How to Claim allowable expenses sole trader: A UK Guide to Deductions

As a sole trader, you only pay tax on your profits, which means that learning to claim every possible business expense is the secret to legally lowering your tax bill. Every single legitimate cost of running your business, from software subscriptions to grabbing a coffee with a client, reduces the profit you’re taxed on. This is your foundation for understanding allowable expenses for sole traders and keeping more of your hard-earned cash.

Your Quick Guide to Lowering Your Sole Trader Tax Bill

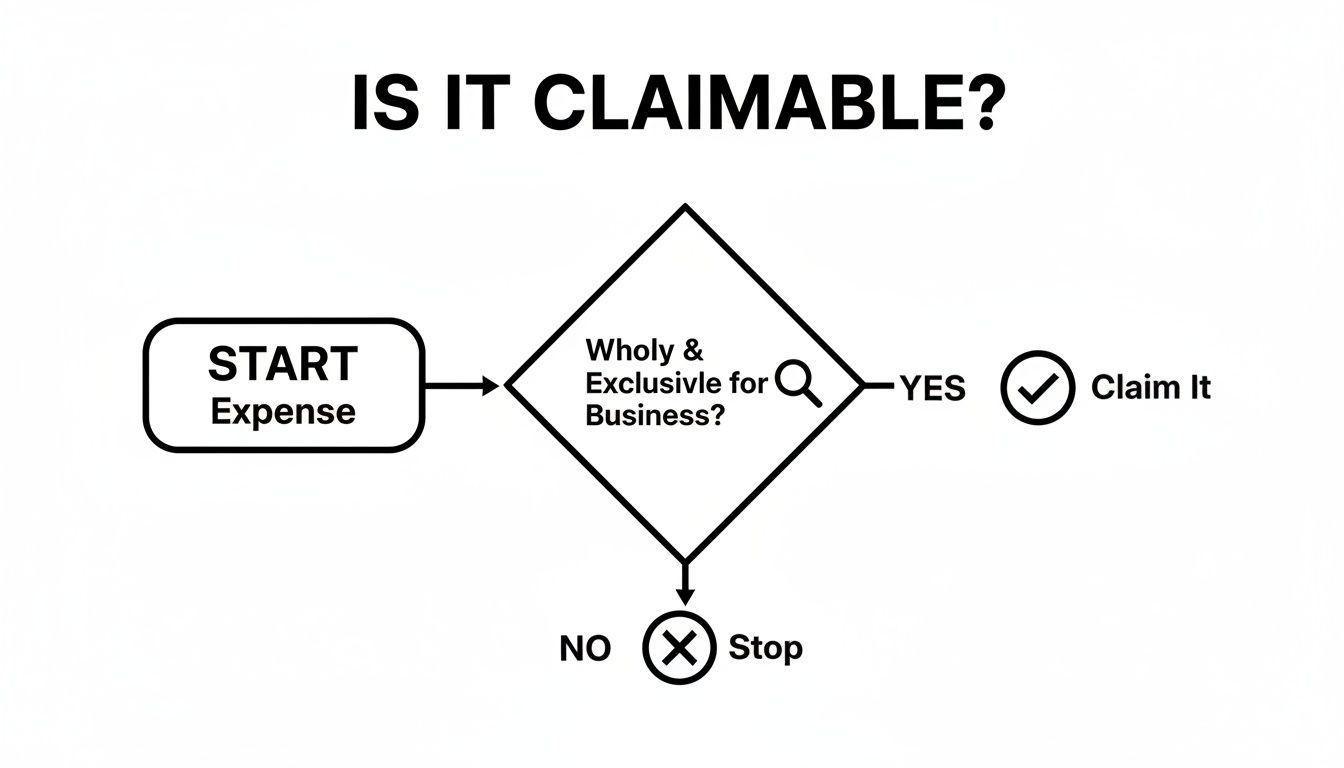

Getting your head around allowable expenses is easily the most effective way for any UK sole trader to shrink their tax bill. The main idea is actually pretty simple: if you spent money wholly and exclusively for your business, you can almost certainly deduct it from your income. This brings down your total profit, and since you only pay tax on your profit, your final bill from HMRC gets smaller.

