A Freelancer's Guide to Mastering Cash Flow Planning in the UK

Cash flow planning is really just the fancy term for figuring out how much money is coming into and going out of your business. For a freelancer, it’s the difference between knowing you can pay your bills next month and just crossing your fingers. It’s a simple habit that turns that nagging financial anxiety into real confidence.

Why Cash Flow Planning Is Your Freelance Superpower

Let’s be honest, nobody gets into freelancing to wrestle with spreadsheets at midnight. You’re a designer, a writer, or a consultant because you love what you do, not because you get a kick out of accounting. But the single biggest threat to your freelance freedom isn't a tricky client or a creative block; it's running out of cash.

It’s a classic trap. Your business can look great on paper, with plenty of invoices sent out, but your bank account can still be depressingly empty. This cash crunch happens when your income and your expenses aren't in sync.

The Hidden Dangers of Poor Cash Flow

For UK freelancers and small businesses, a few specific challenges can turn a profitable month into a financial nightmare. You can’t afford to ignore them.

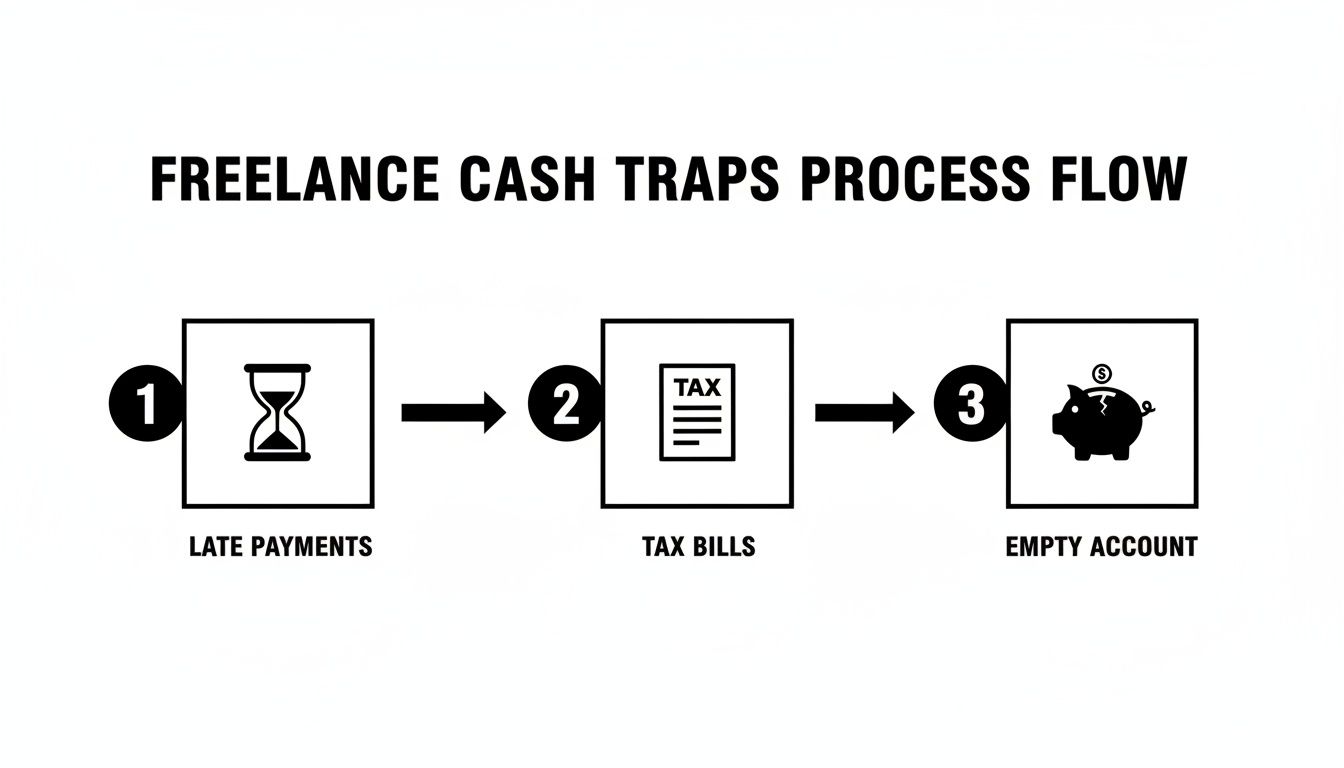

- Chasing Late Payments: When a client pays 30 or even 60 days late, it blows a hole in your budget. Your fixed costs like rent, software subscriptions, and insurance don’t wait around.

