Bookkeeping Services for Small Business: bookkeeping services for small business

So, what exactly are bookkeeping services for a small business? In short, they’re professional services dedicated to recording and managing all the money that moves in and out of your company every single day.

Think of it like this: your bookkeeper is the person keeping the financial engine of your business purring. They make sure every sale, every purchase, and every payment is logged correctly and kept in perfect order.

Your Guide to Small Business Bookkeeping

Welcome to the only guide you'll need on bookkeeping for UK small businesses. Forget the dry definitions; let’s get straight to what this actually means for you and your business.

If your business was a high-performance car, then your bookkeeping is the dashboard. It shows you your speed, your fuel level, and the health of your engine. Without it, you’re just driving blind, hoping for the best.

Getting a firm grip on your finances right from the start is absolutely crucial for survival, let alone growth. This is especially true now, with operational costs seemingly always on the rise. This guide will walk you through the core ideas in a friendly, no-nonsense way, covering what to look for in a service, when it’s time to hire a pro, and how to pick the right one.

Why Good Bookkeeping Matters More Than Ever

Solid financial record-keeping is the bedrock of any strong business. It gives you the clear, up-to-date information you need to make genuinely smart decisions, whether that’s setting your prices or just managing your day-to-day cash flow. Get it wrong, and you could run out of money, miss tax deadlines, or fail to spot a cash drain until it’s far too late.

Good bookkeeping simply gives you confidence in your numbers. It helps you answer vital questions like:

- Profitability: Are your products or services actually making you money?

- Cash Flow: Can you afford to pay your bills and staff next month?

- Tax Obligations: Have you put enough aside for the dreaded VAT and Corporation Tax bills?

- Growth Opportunities: Is now the right time to hire someone new or invest in that piece of equipment you’ve been eyeing?

Bookkeeping isn't just about ticking boxes for HMRC; it's about gaining clarity. It turns a jumble of financial data into a clear story about where your business has been and, more importantly, where you can take it next.

We’ll also dig into how modern tools can make this whole process so much easier. By using a bit of automation, you can claw back hours spent on admin, dodge common money mistakes, and feel properly in control of your finances. If you’re keen to get a head start, check out these small business accounting tips.

This guide is designed to give you the confidence and knowledge to build a rock-solid financial foundation for your business.

What's Really Going On with Small Business Finances in the UK?

If you're running a small business in the UK, you know it's a wild ride. Millions of us, including freelancers, entrepreneurs, and small companies, are the heart of the economy. But with great opportunity comes serious financial pressure. Keeping your head above water financially isn't just a "nice-to-have"; it's a make-or-break part of staying in business.

For so many, managing the money side of things feels like a constant tug-of-war between rising costs and a cash flow that’s all over the place. That's exactly why getting some professional help with your finances has shifted from being a luxury to an absolute necessity. It gives you the clear picture you need to make smart calls when every single pound counts.

The Financial Squeeze is Real

Running a small business means you’re the CEO, the marketing department, and the janitor all at once. The finance hat, though? That’s often the heaviest one to wear. So many owners get bogged down in admin when they should be out there, doing what they love: serving customers and growing their business.

And let's talk about cash flow. It's the lifeblood of your business, and even a temporary dip can quickly snowball into a full-blown crisis, making it tough to pay suppliers, your staff, or even yourself. That knot in your stomach about financial stability? It's a real and constant worry for countless business owners.

This isn't just a feeling; it's a widespread challenge. The constant threat of rising costs creates a high-stakes environment where a single unexpected bill can jeopardise an entire business. Navigating this requires more than just hard work; it demands sharp financial oversight.

It’s in this tough climate that having a crystal-clear view of your financial health becomes non-negotiable.

The Worrying Gap Between Fear and Action

Some recent stats paint a pretty stark picture. A jaw-dropping 54% of UK small business leaders are worried that just one more big cost increase could shut them down for good. But here’s the kicker: despite that fear, a surprising 62% aren't using a professional accountant or bookkeeper to help them navigate these exact pressures.