![]()

Think of it like this: your business income is a full bucket of water. HMRC calculates your tax based on how much water is left in that bucket at the end of the year. Every single allowable expense you claim is like scooping a cup of water out, leaving less behind for them to measure.

The Golden Rule of Claiming Expenses

HMRC’s guidance really boils down to one crucial phrase: "wholly and exclusively." This just means the cost must be purely for the purpose of running your business. For example, buying a new ink cartridge for your business printer is an allowable expense. But using that same ink to print out holiday snaps for your family? That’s a personal cost and not claimable.

Getting this distinction right is the most important part. It’s what stops people from trying to claim their weekly grocery shop or a new TV as a business expense. If you can nail this rule, you’ll be well on your way to making legitimate claims and keeping everything above board.

So, What Can You Actually Claim?

The list of potential expenses is pretty long, but thankfully, most of them fall into just a handful of straightforward categories. Getting to know these helps you spot things you can claim that you might otherwise forget about.

To give you a clearer picture, here’s a quick rundown of the most common expense types.

Common Allowable Expense Categories for Sole Traders

| Expense Category | Common Examples |

|---|---|

| Office Costs | Stationery (pens, paper), postage, phone bills, internet, software subscriptions (e.g., Office 365, Adobe) |

| Travel & Subsistence | Fuel for your car, train tickets, bus fares, parking fees, hotel stays for business trips |

| Marketing & Advertising | Website hosting, social media ads (e.g., Facebook, Google), printed flyers, business cards |

| Legal & Financial | Fees for your accountant, professional indemnity insurance, bank charges, solicitor fees |

| Staff Costs | Employee salaries, subcontractor costs, employer's National Insurance contributions |

| Stock & Materials | Raw materials needed to make your products, goods you buy to resell |

These categories cover the vast majority of day-to-day costs, but the key is to develop a good record-keeping habit.

The goal is to build a habit of tracking every single pound spent on your business. It might seem small at the time, but these costs add up significantly over a tax year, directly impacting your bottom line.

By understanding these fundamentals, you can begin to see how many of your daily operational costs are actually working to lower your tax bill. For more practical ways to manage your finances, check out our other small business accounting tips. This guide will get you set up to confidently identify and claim every allowable expense as a sole trader.

The Most Common Expenses You Can Actually Claim

Alright, now that we’ve got the “wholly and exclusively” rule down, let's get into the good stuff. Knowing exactly what you can claim is where you’ll see a real difference in your tax bill. Think of this as your personal cheat sheet for deductions you can use year after year.

Let’s break down some of the most common, and often forgotten, expenses that pretty much every sole trader will run into. From the keyboard you're typing on to the fuel in your van, each receipt is a small but mighty piece of your tax-saving puzzle.

Essential Office Costs

Your office is your command centre, and the costs to keep it running are classic allowable expenses. And I don't just mean rent for a swanky commercial space. This covers all the little things you need to just get the job done.

You can claim for a whole host of things, including:

- Stationery and Postage: This is everything from pens and notebooks to printer paper, ink cartridges, and the stamps you use to post invoices.

- Software Subscriptions: Any software you genuinely use for your business is fair game. We're talking about accounting software like FreeAgent, project management tools like Trello, design packages like Adobe Creative Cloud, or even your Microsoft Office 365 subscription.

- Phone and Internet Bills: You can claim the business portion of your mobile and broadband bills. If you’ve got a dedicated business line, you can claim 100% of the cost. Simple as that.

These are the nuts and bolts of your operation. Each small purchase adds up, so keeping track of them is absolutely crucial.

Business Travel and Journeys

If you travel for work, a lot of what you spend is claimable. The big thing to remember here is that your daily commute to a regular, permanent workplace doesn't count. But journeys to temporary locations? Absolutely. Think client meetings, site visits, or trips to your suppliers.

Common travel expenses you can deduct include:

- Fuel and Mileage: If you use your personal car, you can claim a straightforward mileage allowance from HMRC.

- Public Transport: Train tickets, bus fares, and taxi rides for business-related trips are all allowable.

- Parking and Tolls: Any parking fees or road tolls you pay while on a business journey can be included.

