What does inclusive of vat mean and how it affects your UK invoices and pricing

When a price is ‘inclusive of VAT’, it just means the tax is already baked into the final price. You won’t get any nasty surprises at the checkout. What you see is what you pay.

What Does Inclusive of VAT Actually Mean?

Let’s use a classic example: grabbing a coffee. When you see £3.50 on the menu board at your local café, that’s the total amount you hand over. That’s VAT-inclusive pricing in a nutshell.

In the UK, this is how most customer-facing businesses have to show their prices. It’s all about being transparent and upfront. No hidden extras.

For freelancers, sole traders, and small business owners, getting your head around this is non-negotiable. It affects everything from how you price your services to how you manage your expenses and keep your books straight. It’s one of those fundamental bits of financial literacy that makes a massive difference.

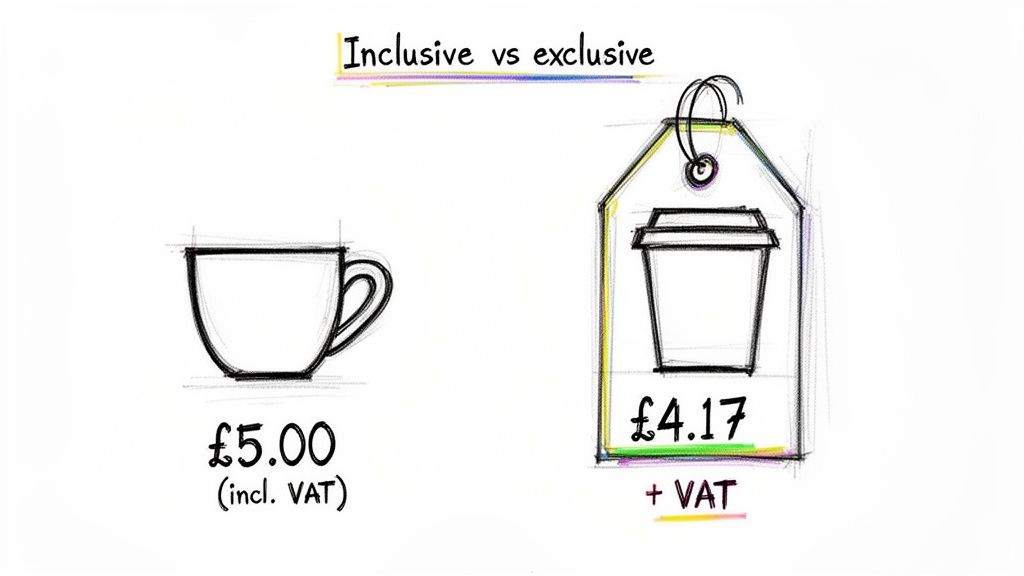

Inclusive vs Exclusive VAT at a Glance

So, what are the key differences? This little table sums it up nicely.

| Aspect | Inclusive of VAT | Exclusive of VAT |

|---|---|---|

| Who Sees It | Primarily consumers and the general public (B2C). | Primarily other VAT-registered businesses (B2B). |

| What It Means | The advertised price is the final, total cost. | The advertised price is the net cost; VAT is added on top. |

| Typical Use | High street shops, restaurants, online retail stores. | Wholesalers, consultants, B2B service providers. |

Ultimately, it all comes down to who your customer is. B2C pricing almost always includes VAT, while B2B pricing often shows the net amount before tax.

If you’re keen to get a really solid grasp of this, check out this guide on what does inclusive of VAT mean. It’s a great resource for building your confidence.