This is a huge disconnect, especially when you learn that 46% of small and medium-sized businesses have recently hit cash flow problems or needed emergency funding. The problem is made even worse by old-school methods; 58% are still wrestling with manual financial processes. This becomes a massive time drain, with 27% of owners admitting they spend an entire working week every single month just on financial admin. You can dig deeper into these findings in a recent Dext study on small business challenges.

Why a Good Bookkeeper is Your Secret Weapon

This is where dedicated bookkeeping services for small business come in. Think of it less as an expense and more as a strategic investment in your business's resilience. It's not just about ticking boxes and recording numbers; it's about building a solid financial foundation.

For freelancers and sole traders, in particular, this kind of support can be the difference between chaos and control. Here's how it helps:

- Know Where Your Money Is: Finally get a clear answer on which services or products are actually profitable.

- Get a Grip on Cash Flow: Better management of your income and expenses means you can see trouble coming and avoid nasty surprises.

- Take the Stress Out of Tax: No more last-minute scrambles. A bookkeeper helps ensure you’re meeting all your HMRC obligations, from VAT returns to Self Assessment.

- Buy Back Your Time: Imagine what you could do with all those hours you'll save. Now you can focus on the stuff that actually makes you money.

At the end of the day, investing in professional bookkeeping is about giving your business the stability it needs to thrive. It helps you shift from constantly putting out financial fires to proactively planning for a successful future. It’s an essential tool for any small business trying to make its way in the UK today.

What Core Bookkeeping Services Actually Include

When you hear “bookkeeping services,” it’s easy to picture someone just punching numbers into a spreadsheet. But that’s barely scratching the surface. Good bookkeeping is all about weaving every financial event, every sale, every purchase, into a clear, accurate story of your business. It’s this story that lets you make smarter, more confident decisions.

So, let's pull back the curtain and look at what’s really involved. Think of these services as the pillars holding up your entire financial structure. They all have their own job to do, but they work together to give you a rock-solid view of your company's health.

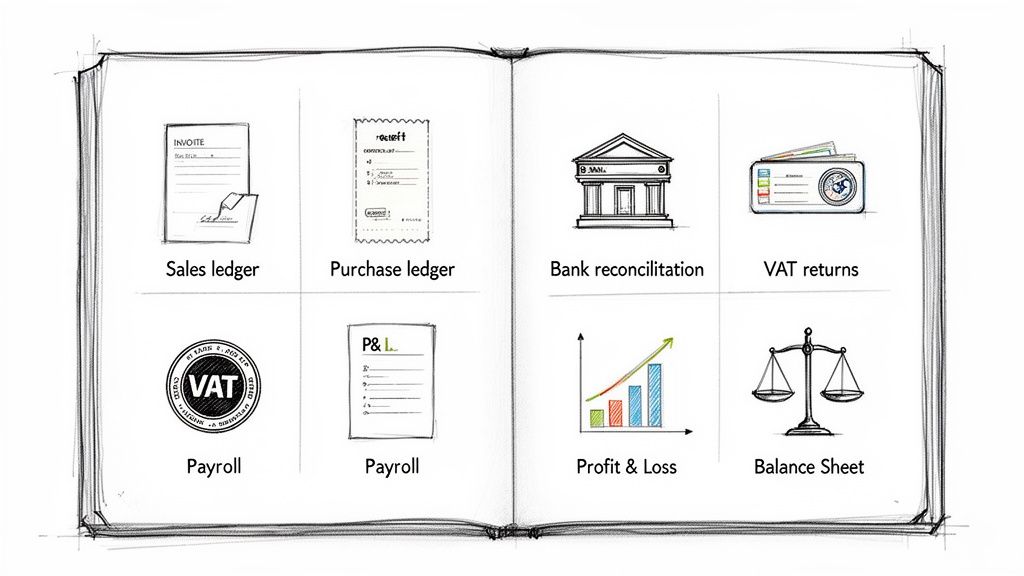

The Foundation: Transaction Management

This is the bread and butter of bookkeeping. It’s the day-in, day-out job of recording every single penny that comes in or goes out of your business. But it's not just about logging numbers; it's about organising them so they actually mean something.