- Quarterly Tax Surprises: That VAT or Self Assessment bill can feel like it comes out of nowhere, completely draining your account if you haven’t been putting money aside.

- The Feast-or-Famine Cycle: We’ve all been there. Irregular project work means your income can swing wildly, making it incredibly tough to cover consistent monthly bills during the quiet spells.

This isn't just a minor headache; it’s one of the main reasons businesses go under. Imagine building a brilliant freelance business, juggling invoices and supplier payments, only to realise you can't pay your next VAT bill. This nightmare scenario plays out far too often: a staggering 73% of UK businesses fail within their first five years, with poor cash flow being the number one culprit. For a deeper dive into why UK businesses face this struggle, annetteandco.co.uk has some great insights.

Cash flow planning isn’t about gazing into a crystal ball. It’s about drawing a realistic map that gives you enough of a heads-up to steer around the potholes instead of driving straight into them.

By getting into a simple forecasting habit, you give yourself the power to see these problems coming from a mile off. It helps you make smarter choices, turning financial admin from a chore into a genuine tool for growing your business. When you’re in control, you can make decisions from a place of strength, and we have more small business accounting tips to help you do just that.

Right, let's get into the nuts and bolts of it. Building your first cash flow forecast is probably the single most powerful thing you can do for your business's financial health. We’re going to keep it simple and start with a 12-week forecast. You don't need any fancy software for this; a basic spreadsheet will do just fine.

The point isn't to predict the future with perfect accuracy. It's about creating a realistic, living picture of the money coming in and going out. This simple act of looking ahead is what gives you the power to spot a cash crunch weeks away and sidestep it before it becomes a real headache.

Mapping Out Your Expected Income

First up, let's map out all the money you genuinely expect to land in your bank account over the next 12 weeks. This is where you need to be a realist, not an optimist. Base your figures on confirmed work and what you know about your clients' payment habits.

- List every client and project: Give each income source its own row.

- Be honest about payment dates: Got a client who consistently pays 15 days late? Build that delay into your forecast. Don't kid yourself.

- Account for all income streams: Are you expecting a VAT refund or selling an old work laptop? Pop it in the forecast.

Getting this down on paper helps you see when the cash from that massive project will actually hit your account, which is often weeks after you’ve finished the work. For most UK freelancers, this means plotting a big project payment you know is due in Week 8 alongside the smaller, regular retainer invoices that land like clockwork.

It’s easy to see how things can go wrong if you don't keep an eye on this. Late payments are the classic start of a domino effect that can quickly lead to a cash crisis.

This is the trap so many of us fall into: the invoice is sent, but the cash isn't there when the tax bill arrives, leaving your account dangerously empty. Proper cash flow planning stops this from happening.

To give you a clearer idea, here is a foundational template showing how to structure your forecast. It tracks expected income against your fixed and variable expenses over a three-month period.

Sample 12-Week Cash Flow Forecast for a UK Freelancer

| Category | Week 1 (£) | Week 2 (£) | Week 3 (£) | ... | Week 12 (£) |

|---|---|---|---|---|---|

| Opening Balance | 2,500 | 3,000 | 2,750 | ... | X,XXX |

| Income In | |||||

| Client A Project | 0 | 1,500 | 0 | ... | 0 |

| Client B Retainer | 750 | 0 | 0 | ... | 750 |

| Total Income | 750 | 1,500 | 0 | ... | X,XXX |

| Outgoings | |||||

| Fixed Costs | |||||

| FreeAgent Subscription | 29 | 0 | 0 | ... | 0 |

| Co-working Space | 250 | 0 | 0 | ... | 0 |

| Variable Costs | |||||

| Software Tools | 0 | 25 | 0 | ... | 0 |

| Travel | 0 | 0 | 100 | ... | 0 |

| Total Outgoings | 279 | 25 | 100 | ... | X,XXX |

| Closing Balance | 3,000 | 4,475 | 4,375 | ... | X,XXX |

This example shows how your closing balance from one week becomes the opening balance for the next, giving you a running total of your financial position.