The key is to keep detailed records of your business journeys. A simple mileage log or just a folder with your tickets and receipts provides the evidence you need if HMRC ever comes knocking.

Marketing and Professional Fees

Getting your name out there and staying on the right side of the law both cost money. Thankfully, HMRC sees these as legitimate business costs. Investing in marketing helps you land new clients, while professional fees make sure you're running your business by the book.

Keep an eye out for these common costs:

- Advertising: This covers money spent on social media ads (think Facebook or LinkedIn), Google Ads campaigns, and listings in business directories.

- Website Costs: The costs of hosting your website, registering your domain name, and any professional themes or plugins are all claimable.

- Professional Services: The fee your accountant charges to do your tax return? Deductible. The cost of a solicitor's advice on a business contract? Also deductible.

- Insurance: Any business insurance, like professional indemnity or public liability, is an allowable expense.

Finally, if you have staff, their salaries, employer's National Insurance contributions, and other related costs are also fully deductible. By building a complete picture of every potential allowable expense for a sole trader, you make sure you’re not paying a penny more in tax than you have to.

Getting Your Home Office Expenses Right

Working from home is a game-changer for many sole traders. It offers amazing flexibility, but it does blur the lines between your personal and professional life, especially when it comes to your expenses. The good news? HMRC has set up clear ways for you to claim a slice of your household running costs back.

You've got two main paths to go down: a super-simple flat rate or a more detailed calculation based on your actual costs. There’s no single "best" option; it really depends on how you work, how much time you spend in your home office, and frankly, how much paperwork you're willing to tackle.

To figure out if any expense is claimable in the first place, the golden rule is always "wholly and exclusively for business." This simple flowchart is a great way to visualise that decision process.

As you can see, if the cost isn't for your business, it's a non-starter.

The Easy Route: Simplified Expenses

If you’re looking for a quick, no-headache way to claim for working from home, HMRC’s simplified expenses are your new best friend. This method lets you claim a set flat rate each month, based on the hours you clock in at home. It’s perfect if you don't have a dedicated office space or just want to skip the maths.

You can use the flat rate as long as you work from home for at least 25 hours a month.

- 25-50 hours a month? You can claim £10.

- 51-100 hours a month? That goes up to £18.

- 101 hours or more? You can claim £26.

These fixed amounts save you from digging out and itemising every utility bill, which is a massive time-saver for any busy sole trader. If you want to dive deeper, you can explore the different types of allowable expenses for a sole trader on Xero.com.

A quick heads-up: if you choose the flat rate, you can't claim for individual bills like gas and electricity. However, you can still claim for other business-specific costs, like your phone and internet. It's all about simplicity over precision.

The Detailed Route: Calculating Your Actual Costs

The other option is to calculate the business proportion of your actual household bills. This method often results in a much larger claim, especially if you have a room that's used purely as an office. It takes a bit more effort, but the payoff can be well worth it.

Think of your home's total running costs as a big cake. You can't claim the whole cake, but you can claim the slice that's used for your business. To figure out the size of that slice, you need to work out what percentage of your home you use for work and how often you use it.

Here’s a simple way to do it:

- Count your rooms: Add up all the main rooms in your house, but leave out bathrooms, hallways, and landings.

- Identify your workspace: How many of those rooms are for business? If you have one dedicated office in a five-room house, your business usage is 20% (1 ÷ 5).

- Apply the percentage: Now you can apply that 20% to your relevant household bills to find the business portion.

Putting the Calculation into Practice

Let's run through an example to see how this works in the real world.

Imagine you live in a four-room flat (we'll ignore the kitchen and bathroom for this calculation) and you use one room entirely as your office. That makes your business use 25% of your home.

Now, let's tally up some of your annual bills:

- Electricity: £800

- Council Tax: £1,500

- Mortgage Interest (just the interest part, not the capital repayment): £4,000

To get your claimable amount, just apply that 25% business-use figure to each cost.

- Electricity claim: £800 x 25% = £200

- Council Tax claim: £1,500 x 25% = £375

- Mortgage Interest claim: £4,000 x 25% = £1,000

Your total claim for home office expenses comes to a whopping £1,575. Compare that to the maximum you could claim on the flat rate (£312 a year), and you can see why putting in a little extra effort can seriously reduce your tax bill.