This nuts-and-bolts work is split into two sides of the same coin:

-

Sales Ledger Management: This is where all your income lives. A bookkeeper tracks every invoice you send, ticks off who has paid, and gently (or not so gently) chases up anyone who’s late. For you, it means no more wondering who owes you what and a much clearer picture of your cash flow.

-

Purchase Ledger Management: This is the other side, tracking everything you spend. Every supplier bill, every little receipt, is recorded and put in the right category. This is vital for knowing where your money is going and making sure you claim every single allowable expense when tax time rolls around. A tidy purchase ledger is your best defence against runaway costs.

Keeping these transactions organised is the first, crucial step toward financial clarity. It’s also a job that can quickly become a monster, especially as you grow. Drowning in a sea of paperwork is why a good receipt scanning app can be a total game-changer.

Ensuring Accuracy: Bank Reconciliation

This is one of the most critical tasks your bookkeeper will handle. Bank reconciliation is simply the process of making sure the money in your bank account perfectly matches the numbers in your accounting software.

It’s a bit like being a financial detective. Your bookkeeper will hunt down any discrepancies, such as a missing payment or a supplier cheque that hasn't been cashed, and make sure everything lines up. No stone is left unturned.

For a small business owner, this process is your safety net. It confirms that your financial records are 100% accurate and that no mystery transactions are lurking in your bank statements, giving you complete confidence in your numbers.

The table below breaks down some of these core services and what they actually mean for your business on a practical level.

Key Bookkeeping Tasks and Their Business Impact

Here's a quick look at the essential bookkeeping services and how each one directly helps your small business run better.

| Bookkeeping Service | What It Means for You | Why It Matters |

|---|---|---|

| Transaction Recording | Every sale, purchase, and payment is logged and categorised. | Creates an accurate, organised foundation for all your financial data. |

| Bank Reconciliation | Your accounting records are matched against your bank statements. | Catches errors, spots potential fraud, and gives you confidence in your numbers. |

| Sales Ledger | Invoices are issued and customer payments are tracked. | Improves your cash flow by making sure you get paid on time. |

| Purchase Ledger | Supplier bills and expenses are managed and paid. | Prevents late fees, helps you manage spending, and maximises tax deductions. |

| VAT Returns | VAT is calculated and returns are filed with HMRC. | Keeps you compliant with tax laws and helps you avoid costly penalties. |

| Payroll Processing | Employee salaries, tax, NI, and pensions are handled correctly. | Ensures your team gets paid accurately and on time, keeping everyone happy. |

| Financial Reporting | You get key reports like the Profit & Loss and Balance Sheet. | Turns raw data into actionable insights so you can make strategic decisions. |

Ultimately, these tasks work together to transform a messy pile of receipts and invoices into a powerful tool for growth.

Staying Compliant: VAT and Payroll Services

As your business grows, you’ll eventually have to deal with VAT and payroll. These are two areas where mistakes can get very expensive, very quickly. Having an expert in your corner is priceless.

A bookkeeper will take care of your VAT returns, calculating what you owe HMRC (or what you’re owed back) and filing everything before the deadline. This one service alone can lift a massive weight off your shoulders, freeing you from deadline stress and the fear of penalties.

And if you have staff, payroll services are non-negotiable. A bookkeeper makes sure everyone is paid correctly and on time, handles all the PAYE tax and National Insurance deductions, and manages pension contributions. It’s a minefield of detail where accuracy is everything.

Providing Insight: Financial Reporting

Finally, all this data collection has a purpose: turning numbers into insight. A key part of any good bookkeeping service is preparing financial reports that show you how your business is really doing.

The two big ones you’ll hear about are:

-

Profit and Loss (P&L) Statement: This is your business’s report card. It adds up all your income and subtracts all your costs over a certain period (like a month or a quarter) to show whether you made a profit or a loss.

-

Balance Sheet: This gives you a financial snapshot of your business on a single day. It lists out your assets (what you own), your liabilities (what you owe), and your equity (the difference between the two).