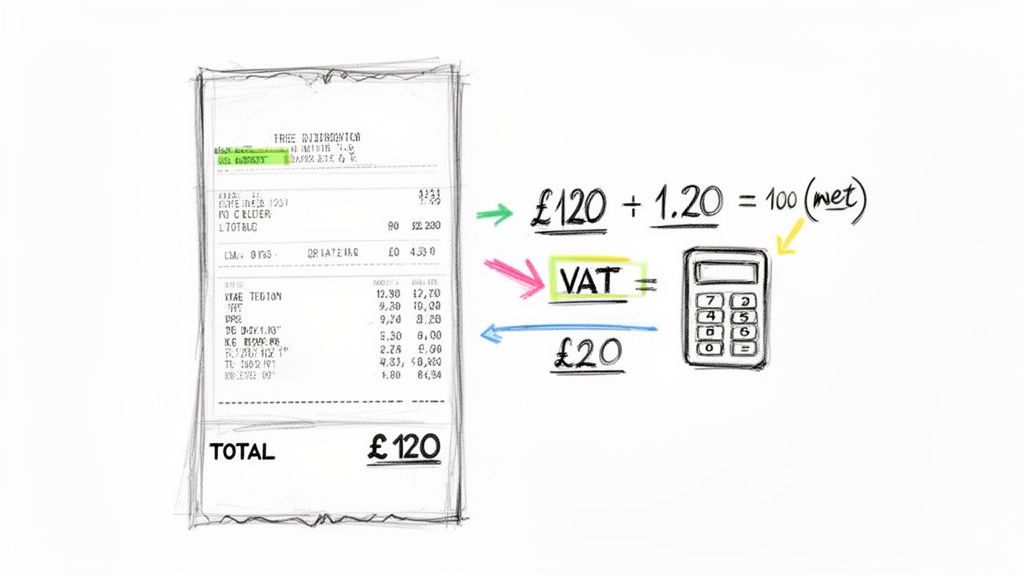

How to Correctly Calculate VAT from an Inclusive Price

Right, let's get into some simple but crucial maths. When you have a receipt with a VAT-inclusive price, you need to work backwards to figure out how much of that total was actually VAT. This is essential if you're VAT-registered and want to reclaim the tax on your business purchases.

Here’s the most common trap people fall into: they just knock 20% off the total price. This will always give you the wrong number and could cause a real headache with your tax returns later on.

Think of it this way: the total price you paid is actually 120% of the original net price (that's the 100% net price + 20% VAT). To find the original price, you just need to reverse that sum.

The Correct VAT Calculation Formula

The formula is refreshingly simple. To find the net price (the cost before tax) from a VAT-inclusive total, you just divide that total by 1.2.

Let's use a real-world example:

- You’ve just paid for a new software subscription that cost £120. This price is inclusive of VAT.

- The calculation is: £120 ÷ 1.2 = £100

- This means the software itself cost £100 (the net price), and the VAT you paid was £20.

That quick division neatly separates the cost of the item from the tax. Getting this right is a big deal, especially for growing businesses. HMRC data shows there are over 184,100 VAT-registered businesses in the £500,000 to £1m turnover bracket alone, a group full of freelancers and small companies where simple calculation mistakes can easily trip up the books.

Key Takeaway: To find the price before tax, always divide the VAT-inclusive total by 1.2. Never just subtract 20% from the total price.

Nailing this calculation means your financial records will be spot-on and ready for HMRC, saving you from any potential trouble down the line. If you want to dive deeper into how tax works with pricing, our guide explaining if net price includes VAT is a great place to start.

Invoices vs. Receipts: What's the Difference and Why Does It Matter?

When you're dealing with VAT, it's not just about getting the numbers right; it's about the paper trail that backs them up. You'll be handling invoices and receipts all the time, but it’s a huge mistake to think they’re the same thing, especially in HMRC’s eyes.

A VAT invoice is the official, legally required document you must issue if you're VAT-registered. It's not just a request for payment; it has to follow strict HMRC rules. Think of it as a detailed breakdown showing your VAT number, the date, and most importantly, the net price, the VAT rate, and the exact VAT amount for everything you sold. This clear separation is non-negotiable for proper tax records.

Now, think about the till receipt you get for a coffee or a tank of petrol. It’s a much simpler bit of paper. It usually just shows the total you paid, a price that already has VAT baked in. Rarely will it give you that clean, separate breakdown of the net cost and the tax.

The Freelancer's Headache

This is where things can get tricky for freelancers and sole traders. You’ve got a stack of receipts for genuine business expenses, but if they don't explicitly show the VAT you paid, how are you supposed to log them properly to claim that VAT back?

This is precisely why getting your bookkeeping right is so important. It’s on you to figure out the VAT portion of your expenses, even when the receipt doesn’t do the maths for you. If you get it wrong, you could end up filing an incorrect VAT return, which can lead to a world of pain with HMRC.

For a VAT-registered business, a proper VAT invoice is the key that unlocks your ability to recover the tax paid on expenses. Without a valid invoice showing the VAT breakdown, you can't legally make a claim.

The good news is that modern tools can take this headache away completely. They can scan those simple receipts, pull out the key information, calculate the correct VAT for you, and pop it straight into your bookkeeping software. It gets rid of the guesswork and makes sure your records are always spot-on and compliant.

