The 12 Best Free Accounting Software Small Business Owners Need in 2026

Running a small business in the UK means keeping a close eye on every pound. You need reliable tools to manage invoices, track expenses, and stay on the right side of HMRC, but the cost of premium software can feel like a significant hurdle, especially when you're just starting out.

The good news is, there's a fantastic range of free accounting software designed specifically for freelancers and small businesses. But 'free' often comes with strings attached, from user limits to missing features that only become apparent just when you need them most. How do you find the best free accounting software for your small business without wasting hours on sign-ups and trials?

This guide cuts through the noise. We're not just listing features; we're diving deep into the practical reality of using these tools. We’ll break down the 12 best free options available in the UK, focusing on what really matters:

- Real-world limitations: What are the hidden catches of the 'free forever' plans?

- UK compliance: Are they MTD-ready and suitable for HMRC submissions?

- Scalability: Which tools genuinely support your business as it grows?

- Ideal User: Who is this software really for?

We've done the legwork, complete with screenshots, direct links, and honest pros and cons for each platform. We'll even cover how to migrate from tools like FreeAgent or integrate with services like Receipt Router. Let’s find the right fit for your business without you needing to spend a single penny.

1. Bokio

Bokio stands out as a strong contender for the best free accounting software small business owners in the UK can find, especially if Making Tax Digital (MTD) for VAT is a priority. It's one of the few platforms offering genuine MTD VAT return filing on its free tier, a feature many competitors gate behind a paywall. This makes it an incredibly practical choice for freelancers and micro-businesses who have crossed the VAT threshold but want to keep overheads to a minimum.

The free plan is refreshingly usable. You can create and send invoices, record expenses manually, and manage your bookkeeping without paying a penny. The interface is clean and straightforward, avoiding the overwhelming complexity of some other systems. While you miss out on the time-saving automation of bank feeds in the free version, the manual entry process is logical enough for those with a lower transaction volume. It provides a clear and scalable upgrade path, so you can start for free and add features like bank feeds and recurring invoices as your business grows.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | No limit on invoices or expenses; manual bank reconciliation required. |

| MTD VAT Returns | Included on the free plan. Generate and submit directly to HMRC. |

| Core Features | Invoicing, expense tracking, fixed asset management, basic reports. |

| Best For | VAT-registered UK freelancers and sole traders on a tight budget. |

| Pros | Genuine MTD VAT support for free; clean, modern user interface. |

| Cons | Most automation (bank feeds, smart suggestions) requires a paid plan. |

Website: https://www.bokio.co.uk/

2. Pandle

Pandle is a fantastic UK-focused option that feels specifically built for sole traders and small limited companies who want solid, no-cost bookkeeping with a very gentle learning curve. Its "free forever" plan is genuinely useful, covering the absolute essentials like invoicing, expense tracking, and crucially, VAT return submissions directly to HMRC. This makes it a strong candidate for anyone needing a simple, compliant solution without an immediate budget for software.

What sets Pandle apart is its clear and budget-friendly upgrade path. While the free version requires you to handle bank transactions manually, the jump to its Pro tier is one of the most affordable on the market. For a small monthly fee, you unlock powerful automation like bank feeds, receipt uploads, and cash flow forecasting. This scalability makes Pandle an excellent piece of best free accounting software small business owners can start with, knowing they won't face a steep price hike when they’re ready for more advanced features. The built-in guidance and UK-centric workflows are a huge bonus for beginners.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Unlimited invoices, quotes, and customers. Manual bank statement uploads. |

| MTD VAT Returns | Included on the free plan. Create and submit VAT returns to HMRC. |

| Core Features | Invoicing, quotes, expense logging, basic reports, multi-currency support. |

| Best For | New UK sole traders and small businesses wanting a simple start with a low-cost upgrade path. |

| Pros | Generous free forever plan; very affordable Pro tier; designed for UK compliance. |

| Cons | Key automation like bank feeds and receipt scanning are locked behind the Pro plan. |

Website: https://www.pandle.com/

3. QuickFile

QuickFile has been a trusted name in the UK for years, offering one of the most feature-rich options for those seeking the best free accounting software small business owners can rely on. Its free tier is uniquely defined by usage volume rather than feature restrictions. So long as you stay under 1,000 nominal ledger entries in a rolling 12-month period, which is ample for many sole traders and micro-businesses, the core platform remains completely free. This includes powerful MTD-compliant VAT submissions, a feature many others charge for.

The platform feels robust and is backed by an incredibly active community forum, which is a fantastic resource for getting quick, practical advice from other UK business owners. You can create professional estimates and invoices, connect to payment gateways like Stripe and GoCardless, and even handle multi-currency transactions. While automated bank feeds are a paid add-on, the manual upload and reconciliation process is straightforward. Its API access also opens the door for custom integrations, providing a level of flexibility not often found in free software.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Free for businesses with fewer than 1,000 nominal ledger entries per year. |

| MTD VAT Returns | Included on the free plan. Supports standard, flat rate, and cash accounting. |

| Core Features | Invoicing, estimates, expense tracking, multi-currency support, API access. |

| Best For | Sole traders and small limited companies with a low to medium transaction volume. |

| Pros | Very generous free tier based on usage; strong VAT tools and an active UK community forum. |

| Cons | Automated Open Banking feeds require a paid subscription; interface can feel a bit dated. |

Website: https://www.quickfile.co.uk/

4. Zoho Books (UK)

Zoho Books offers a surprisingly powerful free tier for UK businesses, positioning itself as a fantastic choice for those just starting out. Unlike platforms that simply restrict features, Zoho's free plan is gated by turnover, specifically for businesses with less than £35,000 in annual revenue. If you fall under this threshold, you get access to an impressive suite of tools, including invoicing for up to 1,000 invoices per year, expense tracking, and even automated bank feeds, a feature almost always reserved for paid plans elsewhere. This makes it a standout option for genuine micro-businesses.