Handling Expenses with Mixed Personal and Business Use

Let's be honest, this is where things can get a bit messy for sole traders. What about your mobile phone, which you use for client calls and scrolling through social media? Or your van, which handles deliveries during the week but does the big food shop on a Saturday? This is a classic stumbling block, but HMRC’s approach is actually quite logical once you get the hang of it.

The magic word here is apportionment. Think of it like a pizza you’re sharing between your business and your personal life. You can only claim the cost of the slices your business "ate". It's up to you to figure out, fairly and reasonably, how big that business slice is for each expense.

This isn't just a nice idea; it's a fundamental principle of UK tax. You have to calculate and claim only the business portion of any cost that serves a dual purpose. Getting this wrong is a common red flag for HMRC, so it’s well worth taking the time to get it right.

Calculating the Business Share of Your Costs

So, how do you actually work this out? The method changes depending on what you're claiming for, but the goal is always the same: find a sensible way to divide the cost based on actual usage. This usually means keeping some simple records to back up your claim if HMRC ever asks.

Here are a few common scenarios and how to tackle them:

- Mobile Phone: The simplest method is to go through a few months of your bills. Figure out what percentage of your calls and data were for clients versus catching up with friends. If you find that 40% of your usage is for work, you can claim 40% of your monthly bill as an allowable expense. Easy.

- Internet: This is very similar to your phone. You need to make a reasonable estimate of its business use. If your broadband is essential for work all day but the rest of the family uses it for Netflix in the evening, a claim of somewhere between 50% to 75% would likely be seen as fair.

- Vehicles: For a car or van, the gold standard is keeping a mileage log. Note down the total miles you drive in a year and the miles you drive specifically for business trips. If you drove 10,000 miles in total and 4,000 of those were for business, your business use is 40%. You can then claim 40% of your vehicle's running costs like fuel, insurance, repairs, and the MOT.

The key is to be fair and realistic. HMRC doesn’t expect you to measure every last kilobyte of data, but they do expect a logical basis for your calculations. Plucking a number out of thin air or just claiming 100% of a mixed-use item is asking for trouble.

A Practical Example with a Mobile Phone Bill

Let's put this into practice. Imagine a freelance designer's annual mobile bill comes to £200. After checking her call history, she sees that £70 of that total was for calls to clients and suppliers. The remaining £130 was for personal chats. In this case, she can claim exactly £70 as an allowable expense for a sole trader.

This same logic applies everywhere. HMRC has detailed guidance on what you can claim if you are self-employed if you want to dig into the official rules. And if you're curious how these principles work for employees, check out our guide on the reimbursement of expenses for team members.

Calculating Mixed-Use Expenses: A Comparison

To give you a clearer picture, this table breaks down how you might apportion some of the most common mixed-use expenses you'll come across as a sole trader.

| Expense Type | Method for Calculation | Example |

|---|---|---|

| Vehicle Use | Track business mileage versus total mileage for the year. | If business trips make up 3,000 of 10,000 total miles, you can claim 30% of all running costs. |

| Phone Bill | Analyse several bills to determine the percentage of business calls, texts, and data usage. | If 60% of your phone usage is for work, you can claim 60% of your monthly contract cost. |

| Home Internet | Estimate the split based on how much time the internet is used for business vs personal. | If you work eight hours a day and the family uses it for four, a 66% business claim could be justified. |

Once you get your head around this simple but vital principle of apportionment, you can claim for mixed-use items with confidence. It ensures you get the tax relief you're entitled to without ever crossing the line.

How to Effortlessly Track Your Business Expenses

Knowing what counts as an allowable expense for a sole trader is only half the battle. The other, equally crucial half is proving it to HMRC.

Good record-keeping is non-negotiable, but that doesn't mean you're doomed to a life of overflowing shoeboxes and fiddly spreadsheets. Let's ditch the manual data entry and look at a modern, stress-free way to manage your expenses that gives you back your most valuable asset: your time.

Why Automation Is a Game Changer

If you're a busy sole trader, you know admin is a constant drain. Chasing down faded receipts, typing details into a spreadsheet, and trying to match everything to your bank statements isn’t just tedious; it’s time you could be spending on actual paying work. This is where automation really changes the game.