These reports aren't just for your accountant at the end of the year. They're powerful tools you can use month-to-month to track your progress, spot trends, and plan your next move with real confidence.

Knowing When to Hire a Bookkeeper

Figuring out whether to manage your own books or bring in a pro is a classic crossroads for any small business owner. Going the DIY route feels like the sensible, money-saving option at first, especially when you're just starting out. But as your business starts to grow, that initial saving can quickly get eaten up by lost time and costly mistakes.

The real question isn't just about saving a few quid; it's about what your time is worth. Every hour you spend battling with spreadsheets and trying to make sense of bank statements is an hour you’re not spending on what you do best: serving customers, perfecting your product, and actually growing the business. Getting that balance right is everything.

The DIY Dilemma: Weighing the Pros and Cons

At first glance, handling your own bookkeeping seems easy enough. You grab some accounting software, watch a few tutorials, and you're off. The biggest perk is obvious: you’re not paying a monthly fee or hourly rate to a professional, which can be a massive help when cash flow is tight.

But the DIY approach has some serious blind spots. It’s a huge time sink, not just tapping in numbers but actually learning the ins and outs of accounting and tax rules. The risk of getting something wrong is also much higher. A simple mistake, like miscategorising an expense or messing up a VAT calculation, can throw off your financial reports entirely. That can lead to bad business decisions or, even worse, a headache from HMRC.

Here’s a quick way to look at it:

-

DIY Bookkeeping:

- Pros: Cheaper to start with, and you have total control over your financial data.

- Cons: Incredibly time-consuming, high risk of errors, can be a major source of stress, and you might miss out on tax-saving opportunities.

-

Hiring a Bookkeeper:

- Pros: Buys back your time, ensures accuracy and compliance, gives you expert financial insights, and massively reduces your stress levels.

- Cons: It’s another business expense you need to budget for.

Ultimately, it comes down to a simple trade-off. You're either investing your time or you're investing your money to get the job done properly.

Tipping Points: The Signs It’s Time to Outsource

So, how do you know when you’ve hit that tipping point? There are a few clear signs that your business is ready for professional bookkeeping services for small business. Think of them as red flags telling you that your current way of doing things just isn't cutting it anymore.

Your business isn't the same as it was on day one. As it grows, so does its financial complexity. The UK is home to a staggering 5.5 million small businesses, which shows just how diverse the entrepreneurial world is. Within that massive group, some are simple sole traders, but millions are registered for VAT and PAYE, each with growing compliance needs that demand a professional eye. This growth is exactly why the bookkeeping industry's revenue is on track to hit £7.3 billion by 2030. You can learn more about what’s shaping the UK's small business economy.

Realising you've outgrown your DIY spreadsheet is a crucial moment.

It's a classic case of what got you here won't get you there. The hands-on approach that worked when you had five clients a month becomes a serious bottleneck when you have fifty. Outsourcing isn't admitting defeat; it's a strategic move to enable further growth.

Here are some of the most common triggers that tell you it's time to hire a bookkeeper:

-

You Spend More Time on Admin Than Growth: If you’re consistently sacrificing evenings and weekends to catch up on paperwork instead of planning your next big move, it’s time for a change. Your time is your most valuable asset, so use it wisely.

-

Your Business is Getting Complicated: Have you recently registered for VAT, hired your first employee, or started dealing with international payments? Each of these adds a new layer of complexity that a professional can handle far more efficiently.

-

You’re Gearing Up for a Loan or Investment: Banks and investors want to see pristine, accurate financial records. No exceptions. A professional bookkeeper ensures your accounts are in perfect order, which seriously boosts your chances of securing that funding.

-

Tax Deadlines Fill You with Dread: If the thought of your next VAT return or Self Assessment makes your stomach churn, that's a crystal-clear sign you need support. A bookkeeper will make sure everything is filed correctly and on time, every time.

-

Your Numbers Don’t Tell You Anything: Do you look at your financial reports and have no real idea if you’re actually profitable or where all your cash is going? A bookkeeper can bring the clarity you're desperately missing.