The platform is part of the wider Zoho ecosystem, which is both a pro and a potential point of consideration. Its real strength lies in scalability; as your business grows beyond the free tier, you can seamlessly upgrade or integrate with other Zoho products like CRM or Projects. The user interface is clean, professional, and comes with the added benefit of email support even on the free plan. While the revenue cap is a hard limit, for those who qualify, Zoho Books delivers one of the most feature-rich free accounting software packages available for a small business. Exploring this kind of automation in accounting from day one can set your business up for future efficiency.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | For businesses with annual revenue under £35,000. 1 user + 1 accountant. |

| MTD VAT Returns | Not included on the free plan; requires a paid subscription. |

| Core Features | Invoicing, expense tracking, bank feeds, client portal, basic reports. |

| Best For | Micro-businesses and sole traders under the UK VAT threshold. |

| Pros | Very generous free features (including bank feeds); excellent scalability. |

| Cons | Becomes a paid product once revenue exceeds £35,000; no MTD on free tier. |

Website: https://www.zoho.com/uk/books/

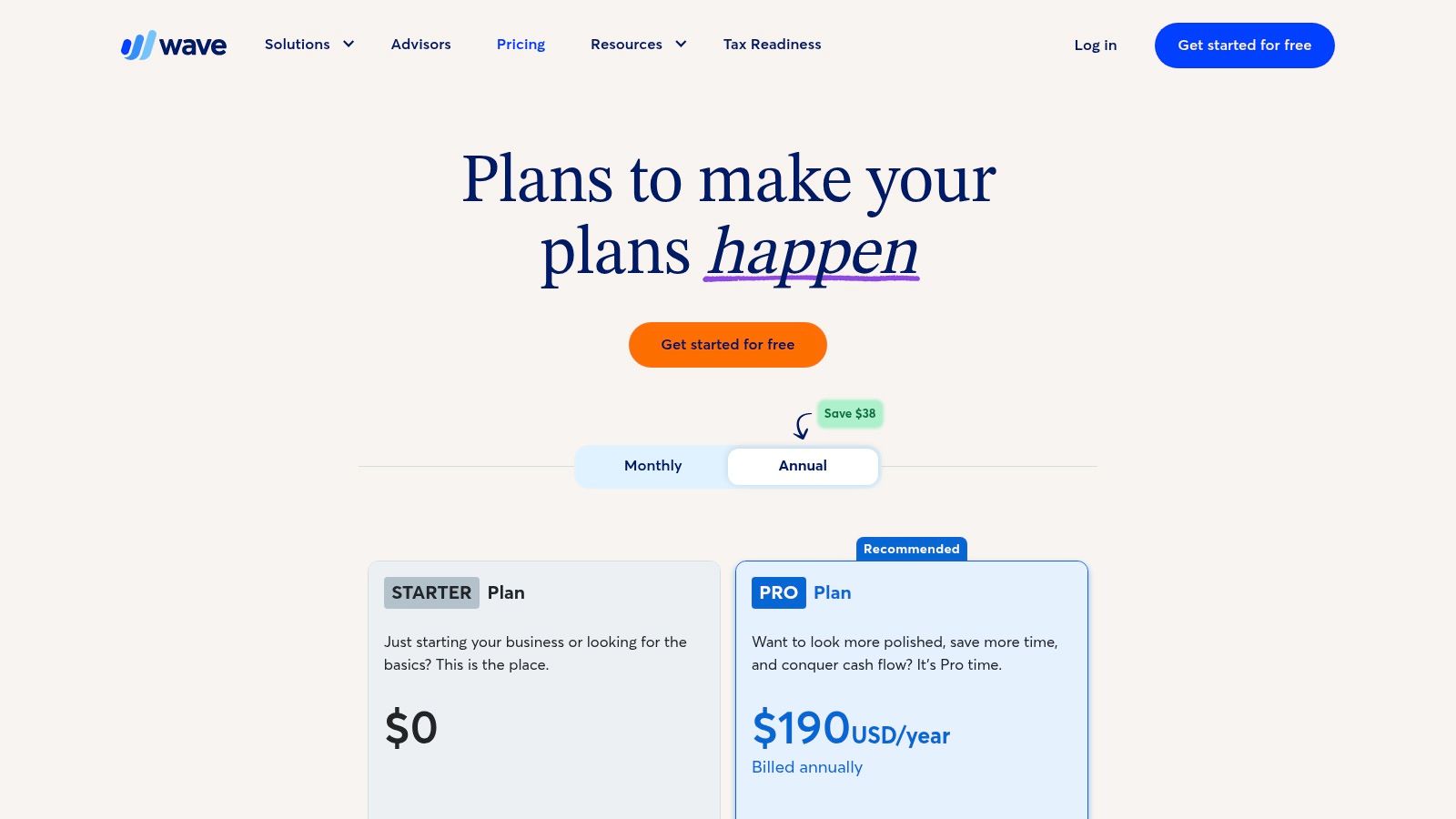

5. Wave Accounting

Wave is a globally recognised name and a popular choice for the best free accounting software small business owners can find, especially those who don't need UK-specific tax features like Making Tax Digital (MTD). Its core promise is compelling: truly free accounting, invoicing, and receipt scanning without limits. This makes it an excellent starting point for new freelancers, sole traders, or small businesses whose primary need is to track income and expenses and issue professional invoices. The platform is supported by optional, paid add-ons like payment processing and payroll (which is focused on North America).

The user interface is one of Wave's strongest assets; it's clean, intuitive, and easy to navigate even for those with no prior accounting experience. The free plan is genuinely powerful, offering unlimited invoicing, expense tracking, and contact management. While it excels at general bookkeeping, its major limitation for UK users is the lack of native MTD for VAT filing. Businesses that are not VAT-registered or that file VAT outside of the MTD system can still find immense value here, but those needing direct HMRC submissions should look at UK-focused alternatives. For a deeper dive into tools that handle financial documents, check out our guide on the best expense management software.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | No limits on invoices, expenses, or users. Optional paid add-ons. |

| MTD VAT Returns | Not included. Lacks direct integration with HMRC for MTD submissions. |

| Core Features | Unlimited invoicing, expense tracking, receipt scanning, basic reports. |

| Best For | Non-VAT-registered freelancers and small businesses needing robust free tools. |

| Pros | Genuinely free core accounting with no limits; clean and user-friendly design. |

| Cons | No native MTD for VAT support; live customer support is a paid feature. |