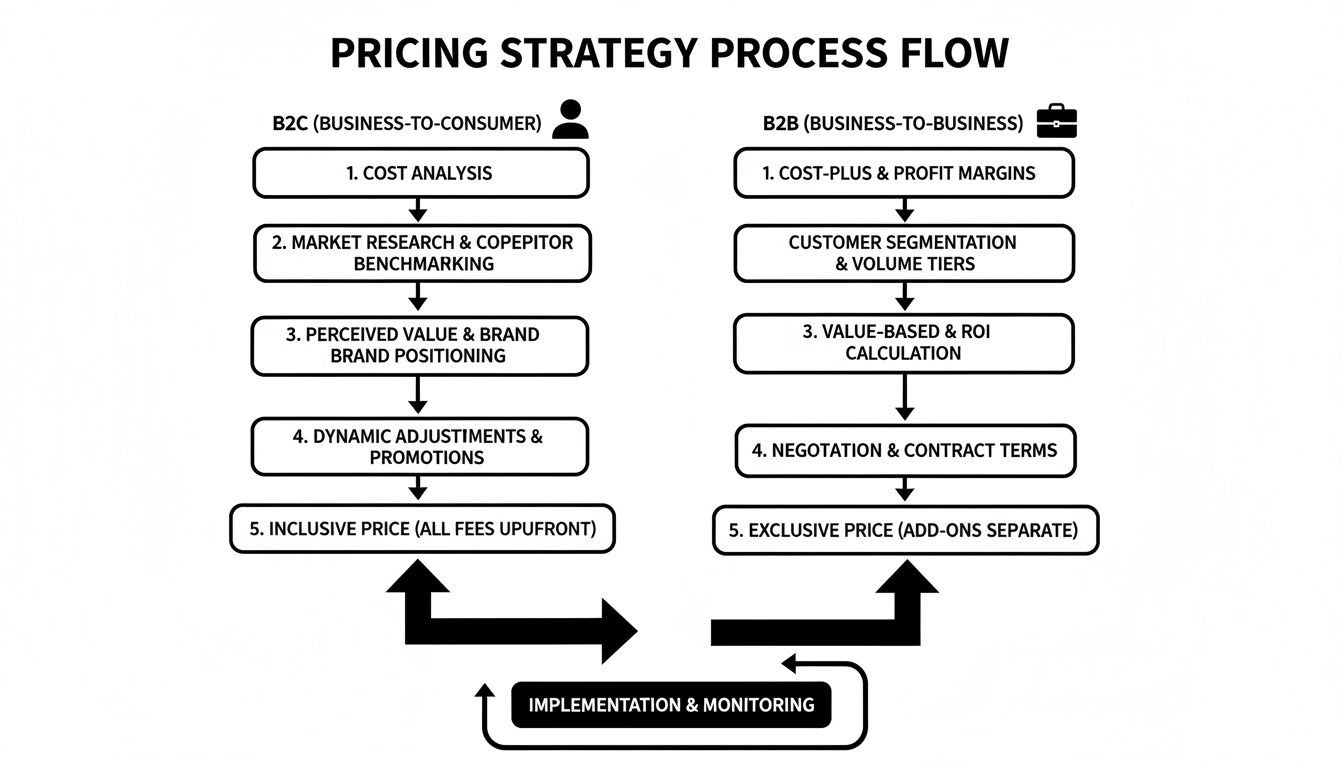

Creating a Pricing Strategy That Works for You

Figuring out how to price your services is a massive part of running a business. One of the first questions you'll hit is whether to quote your prices with VAT included or added on top. Honestly, the answer almost always comes down to one thing: who you're selling to.

If your customers are the general public (what’s known as a B2C, or business-to-consumer, model), you absolutely have to show your prices inclusive of VAT. It’s not just good practice; it’s the law here in the UK. People want to see one price and know that’s exactly what they'll pay at the checkout. No nasty surprises.

B2B vs B2C Pricing

Now, when you're working with other VAT-registered businesses (B2B), the rules of the game change completely. These clients can usually claim back the VAT you charge them, so what they really care about is the net cost, the price before VAT.

Because of this, it's standard practice to show your prices exclusive of VAT. It gives them a crystal-clear picture of what the service will actually cost their business.

For instance, imagine a web designer quoting £1,000 for a project. To a business client, they'd present it as £1,000 + VAT. But if they were advertising that same service to the public, they'd list it as £1,200. The total amount paid is identical, but the way it's presented matches what each type of customer needs to know.

Getting this right is all about clear communication and building trust. You'll also need to keep an eye on the VAT registration threshold, which is set to be £90,000 of taxable turnover for 2026-27. It's worth remembering that you can register voluntarily before you hit that number. Doing so can be a savvy move, as it lets you reclaim the VAT you spend on your own business purchases.

Ultimately, choosing the right strategy isn't just about ticking a compliance box. It’s about making the sales process smooth and transparent for your clients. If you’re struggling to structure your pricing, our guide on calculating your freelance rate in the UK is a great place to start.

Streamlining Your Bookkeeping For VAT-Inclusive Receipts

When you're juggling VAT, getting your financial admin right is non-negotiable. Handling receipts that just show one total figure, with the VAT already baked in, can be a headache unless you have a solid process. Thankfully, modern bookkeeping software is built for this exact challenge.

