invoice number

- Your business name, address, and VAT registration number

- The date you supplied the goods or services (known as the 'tax point')

- The invoice date

- Your customer's name and address

- A clear description of what you're charging for

- The net amount (before VAT) for each item

- The VAT rate charged per item

- The total amount of VAT

- The gross total amount payable

Get into the habit of double-checking every invoice for these details before it goes out the door. It’ll save you a ton of hassle and keep your clients happy.

Ready to stop wrestling with receipts and automate your VAT workflow? With Receipt Router, you can forward your receipts and let automation handle the rest, matching them in FreeAgent and creating a perfect, audit-proof record. Start saving hours and claim back every penny you're owed.