Website: https://www.waveapps.com/pricing

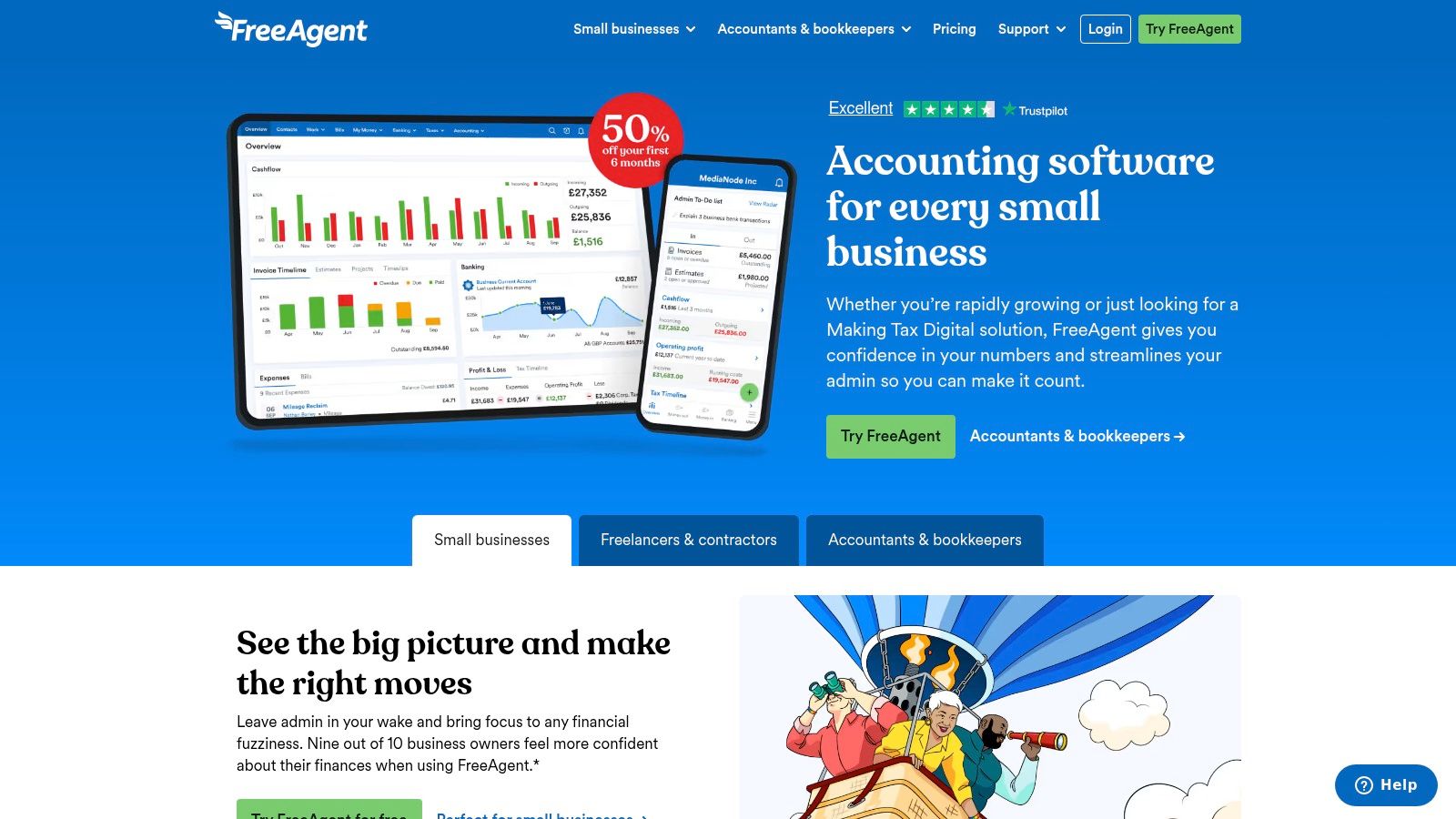

6. FreeAgent

FreeAgent presents a unique proposition in the hunt for the best free accounting software small business owners can get. While not free for everyone, it becomes completely free if you hold an eligible business current account with NatWest, Royal Bank of Scotland, Ulster Bank, or Mettle. For those who can access it this way, it's arguably one of the most powerful and mature UK-focused accounting platforms available without a subscription fee, offering features that many rivals charge a premium for.

The platform is exceptionally well-suited to the needs of UK freelancers, contractors, and small limited companies. It includes live bank feeds, MTD-compliant VAT submissions, and even helps you prepare and file your Self Assessment tax return directly to HMRC. Its "Tax Timeline" feature is a standout, providing a clear forecast of upcoming tax liabilities so you're never caught off guard. For businesses that rely on accurate expense tracking, it is possible to streamline receipt capture with FreeAgent to further automate bookkeeping workflows.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | No limits; full feature set is free if you hold an eligible NatWest Group business account. |

| MTD VAT Returns | Included. Full support for generating and filing MTD VAT returns directly to HMRC. |

| Core Features | Live bank feeds, unlimited invoicing, expense tracking, payroll, Self Assessment filing. |

| Best For | UK freelancers and small businesses who bank with NatWest, RBS, Ulster Bank, or Mettle. |

| Pros | Robust, UK-specific feature set for free (with eligible bank account); excellent tax support. |

| Cons | It's a premium paid product if you do not qualify for the bank-funded offer. |