Detailing Your Business Outgoings

Next, you need to list every single business expense. This is where being meticulous really pays off. To get a proper handle on your finances, it’s crucial to split your costs into two camps.

Your forecast is only as good as the data you put into it. Forgetting even small, regular expenses can paint a dangerously misleading picture of your financial health, setting you up for a nasty surprise.

Here’s how I recommend breaking down your spending:

- Fixed Costs: These are the predictable bills that hit your account regularly and don't change much. Think of your FreeAgent subscription, business insurance, co-working space rent, or professional indemnity cover. They're the reliable bedrock of your expenses.

- Variable Costs: These are the expenses that go up and down with your workload. This could be anything from project-specific software and subcontractor fees to train tickets for client meetings or postage if you’re sending out physical products.

Once you have your income and your outgoings mapped out week-by-week, you can calculate your closing balance. Just take the week’s opening balance, add all the income, and then subtract all the outgoings. That final number becomes the opening balance for the following week. Simple.

Of course, keeping on top of all those little receipts and expenses can feel like a chore. You can learn more about how a receipt scanning app can take that pain away, automatically capturing the data you need to ensure your forecast is always built on accurate, real-time information.

Taming Your Expenses with FreeAgent

Let's be honest, your cash flow forecast is only as good as the numbers you put into it. And if you're manually tracking every coffee, train ticket, and software invoice, you're setting yourself up for mistakes and probably missing out on tax deductions. It’s time to build a system that catches every single expense without the faff.

Automating this isn’t just about saving a few minutes here and there. It’s about creating a rock-solid, accurate foundation for your entire cash flow plan. When your expenses are logged the moment they happen, your forecast stops being a hopeful spreadsheet and starts being a genuinely useful tool for making smart business decisions.

Linking Your Tools for Effortless Tracking

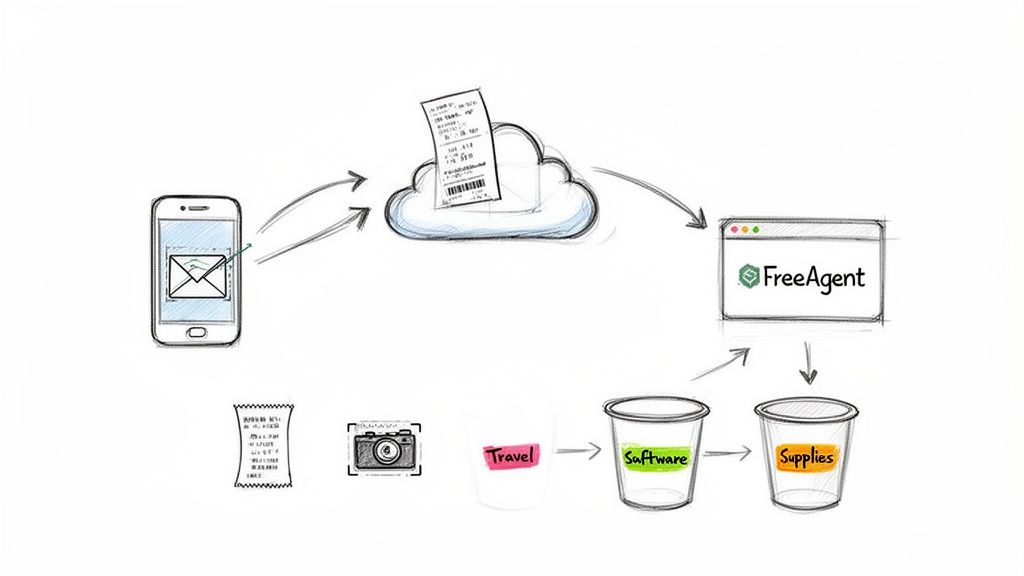

The real goal here is to kill off manual data entry for good. It's a time-sink and a breeding ground for errors. By connecting a tool like Receipt Router directly to your FreeAgent account, you can create a workflow that handles most of your expenses without you lifting a finger.