If any of these points hit a little too close to home, it’s probably time to start looking for professional help. It can feel like a big step, but it’s one that will pay for itself many times over in saved time, reduced stress, and smarter business decisions.

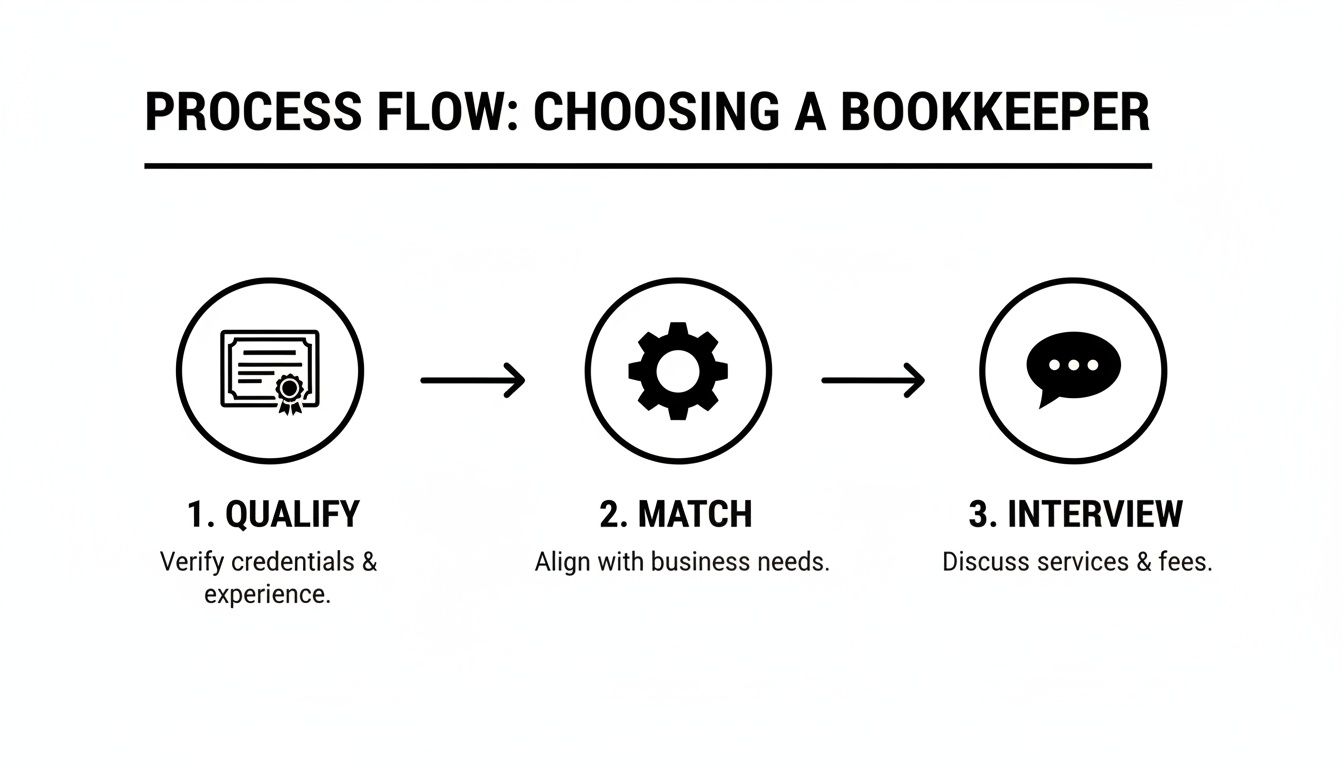

How to Choose the Right Bookkeeping Service

Alright, so you’ve decided it’s time to bring in a professional. That’s a huge step forward for your business. Now for the slightly trickier part: finding the right person or service that actually gets you and your business. You’re not just looking for a number-cruncher; you’re looking for a financial partner who can help steer the ship.