Website: https://www.freeagent.com/

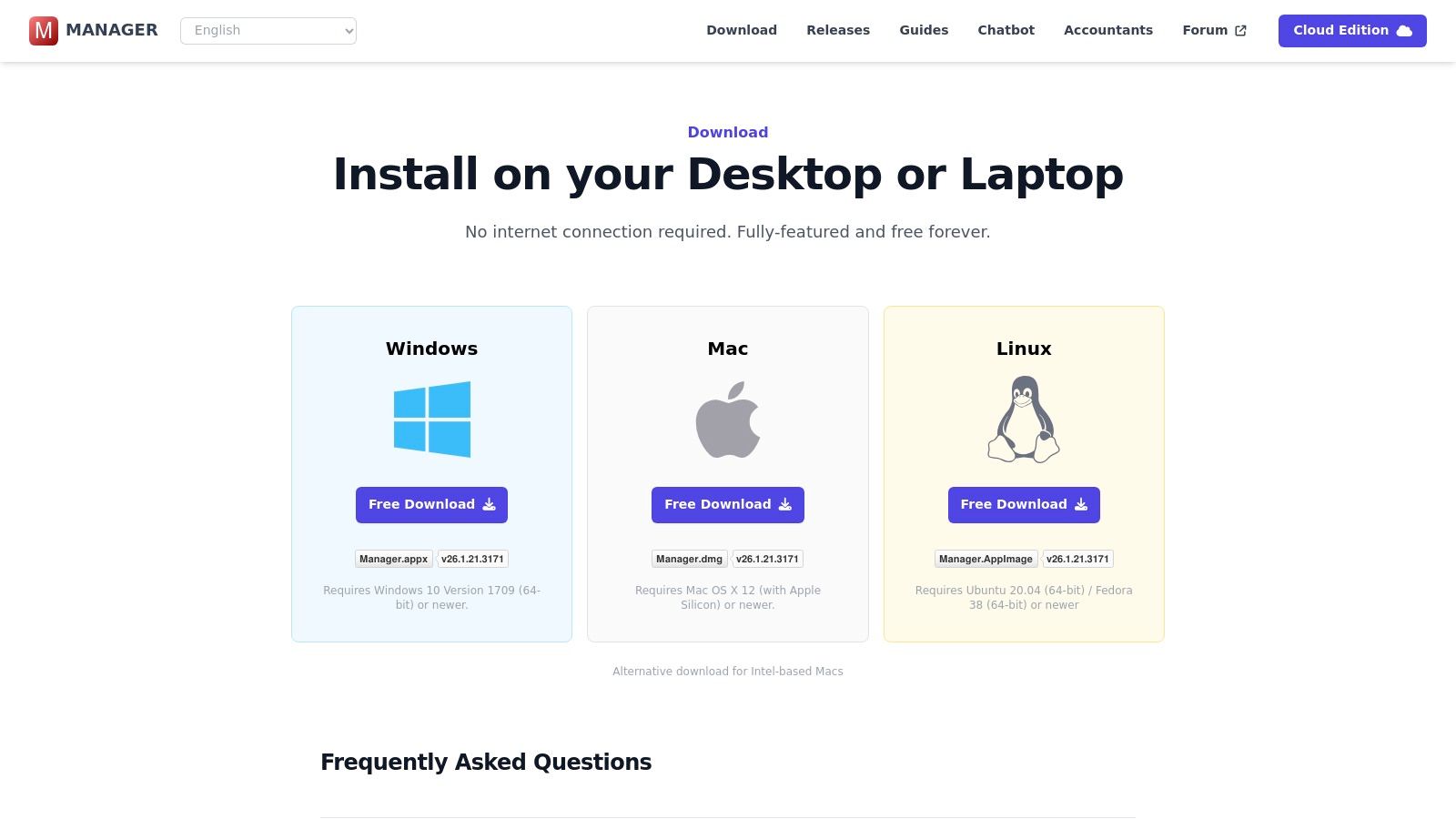

7. Manager.io (Desktop Edition)

Manager.io offers a powerful and comprehensive solution for businesses seeking robust, offline accounting capabilities. It’s not a cloud service but a full-featured desktop application that you download and run locally on your computer. This makes it a unique contender for the best free accounting software small business owners can find if they prioritise data privacy and offline access over remote collaboration. Its free desktop edition is not a trial; it's free forever with no limits on transactions, companies, or features, which is incredibly generous.

The platform operates on a proper double-entry accounting system and covers everything from invoicing and expense claims to fixed assets and inventory management. It’s more of a traditional accounting system than some of the newer, simplified cloud apps, which means there is a steeper learning curve. However, this depth provides greater control and more detailed reporting. The key trade-off is the lack of direct MTD VAT filing for UK users in the free version; you'll have to use bridging software to submit your returns. For those who need multi-user access or cloud sync, paid server and cloud editions are available.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Unlimited companies, invoices, expenses, and all features included in the desktop version. |

| MTD VAT Returns | Not included. Requires separate bridging software to file with HMRC. |

| Core Features | Full double-entry ledger, invoicing, bills, inventory, fixed assets, custom reports, multi-currency. |

| Best For | Small businesses wanting a feature-rich, offline system with full data ownership. |

| Pros | Completely free desktop version with no limits; powerful, comprehensive features; works offline. |

| Cons | No direct MTD VAT e-filing; steeper learning curve; remote access requires paid upgrades. |

Website: https://www.manager.io/download

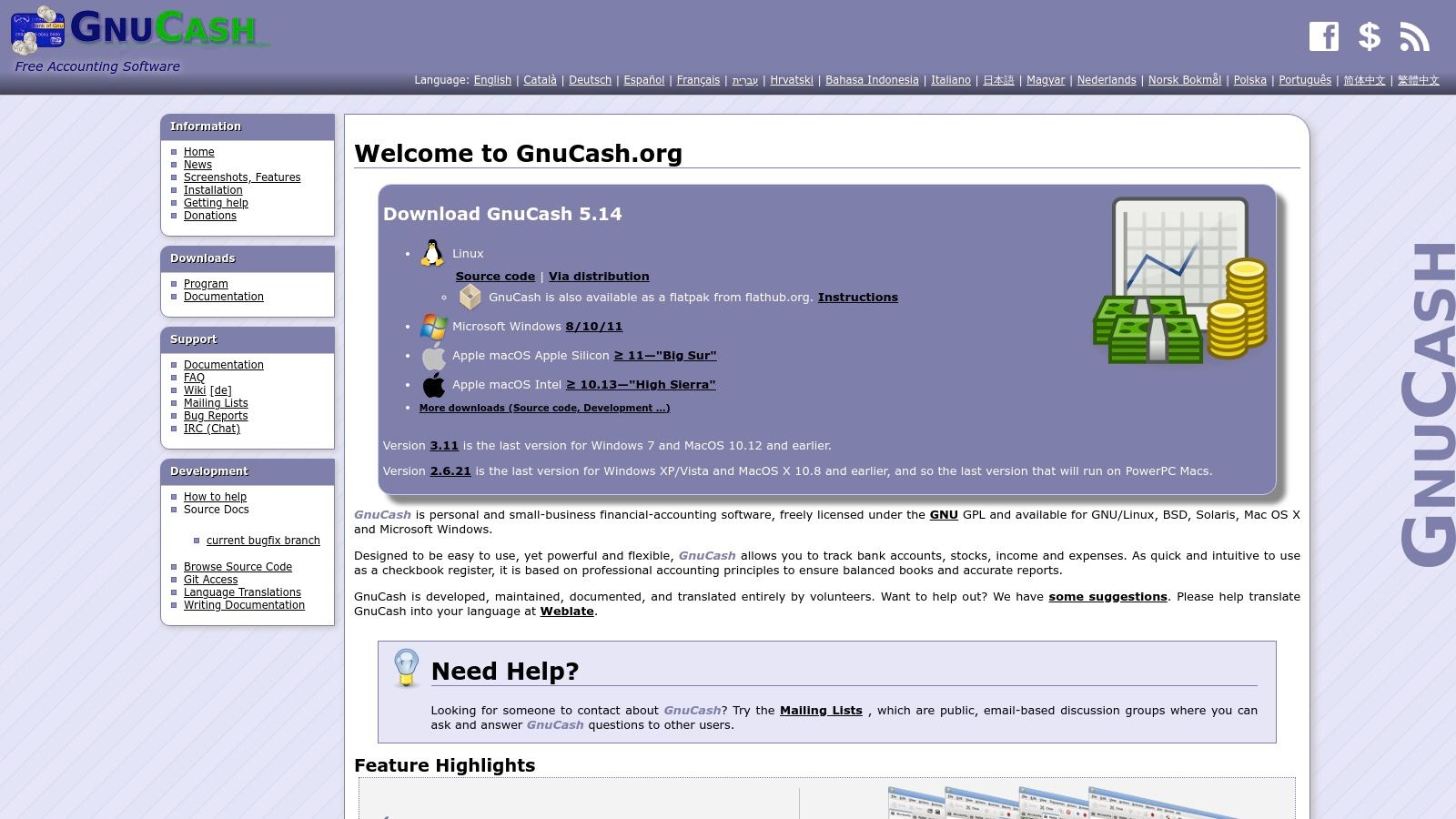

8. GnuCash

GnuCash is the old-school, open-source powerhouse in the world of finance software, and it holds its own as a potential option for the best free accounting software small business owners can get if they prioritise power over polish. As desktop software, it provides a robust, double-entry accounting system that’s completely free forever. It handles invoicing, accounts payable/receivable, and scheduled transactions with a level of detail that many cloud platforms charge for, making it a solid choice for those who want full control over their data without any subscription fees.