Think about it this way: you just paid for a new software subscription, and the invoice hits your inbox. The old way involved downloading the PDF, logging into FreeAgent, and typing everything out. The new way? You just forward that email to your unique Receipt Router address. Done. The system pulls out all the key details and pops the expense right into your accounts, correctly categorised and ready to go.

Here’s a quick look at how that process works in the background, feeding accurate data straight into your accounting software.

This simple flow from snapping a picture to organised accounts is what keeps your forecast accurate and up-to-date.

Making Total Automation a Reality

A truly great system has to handle every type of expense, not just the simple digital ones. Here are a few practical tips to make sure nothing ever slips through the net.

- Set Up Email Rules: For those recurring digital receipts from suppliers like Adobe, Amazon Web Services, or your web hosting, set up a simple auto-forwarding rule in your email client. This means you never even have to think about them again. They just appear in your accounts.

- Snap Paper Receipts on the Go: What about that receipt from a client lunch or a run to the post office? Don't let it get crumpled in your wallet. Just snap a quick photo on your phone and forward it to your Receipt Router address. It takes ten seconds.

- Deal with Multi-Currency Payments: If you work with international clients or use software priced in dollars or euros, you know what a pain manual conversion can be. A good automation tool handles all the currency conversion for you, recording the expense in pounds sterling at the correct exchange rate on the day.

Once you get your expense pipeline automated, you’re doing more than just saving time. You're building a real-time picture of your spending that makes your cash flow planning genuinely powerful.

This is the kind of automation that leads to proper, reliable forecasting. A slick system for your payables is a cornerstone of good financial management, after all. If you want to dig deeper into this, you can learn more about how to automate your accounts payable and get a tighter grip on your finances. It’s all about removing the guesswork and making decisions based on data you can actually trust.

Turning Your Forecast into Action

Right, so you've built your cash flow forecast. That spreadsheet isn't just a boring list of numbers; it's your new secret weapon. This is where the real magic happens, turning all that data into smart, confident decisions instead of just panicking at your bank balance every Tuesday.

The true power of a good forecast is its ability to act like a crystal ball for your finances. A quick scan of your projected closing balances for the next few weeks can flag a potential cash shortfall long before it becomes a full-blown crisis. If you spot that Week 8 is looking a bit dicey and heading into the red, you've got time. Plenty of time, in fact, to chase that client who’s dragging their feet, hold off on buying that non-essential bit of kit, or have a chat with the bank about a small overdraft.

Putting Your Finances Through a Stress Test

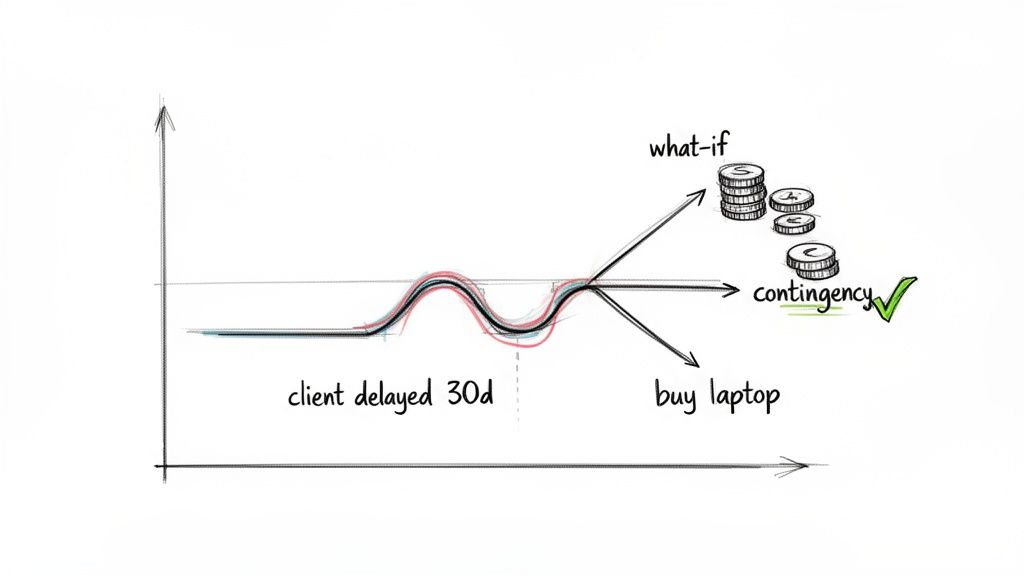

Now for the fun part: playing with the numbers to see what might break. Think of this as a financial fire drill. Running a few 'what-if' scenarios helps you understand just how robust your business actually is. Don't wait for things to go wrong, model them first.