This is a big decision, and with the UK bookkeeping market set to hit £6.8 billion in 2025, you’ve got plenty of options, over 6,000 individual businesses, in fact. You can dig into the numbers in this UK bookkeeping market report. A little bit of homework now will help you find a real expert who becomes a genuine asset, not just another thing on your to-do list.

Check for the Right Qualifications

First things first, let’s talk qualifications. In the UK, anyone can technically call themselves a "bookkeeper," as the title isn't legally protected. This makes checking for professional certifications your best line of defence against someone who’s just good with a calculator.

Keep an eye out for credentials from two of the main professional bodies:

- AAT (Association of Accounting Technicians): Seeing this is a great sign. It means the bookkeeper has a solid, practical grounding in accounting principles.

- ICB (Institute of Certified Bookkeepers): This is another top-tier organisation that sets high standards, with a specific focus on bookkeeping skills.

When you see those letters after someone’s name, it tells you they’re qualified, they’re committed to keeping their skills up-to-date, and they’re held accountable by a professional body. It’s a simple way to spot the pros.

Find a Specialist in Your Field

Think about it: you wouldn’t hire a plumber to fix your car. The same logic applies here. A bookkeeper who spends their days working with construction firms will be an absolute whizz with the Construction Industry Scheme (CIS). Someone who specialises in ecommerce will know the ins and outs of platforms like Shopify and Stripe like the back of their hand.

Finding someone with experience in your sector is a massive advantage. They’ll already know the common financial headaches, the typical profit margins, and the specific expenses you can claim. That kind of industry-specific know-how can save you a ton of time and, more importantly, money.

Prioritise Software Experience

Your accounting software is the heart of your financial operations. So, it's vital that your bookkeeper is an expert in the system you use, whether that’s FreeAgent, Xero, or QuickBooks. Look for someone who is a certified partner or can prove they have extensive experience with your chosen platform.

This means they can jump right in without any hand-holding. They’ll know how to get the most out of the software, use its features efficiently, and sort out any little quirks that pop up. The last thing you want is to pay for their learning curve.

Key Questions to Ask a Potential Bookkeeper

Once you’ve narrowed it down to a shortlist, it’s time for a chat. This is your chance to see if they’re a good fit, not just on paper, but in personality and working style too.

Think of this as a two-way street. You’re interviewing them, but you’re also getting a feel for their communication style and whether you can build a solid working relationship.

Here are a few essential questions to get the ball rolling:

- How do you prefer to communicate? Are they a quick-phone-call person, or is everything done through email? Make sure their style works for you.

- What’s your fee structure? Do they charge by the hour, or do they offer a fixed monthly fee? A fixed fee is often better for budgeting because you know exactly what’s going out each month.

- What’s included in your standard package? Get them to spell out exactly what you get for your money. Are VAT returns and payroll included, or are they extras?

- How do you handle mistakes or discrepancies? Everyone makes mistakes. A good bookkeeper will have a clear process for finding and fixing them, and they’ll be upfront about it.

- Can you provide a few references? Speaking to other small business owners they’ve worked with can give you the confidence you need to make the final call.

Taking the time to hire carefully will pay off in spades. The right bookkeeper doesn’t just manage your books; they give you the clarity and peace of mind to get back to what you do best: growing your business.

Let Automation Do the Heavy Lifting for You

Even with a brilliant bookkeeper on your side, it’s still a partnership. They need you to supply clear, organised records to work their magic. This is where a little bit of modern tech can make a massive difference.

We all know the classic small business nightmare: the shoebox overflowing with crumpled receipts, the inbox bursting with invoices, and the mad dash to find everything before the tax deadline. It’s not just a headache; it’s a surefire way to miss out on valuable deductions and make costly mistakes.

How Automated Record-Keeping Changes Everything

Automation is the perfect solution to this chaos. It acts as a bridge between your day-to-day spending and your bookkeeper's records. Instead of you manually sorting and forwarding every single document, a smart tool can catch it all, ensuring nothing ever slips through the cracks.

Think of it as your personal admin assistant, tirelessly handling the tedious tasks that are so easy to mess up when you’re doing them by hand. It’s all about creating a smooth, reliable flow of financial information that’s always accurate and ready to go.