The trade-off for this power and freedom is a lack of modern cloud conveniences and UK-specific features. The interface feels dated compared to slick, modern web apps, and there is a steeper learning curve. Crucially for VAT-registered businesses, GnuCash has no native Making Tax Digital (MTD) filing capabilities. This means you will need to use separate bridging software to submit your VAT returns to HMRC, adding an extra step and potential cost to the process. However, for a sole trader or micro-business not yet VAT-registered, its comprehensive features are hard to beat at the price of zero.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | No limits. The software is entirely free and open-source. |

| MTD VAT Returns | Not included. Requires third-party bridging software for HMRC submissions. |

| Core Features | Double-entry accounting, invoicing, accounts receivable/payable, scheduled transactions, robust reporting. |

| Best For | Sole traders and small businesses (not VAT-registered) who prefer desktop software and want powerful features for free. |

| Pros | Completely free with no hidden costs; powerful and flexible double-entry system; cross-platform (Windows, macOS, Linux). |

| Cons | No native MTD VAT support; dated interface and steeper learning curve; requires manual data backup. |

Website: https://www.gnucash.org/

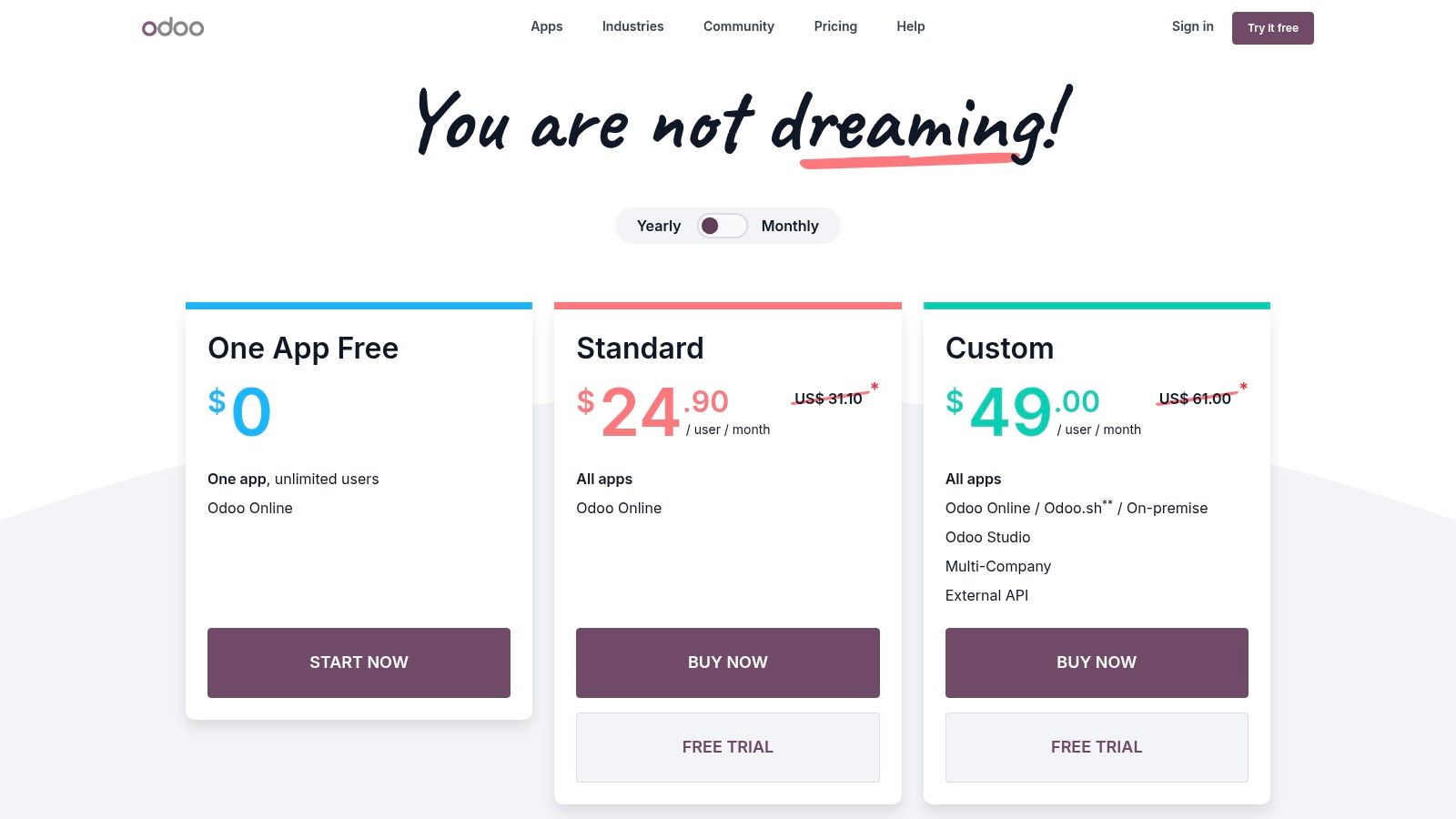

9. Odoo (One App Free)

Odoo presents a unique proposition in the world of free accounting software. It's not a dedicated accounting tool but a massive, enterprise-grade business management suite that cleverly offers one of its applications for free. By selecting the Accounting app as your one free module on Odoo Online, you gain access to a powerful, full-featured system without charge for unlimited users. This makes it a fascinating contender for the best free accounting software small business owners can find, particularly those who anticipate needing a more integrated system in the future.

The free accounting app is genuinely robust, covering invoicing, bills, bank reconciliation, and comprehensive reporting. Its biggest advantage is scalability; you're starting on a platform that can eventually run your CRM, inventory, and website. The catch is the strict one-app limit. Adding a second app, like Inventory or CRM, immediately moves you to a paid plan. While it can be configured for UK VAT and MTD, it may require more initial setup than UK-specific platforms. However, for a team that needs a powerful, collaborative accounting tool with no user limits and is willing to work within the single-app constraint, Odoo is an exceptional free option.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Strictly limited to one app (the Accounting app). Unlimited users are included. |

| MTD VAT Returns | Supported, but may require more initial configuration than UK-centric software. |

| Core Features | Full double-entry accounting, invoicing, bank reconciliation, expense management, extensive reporting. |

| Best For | Growing teams needing a powerful free accounting tool with unlimited users and future scalability options. |

| Pros | Enterprise-grade platform for free; unlimited users; highly scalable into a full business suite. |

| Cons | Strict one-app limit; advanced features (API, Studio) are paid; UK-specific setup can be complex. |