Start by asking yourself some tough but necessary questions:

- What if my biggest client pays 30 days late? Just shunt that income entry forward a few weeks in your forecast. You’ll instantly see the knock-on effect on your cash balance and can figure out how to cover the gap.

- What if my laptop gives up the ghost and I need a new £1,500 machine next month? Pencil that big one-off expense into your outgoings and see if you can absorb the hit without causing a major drama.

- What if I actually land that massive project I pitched for? Pop the new income and any extra costs into the forecast to see how it really impacts your bottom line.

By stress-testing your finances like this, you go from being a passenger to being the pilot of your business. It's the difference between crossing your fingers and having a solid plan B (and C).

This isn't just academic, either. For UK startups, a staggering 38% of failures are pinned on cash flow problems. That stat alone should tell you why getting a handle on your forecast is non-negotiable. When you learn that up to 82% of businesses that go under point to cash shortages as the culprit, you realise how crucial this planning really is. You can find more details on these figures and learn how to safeguard your business from these statistics.

Finding the Rhythm of Your Business

Over time, your forecast starts to tell a story. It reveals the natural ebb and flow of your business, your own unique financial rhythm. You can clearly see your most profitable months and the ones where things tend to quieten down, which is gold dust for planning.

If you know August is always a ghost town for new work, you can start building up a cash buffer in June and July to comfortably cruise through the slow patch. On the flip side, knowing your peak seasons lets you be more strategic. Is October always manic? That might be the perfect time to invest in that new software or training course, knowing the cash will be there to cover it. This is the kind of forward-thinking that separates the freelancers who just get by from the ones who genuinely thrive.

Tackling the All-Too-Common Freelance Cash Flow Hiccups

Even with the most beautiful forecast, reality has a funny way of not sticking to the plan. Your cash flow plan isn't just about mapping out the good times; it's your defence against the curveballs and dramas that every UK freelancer knows and… well, loathes. We’re talking about clients who treat payment deadlines as a mild suggestion or those surprise bills that land on your doormat with a thud.

Think of this section as your financial first-aid kit. It’s filled with down-to-earth solutions for the most common headaches, helping you get through them without torching client relationships or your sanity.

Chasing Late Payments (Without Being a Pain)

Is there anything more infuriating than an overdue invoice? You’ve delivered the goods, but the money is nowhere to be seen. Chasing what you’re owed is a real art form because you have to be firm but professional. You need to get paid, but you also want to keep the client.

The secret is to have a calm, systematic process that gradually ramps up. Don’t go from zero to a hundred overnight. A few gentle, automated reminders before the due date can work wonders, followed by polite but direct emails once the deadline has passed.

Here’s a simple three-email sequence that works a treat. Feel free to tweak it to match your own style:

- The Gentle Nudge (1-2 days late): Keep it friendly and low-pressure. Always assume it was a simple mistake. I usually frame this as a quick check-in to make sure they got the invoice and that everything was okay with the work.

- The Direct Follow-Up (a week late): Still polite, but a bit more to the point. Mention the invoice number and the due date again, and ask for a quick update on when you can expect the payment to land.

- The Final Notice (2+ weeks late): Time to be firm. State clearly that the invoice is now significantly overdue. It’s worth reminding them of your payment terms and mentioning that you may have to add late payment charges (as is your right under UK law) if it isn’t settled by a new, firm date.

Top tip: Always, always keep a record of every email and call. This paper trail is your best friend if things get messy and you need to prove you’ve been patient and reasonable.

Smoothing Out That Feast-or-Famine Cycle

Every freelancer has been there. One month you’re buried under a mountain of incredible projects, and the next, you're staring at an empty inbox, wondering where your next gig is coming from. That income rollercoaster makes planning your cash flow feel almost impossible. The key is to take active steps to smooth out those peaks and troughs.