Instead of letting receipts pile up in a forgotten corner, you can capture and file them in seconds. The whole point is to create a smooth process where every expense is recorded, categorised, and archived with barely any effort. Not only does this save hours of admin, but it also means you never miss out on claiming an expense just because the receipt went missing.

The real power of an automated system is that it works quietly in the background, building a perfect, HMRC-compliant digital archive for you. It gives you complete peace of mind, especially when Self Assessment season rolls around.

Creating a Seamless Digital System

So, what does this actually look like day-to-day? It’s probably simpler than you think. Loads of modern accounting tools are now built to connect with automated receipt management systems.

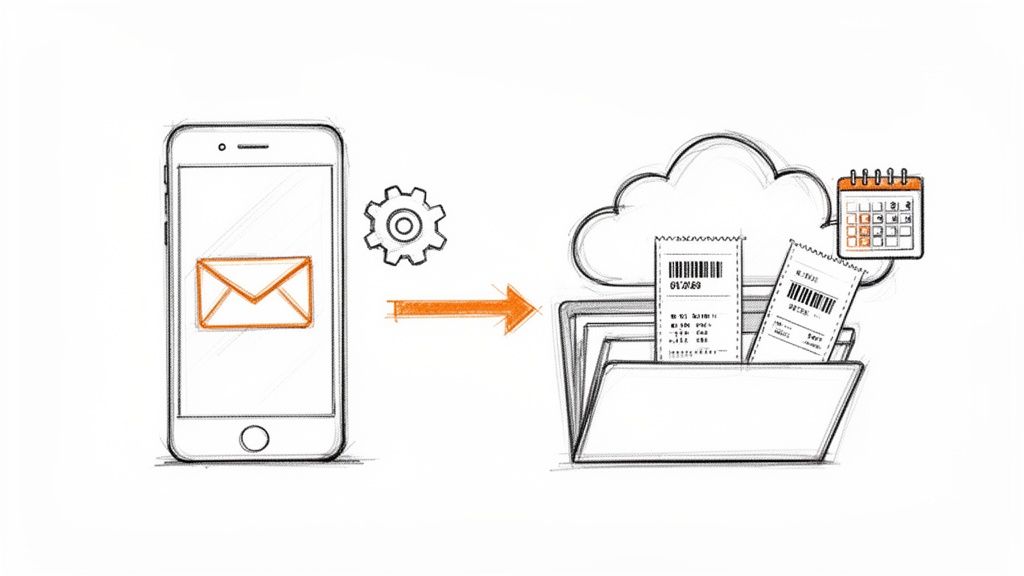

Here’s a typical workflow:

- A digital receipt arrives: A supplier emails you an invoice for your monthly software subscription.

- Forward and forget: Instead of downloading it, you just forward the email to a unique, dedicated address.

- The magic happens: A tool like Receipt Router instantly pulls out the key info, like the supplier, date, and amount, and attaches the receipt to the right transaction in your accounting software, like FreeAgent.

- A safe, secure copy: At the same time, a copy of the receipt is filed away neatly in a secure folder in your Google Drive.

That whole process takes less than ten seconds. And for paper receipts? Just snap a photo with your phone and email it to the same address. The result is identical: a perfectly organised, searchable, and compliant record of all your business spending. It's a massive step up from basic spreadsheets and a great way to find better apps that track your spending.

The Payoff: More Than Just Less Paperwork

Switching to an automated system does more than just save you a headache at tax time. The benefits ripple through your business all year long.

- Maximise Your Claims: When tracking is this easy, you’re far less likely to lose receipts for those small cash purchases that really add up.

- Stay Organised 24/7: No more frantic January panic searching for documents. Your records are always up-to-date and ready for inspection.

- Get a Clearer Financial Picture: With all your expenses properly categorised in real-time, you get a much better view of where your money is actually going.

- Focus on What Matters: By slashing hours of boring admin each month, you free up the headspace and time to focus on what you do best, serving your clients and growing your business.

By turning a tedious chore into a simple, automated habit, you can be confident that every allowable expense as a sole trader is captured, claimed, and proven, all with minimal effort.