Website: https://www.odoo.com/pricing

10. ZipBooks

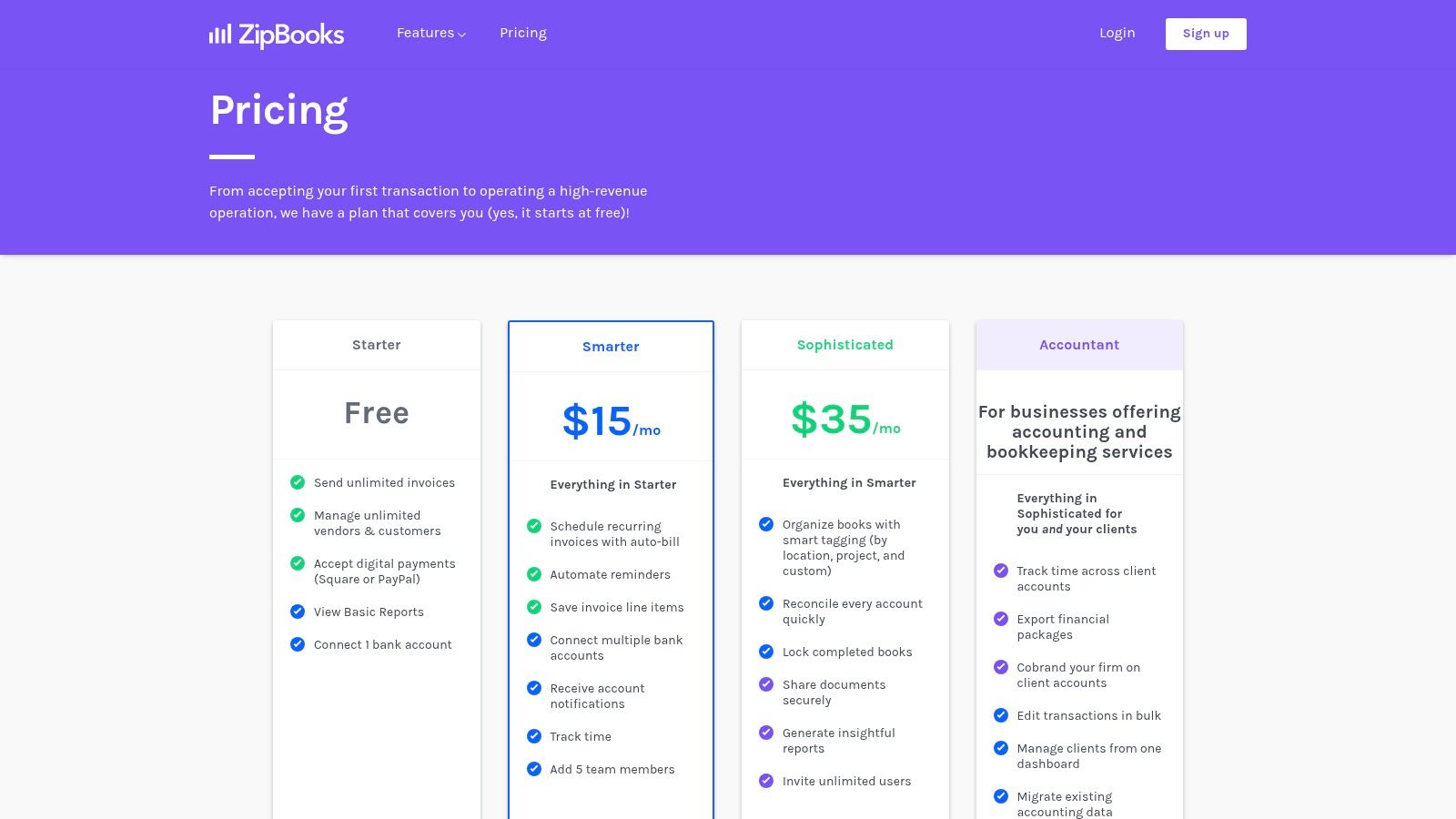

ZipBooks offers a clean and approachable entry point into cloud accounting, making it a solid choice for freelancers or brand-new businesses that prioritise simplicity over comprehensive features. Its free "Starter" plan is genuinely useful, providing unlimited invoicing and the ability to manage unlimited clients or vendors. Unlike many competitors, ZipBooks generously includes a connection to one bank account for free, allowing for more streamlined reconciliation from the get-go.

The platform is designed with a US audience in mind, so its primary weakness for UK users is the lack of specific features like Making Tax Digital (MTD) for VAT submissions. This makes it unsuitable for any VAT-registered business. However, for a sole trader or micro-business operating well below the VAT threshold, its straightforward invoicing, expense tracking, and basic reporting are more than enough to get organised. It’s a great example of best free accounting software small business owners can use if their needs are simple and they want a polished, user-friendly experience without the UK-specific tax complexities.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Unlimited invoices & clients; one bank account connection included. |

| MTD VAT Returns | Not supported. The platform is not designed for UK tax compliance. |

| Core Features | Invoicing, expense management, contact management, basic reports. |