Take a platform like FreeAgent, for instance. When you're logging an expense, you don't need to get your calculator out. Just pop in the total amount from the receipt and tell the software the price is inclusive of VAT. It then does the maths for you, neatly splitting out the net cost from the VAT based on the correct rate.

This one simple step keeps your records spot on and your books tidy for tax time. More importantly, it helps you avoid the classic mistake of miscalculating the VAT yourself, which could mean you claim back the wrong amount from HMRC.

Automating Your Receipt Management

Let's be honest, nobody enjoys manually typing in details from a mountain of receipts. It’s slow, tedious, and easy to make mistakes. This is where automation tools really earn their keep for freelancers and small businesses.

By letting technology extract the data from your receipts, you're not just saving yourself hours of admin; you're creating a perfect digital paper trail. It’s the simplest way to make sure you can claim back every single penny of VAT you're entitled to, minus the manual entry stress.

Tools like Receipt Router are designed to do exactly this. You just forward an email receipt or snap a photo of a paper one, and the tech gets to work, pulling out all the key information. It then cleverly matches it to the right transaction in your accounts and attaches the receipt file for you.

This flowchart gives you a great visual on how your pricing approach changes depending on whether you’re selling to the public or another business.

As you can see, it breaks down the standard practice: VAT-inclusive prices for consumers (B2C) and VAT-exclusive prices for your business clients (B2B).

Best Practices For Digital Records

A stress-free bookkeeping system is all about good habits. Here are a few simple tips for keeping your digital receipts in order:

- Be Consistent: Pick one system and stick to it. Whether it's an automation app, a dedicated folder in the cloud, or your accounting software’s own storage, consistency is key.

- Act Fast: Sort out receipts the moment you get them. Ping over that email or scan that paper copy straight away. It’s the best way to stop a dreaded backlog from building up.

- Use Smart Naming: If you’re storing files manually, give them logical names. Something like "2024-05-21-Client-Lunch-£45.pdf" makes things a breeze to find later.

If you really want to get a grip on VAT-inclusive receipts and make data entry a thing of the past, it’s worth looking into what dedicated OCR for receipts technology can do. And for anyone aiming to go fully digital, a good receipt scanning app is an absolute must-have in your toolkit.

A Few Common VAT Sticking Points

Even with a solid grasp of what ‘inclusive of VAT’ means, some real-world situations can still trip you up. Let's walk through a few of the questions I hear all the time from freelancers and small business owners. Getting these right will give you that extra bit of confidence when managing your finances.

Do I Show VAT on Invoices If I'm Not VAT Registered?

Definitely not. This is a big one, and getting it wrong is a serious legal misstep. If your business isn't registered for VAT, you have no legal right to charge VAT or even mention it on your invoices.

Your invoices should just show the total price for your goods or services, plain and simple. Trying to add VAT when you’re not registered with HMRC is against the law and can land you in hot water with some hefty penalties.

What Happens If I Mess Up the VAT Calculation from an Inclusive Price?

It happens, but if you're VAT-registered and you miscalculate the VAT from an inclusive receipt, you could end up short-changing HMRC. This usually means you’ve accidentally reclaimed more VAT than you were actually entitled to.

If this mistake is flagged during a routine check or a full-blown audit, you could be facing penalties and interest on top of the amount you owe. This is exactly why so many of us rely on good bookkeeping software because these tools are built to get these calculations right every single time, minimising the risk of human error.

Can I Reclaim VAT on Every Single Business Purchase?

I wish! But no, you can only reclaim VAT on purchases made purely for business purposes. And even then, some items have their own quirky rules.

The classic example is entertaining clients. Taking a client out for a meal is a perfectly legitimate business expense, but you almost always cannot reclaim the VAT paid on the bill. If you're ever in doubt about a specific purchase, it’s always best to check the official HMRC guidance or have a quick chat with your accountant.

Nailing this down is key to keeping your VAT returns accurate and staying on the right side of the taxman.

Is the UK VAT Rate a Flat 20 Percent?

While the standard 20% rate covers most things, it's not the full story. The UK has a couple of other VAT rates that you’ll definitely come across.

- The Reduced Rate (5%): This applies to a few specific things, like home energy bills and children’s car seats.

- The Zero Rate (0%): This is for essentials like most food you'd get from a supermarket, as well as books and kids' clothes.

Even for these items, the price you see on the tag is still ‘inclusive of VAT’; it’s just that the tax included is either 5% or 0%. The standard rate has been sitting at 20% since way back in 2011, but it always pays to know about the exceptions.

Stop wasting time on manual receipt entry. Receipt Router automatically extracts data from your receipts, matches it to the right transaction in FreeAgent, and creates a perfect digital archive. Set it up once and save hours every month. Get started at https://receiptrouter.app.