-

Your Own Receipt Inbox: Imagine having a unique email address just for your business receipts. When an invoice from Amazon or a supplier hits your main inbox, you just forward it. The system instantly pulls out all the important details, with no more manual data entry for you.

-

Safe and Sound in the Cloud: Every receipt and invoice gets scanned and stored securely online. This creates a perfectly organised digital filing cabinet that you can search anytime. Lost receipts become a thing of the past, and a tax audit suddenly seems a lot less scary.

The process of finding a great bookkeeper is just as structured. Here’s a simple way to think about it:

It’s a clear path: first, you check their credentials, then you see if their skills match your needs, and finally, you sit down for a chat to see if you click.

A Smoother Partnership with Your Bookkeeper

When your records are this organised, working with your bookkeeper becomes ridiculously easy. They get instant access to clean, up-to-date information without ever having to chase you for a missing receipt.

This frees them up to spend their time on what really matters: offering you proper financial advice and helping you spot opportunities to grow.

Automation turns your financial admin from a messy, last-minute chore into a slick, proactive system. You're not just saving time; you're boosting accuracy, claiming every expense you're entitled to, and giving your bookkeeper the tools they need to give you their best work.

This modern approach means fewer errors, less back-and-forth, and a much clearer financial picture for your business. To see how this all works behind the scenes, you can read more about the role of automation in accounting. By bringing these tools into your workflow, you’re building a much stronger financial foundation for the future.

Got Questions About Bookkeeping? We've Got Answers

Even with the basics covered, you probably still have a few questions buzzing around. That's completely normal. Getting straight answers is the best way to feel confident about picking the right bookkeeping service for your business. Let's tackle some of the most common queries we hear from founders.

What's the Real Difference Between a Bookkeeper and an Accountant?

It's a classic question, and the answer is simpler than you might think. Imagine you're building a house.

Your bookkeeper is the on-site foreman, meticulously laying the bricks day in, day out. They’re in the nitty-gritty of your finances, recording every single transaction, chasing invoices, reconciling your bank statements, and sorting out your VAT returns. Their job is to build a solid, accurate foundation of financial records.

Your accountant is the architect. They step back and look at the bigger picture built from the bookkeeper's daily work. They analyse the data to offer strategic advice, prepare your official year-end accounts, and handle the big stuff like your corporation tax return. You really do need both: the bookkeeper for daily clarity and the accountant for yearly compliance and forward-thinking strategy.

How Much Should I Expect to Pay for Bookkeeping in the UK?

This is a "how long is a piece of string?" kind of question, as the cost really depends on what you need. There’s no single price tag because every business is different.

Here’s a rough guide to give you a starting point:

- By the Hour: If you go with a freelance bookkeeper, you can expect to pay somewhere between £25 and £50 an hour. This works well if you just need a bit of help here and there each month.

- Monthly Packages: Fixed-fee packages are brilliant for budgeting because you know exactly what you're paying. These typically start around £100 a month for a simple setup and can go up to £500 or more if you have lots of transactions, need payroll, or have a more complex business structure.

Your best bet is to chat with a few providers and get detailed quotes. That way, you can see exactly what’s included for the price and find a service that feels right for your budget.

Think of it as an investment, not just another expense. The hours you'll save and the peace of mind you'll get from having accurate numbers is often worth far more than the monthly fee.

Can I Switch Bookkeepers if It's Not Working Out?

Yes, absolutely! It’s your business and your money. You need to feel 100% confident in the person or company handling your finances. If your current bookkeeper isn't hitting the mark, you have every right to find someone who's a better fit.

Just be sure to check your contract for any notice period you need to give. Any true professional will make the handover a breeze. They should work with your new bookkeeper to pass over all your records smoothly, ensuring there are no hiccups for your business.

Ready to stop wrestling with receipts and give your bookkeeper the clean data they need? Receipt Router connects directly with FreeAgent to automate your receipt management. Forward your receipts, and we handle the rest, saving you hours every month. Start your journey to effortless bookkeeping today.