| Best For | UK sole traders and freelancers who are not VAT-registered. |

| Pros | Very clean interface; one free bank connection is a major plus. |

| Cons | US-centric design with no UK-specific tax features like MTD VAT. |

Website: https://zipbooks.com/pricing

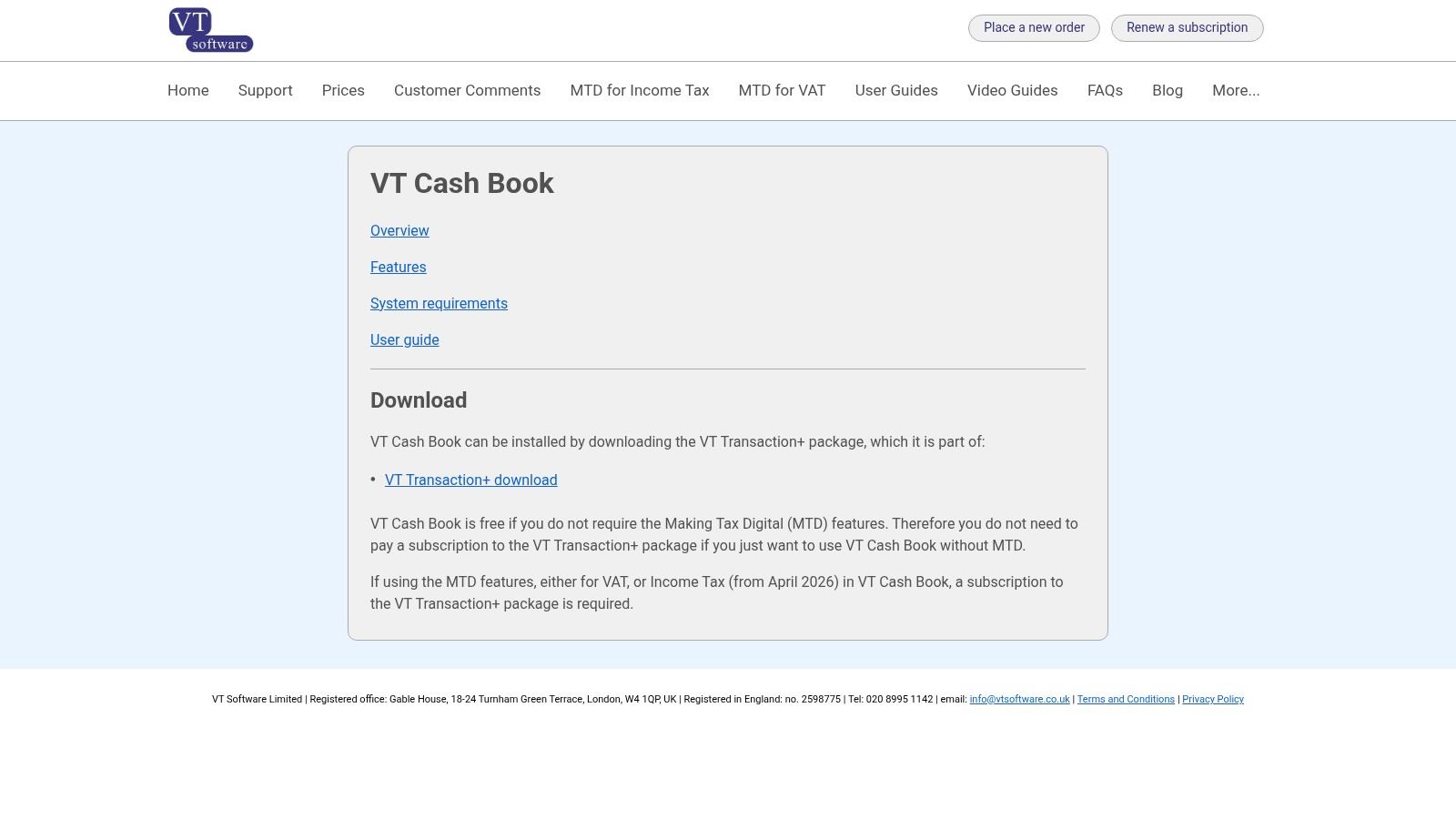

11. VT Cash Book

VT Cash Book harks back to a simpler time, offering a no-frills, desktop-based solution that remains a solid choice for the best free accounting software small business owners who prioritise speed and simplicity over cloud features. Developed by VT Software, a name well-respected by UK accountants, this tool is essentially a digital cashbook. It provides a straightforward double-entry bookkeeping system without the complexity of a full-blown cloud platform, making it ideal for those who just need to track income and expenses locally on their computer.

The software is completely free for basic bookkeeping, which is its main appeal. You can record payments and receipts, reconcile your bank accounts, and produce essential reports like a profit and loss statement. Its lightweight nature means it runs quickly on most machines and you own your data locally. However, its biggest limitation is that critical features like Making Tax Digital (MTD) for VAT are not included. To file your VAT returns directly, you must upgrade to their paid product, VT Transaction+. This positions VT Cash Book perfectly for non-VAT-registered businesses or those who prefer to hand their records to an accountant for final submission.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Fully functional for basic bookkeeping; no limits on transactions. |

| MTD VAT Returns | Not included. Requires a paid upgrade to VT Transaction+. |

| Core Features | Double-entry bookkeeping, bank reconciliation, profit & loss, balance sheet. |

| Best For | Non-VAT-registered sole traders or small businesses comfortable with desktop software. |

| Pros | Genuinely free for core bookkeeping; fast and lightweight; trusted UK brand. |

| Cons | MTD VAT requires a paid upgrade; no cloud access or modern automation. |