Your Allowable Expense Questions Answered

We get a lot of questions about the nitty-gritty rules for sole trader expenses. It’s easy to feel confident about the straightforward stuff, but what about the grey areas? Let’s tackle some of the most common queries we see and give you some clear, practical answers to help you handle these tricky situations.

Can I Claim My Daily Commute to Work?

This is probably the question we hear most, and the answer is almost always a firm no. HMRC is very clear on this one: travel between your home and a permanent, regular place of work is just ordinary commuting. Since everyone has to get to work, they don't see it as an expense you're only incurring for your business.

But things change completely if your journey is to a temporary workplace. This is a crucial distinction for any sole trader who travels to meet clients or work on different sites.

Let’s say you're a freelance graphic designer:

- Not Claimable: Driving from home to the co-working space you rent and use every single day. That’s your regular commute.

- Claimable: Driving from your home office to a new client's office across town for a one-off project meeting. That’s a journey to a temporary workplace.

The same logic applies if you’re a tradesperson. A plumber travelling from home to a customer's house for a repair can absolutely claim those travel costs. But if that same plumber takes a six-month contract working on a single construction site every day, that site could easily be classed as a permanent workplace, making the daily travel a non-claimable commute. It all comes down to whether the workplace is temporary or your regular patch.

What About Buying Something Big Like a Laptop?

When you buy a significant item for your business that you expect to last a while, like a new laptop, a professional camera, or a van, you can't just pop it down as a simple day-to-day expense. These larger purchases are known as capital assets, and they're handled through a system called capital allowances.

Think of it this way: an expense like printer paper gets used up quickly. A capital asset, like your computer, gives your business value over several years. Instead of claiming its full cost in the tax year you bought it, capital allowances let you deduct a portion of its value from your profits each year.

The most common way sole traders do this is through the Annual Investment Allowance (AIA). This handy allowance usually lets you deduct the full value of most business equipment from your profits in the year you buy it, right up to a very high limit.

For a sole trader, this is fantastic news. It means if you buy a £1,500 laptop purely for your business, you can typically deduct the full £1,500 from your profits before tax. This gives you immediate tax relief on that major investment.

This system makes sure you get the tax benefit for investing in the big-ticket items that help your business grow, even though they aren't everyday running costs.

Can I Claim for Training Courses?

Absolutely! As long as the training is directly related to improving the skills you need for your current business, you can claim the costs. HMRC sees professional development as a legitimate expense because it helps you stay competitive and effective at what you do.

The key condition here is that the course must be for maintaining or upgrading your existing expertise, not for starting a new business or pivoting into a completely different field.

Here’s how to tell the difference:

- Allowable: A self-employed copywriter paying for a course on SEO to improve their writing for online clients. This directly enhances their existing skills.

- Not Allowable: That same copywriter taking a course to retrain as an electrician. That’s for starting a new, unrelated business.

So, if you're a web developer attending a conference on new coding languages, or a photographer taking a workshop on advanced lighting techniques, those costs are perfectly claimable. This includes the course fees, any essential books, and even your travel to get there.

Are Food and Drink Expenses Ever Allowable?

This is another area that trips people up because, generally, HMRC views meals as an everyday living cost for everyone, self-employed or not. You can't claim for the lunch you buy while working from home or in your regular office.

However, there are specific situations where food and drink, often called subsistence costs, do become an allowable expense. The main rule is that the cost must be incurred while you’re on a business journey that’s outside of your normal working pattern.

For instance, you can claim for reasonable meal costs if you're travelling overnight for business. If you drive to a conference 100 miles away and have to stay in a hotel, the cost of your evening meal and breakfast would be allowable.

You can also sometimes claim for meals on journeys that aren't part of your regular routine. Let’s say a freelance consultant who normally works from home has to travel to a client's office for an all-day workshop. The cost of a modest lunch could be allowable. The claim always has to be reasonable; a fancy three-course meal with wine would raise eyebrows, but a simple sandwich and coffee is perfectly fine.

Stop drowning in receipts and let automation handle the admin. Receipt Router connects directly to your accounting software, capturing and organising every expense with zero manual entry. Just forward your email receipts and watch your records build themselves. Get started with Receipt Router today and make tax time effortless.