The first, most crucial step is building a financial buffer: your contingency fund, or ‘rainy day’ fund. Your target should be enough cash to cover three to six months of all your essential outgoings, both business and personal. This isn't money to play with or invest; it's a boring-but-brilliant safety net that lets you pay the bills during a quiet spell without breaking a sweat.

Beyond that, start thinking about diversifying your income. Could you offer a monthly retainer service to a couple of key clients? Maybe create a digital product, an online course, or offer some coaching? Building more predictable, recurring revenue is one of the single best things you can do to stabilise your cash flow for good.

What’s Next for Freelancer Finances?

Let's be honest, the way freelancers and small business owners have traditionally handled their money is changing, and it's about time. We're finally ditching the nightmare spreadsheets and late-night receipt-sorting sessions. Instead, we're stepping into a much saner world of smart, connected tools that actually work for us.

This isn't just a fleeting trend. The demand for better cash flow tools is massive. The UK's financial management services sector just hit a whopping £6.6 billion in revenue. That number tells a story: businesses are desperate for simpler, more effective ways to manage their money. If you're curious about the bigger picture, you can check out the full financial management report on ibisworld.com.

Getting on Board with Smarter Systems

Modern tech now gives freelancers the power to automate the kind of soul-destroying tasks that used to eat up entire evenings. Remember trying to track multi-currency payments from an international client, or trying to match up a dozen tiny coffee receipts? What once took hours of painful admin can now be sorted in minutes, automatically.

It’s not just about staying on the right side of things like Making Tax Digital. By adopting smart, affordable systems, you're actually building a more robust and resilient business that’s ready to grow without the growing pains.

These kinds of tools aren't just for the big players anymore. For a relatively small monthly fee, you can get a setup that slots right into your cash flow planning, giving you a live, accurate picture of where you stand financially. This isn't just about saving a bit of time, it's about making smarter decisions, dodging those nasty month-end panics, and ultimately, building a freelance career that lasts.

Got Questions About Cash Flow Planning? We’ve Got Answers

Getting your head around cash flow planning for the first time can feel a bit like learning a new language. It’s normal to have a few questions. Let's tackle some of the most common ones we hear from freelancers and small business owners across the UK.

How Often Should I Be Updating My Forecast?

Honestly, for most freelancers, a quick weekly check-in is perfect. It’s usually a 15-minute job, tops, but it means you’re never caught off guard by an unexpected bill or a change in your pipeline. Think of it as a quick financial health check.

If you’re running a business with lots of daily transactions or your margins are super tight, you might find it helpful to glance at it more often. But at the absolute minimum, get into the habit of sitting down with it at the beginning of each month. It's the best way to make sure you're starting the month on the right foot.

What’s The Real Difference Between Cash Flow And Profit?

This one trips up so many people, but it’s a crucial distinction. Profit is what’s left over on paper after you’ve subtracted all your business costs from your revenue. It's a great indicator of how efficient and viable your business model is.

Cash flow, on the other hand, is the actual, tangible money flowing into and out of your bank account. You can have a hugely profitable month on your P&L sheet but be completely broke if your clients haven't paid their invoices yet. This is exactly why solid cash flow planning is non-negotiable.

Profit tells you if your business is making money. Cash flow tells you if you can pay your rent next month. Both are vital, but only a lack of cash can shut you down overnight.

My Income Is All Over The Place. How Can I Possibly Forecast It?

This is the classic freelancer's dilemma! Forecasting with a variable income isn't about gazing into a crystal ball; it's about making educated, realistic projections.

A great starting point is to look at your income over the last three to six months and work out a monthly average. That gives you a decent baseline.

For a more conservative and safer forecast, take your lowest-earning month from that period and treat that as your baseline. Any confirmed projects or new client work you land can then be added on top. This approach means you’re planning for the lean times, so you know your core costs are covered no matter what. Anything extra is a bonus.

Ready to swap the guesswork for genuine clarity? Receipt Router plugs right into your FreeAgent account, pulling in every expense automatically. This means your forecast is always working with precise, up-to-the-minute numbers. See how it works at https://receiptrouter.app.