Website: https://www.vtsoftware.co.uk/cashbook/download.htm

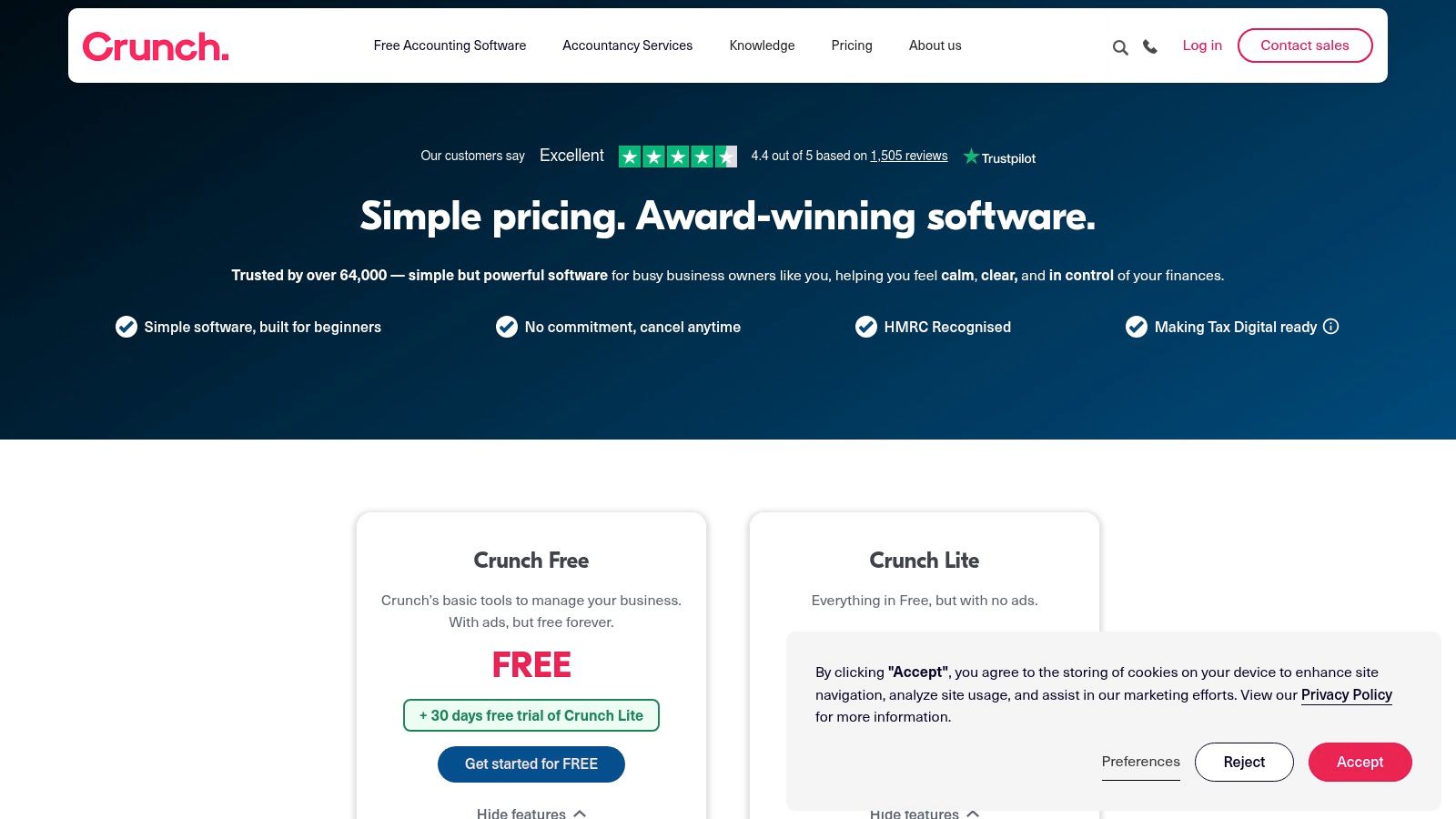

12. Crunch Free

Crunch Free offers a genuinely free-to-use platform that serves as an excellent entry point into organised bookkeeping. While many platforms offer free trials, Crunch provides a permanently free tier supported by ads, making it a sustainable choice for sole traders and freelancers who are just starting out and need to keep costs at zero. It covers the essentials like creating unlimited invoices and tracking expenses, providing a solid foundation for managing your business finances without any initial investment.

What makes Crunch a strong contender for the best free accounting software small business owners can choose is its clear and logical upgrade path. You can begin on the free plan and, as your business grows or your needs become more complex, seamlessly transition to their paid tiers. These tiers remove ads, introduce automation like bank feeds, and can even include full accountant support for tax filings. This scalability is perfect for new businesses that anticipate growth but want to avoid the hassle of migrating systems later on. You can upload bank statements via CSV to reconcile transactions, which is a practical workaround for the lack of direct bank feeds on the free plan.

Key Details & Features

| Feature | Details |

|---|---|

| Free Tier Limits | Unlimited invoices and expenses; ad-supported user interface. |

| MTD VAT Returns | Not included on the free plan; requires a paid upgrade. |

| Core Features | Invoicing, expense management, CSV bank statement uploads, basic reporting. |

| Best For | Freelancers and new sole traders wanting a simple start with a growth path. |

| Pros | Genuinely free UK option; smooth upgrade to accountant-backed packages. |

| Cons | Free version is ad-supported; HMRC filings and automation are paid features. |

Website: https://www.crunch.co.uk/software-pricing

Top 12 Free Accounting Software for Small Businesses: Comparison

| Software | Core features | Quality (★) | Price / Value (💰) | Target audience (👥) | USP (✨ / 🏆) |

|---|---|---|---|---|---|

| Bokio | MTD VAT filing, invoicing, expenses, payroll tools | ★★★★ | 💰 Free tier; paid bank feeds & automation | 👥 UK freelancers & micro businesses | ✨ MTD‑ready freemium; 🏆 clear upgrade path |

| Pandle | VAT submissions, invoicing, multi‑currency, mobile app | ★★★★ | 💰 Free forever base; low‑cost Pro for feeds | 👥 Small UK businesses on a budget | ✨ Budget‑friendly Pro; fast UK workflows |

| QuickFile | MTD VAT, estimates, invoicing, API | ★★★★ | 💰 Free under entry threshold; paid add‑ons | 👥 Small UK firms with light volumes | ✨ Generous usage‑based free tier; API |

| Zoho Books (UK) | Invoicing, expenses, bank recon, VAT support | ★★★★ | 💰 Free if under turnover threshold; paid tiers scale | 👥 Micro businesses wanting growth path | ✨ Integrates into Zoho suite; scalable |

| Wave Accounting | Core accounting, invoicing, optional payments | ★★★ | 💰 Core features free; paid add‑ons for services | 👥 Small non‑MTD businesses, startups | ✨ Truly free core ledger; simple UI |

| FreeAgent | Live bank feeds, MTD VAT, tax timelines, mobile | ★★★★★ | 💰 Paid (free w/ eligible NatWest Group accounts) | 👥 UK freelancers & self‑employed | 🏆 Strong UK tax support; bank‑funded free option |

| Manager.io (Desktop) | Double‑entry ledger, invoicing, inventory, offline | ★★★ | 💰 Desktop edition free; cloud/server paid | 👥 Offline users & small businesses | ✨ Full offline double‑entry for free |

| GnuCash | Double‑entry, AR/AP, scheduled txns, reports | ★★★ | 💰 Completely free (open‑source) | 👥 Tech‑savvy sole traders & small firms | ✨ GPL open‑source; highly flexible |

| Odoo (One App Free) | Full accounting app, invoices, bank recon | ★★★★ | 💰 One app free (unlimited users); extra apps paid | 👥 Businesses needing enterprise features + one app | ✨ Enterprise‑grade free accounting; unlimited users |

| ZipBooks | Unlimited invoices, basic reports, 1 bank conn. | ★★★ | 💰 Free Starter; paid tiers add automation | 👥 Very small or non‑VAT UK businesses | ✨ Simple UI; one free bank connection |

| VT Cash Book | Double‑entry cashbook, desktop tooling | ★★★ | 💰 Free for cashbook; MTD via paid add‑on | 👥 UK users needing lightweight desktop cashbook | ✨ Fast, lightweight UK desktop tool |

| Crunch Free | Invoicing, expense tracking, CSV uploads, basic recon | ★★★ | 💰 Free ad‑supported tier; paid accountant plans | 👥 Freelancers & sole traders starting out | ✨ Ad‑supported free starter; clear upgrade path |

Making Your Final Decision

Right then, let's pull all this together. We've explored a dozen of the best free accounting software options for your UK small business, from MTD-compliant cloud platforms like Bokio and Pandle to powerful desktop stalwarts like Manager.io. It's easy to feel a bit overwhelmed by the choice, but the perfect solution isn't about finding a single, magical "best" tool. It's about finding the one that is best for you, right now.

Your journey to organised finances starts with a clear-eyed look at your own business. A freelance copywriter with a handful of clients has vastly different needs from a small e-commerce shop managing inventory and multiple payment gateways. The single most important takeaway is this: your business stage dictates your software choice. Don't be swayed by a long list of features you'll never use. Focus on the one or two things that will make the biggest difference to your working week.

Key Takeaways Distilled

Let's recap the core principles we've covered to help you choose wisely:

- MTD is Non-Negotiable: For most VAT-registered businesses in the UK, Making Tax Digital compliance is a must. This immediately prioritises tools like Bokio, Pandle, and QuickFile that have built-in, approved MTD functionality in their free plans.

- The "FreeAgent" Advantage: If you bank with NatWest, Royal Bank of Scotland, or Mettle, the decision becomes much simpler. Getting a full-featured premium tool like FreeAgent for free is an unbeatable offer and should be your first port of call.

- "Free" Has a Cost: Remember that "free" can sometimes mean "costs you time". If a free plan's limitations on bank feeds, user access, or invoice volumes force you into hours of manual data entry, it's not truly free. Your time has value, and a small monthly subscription for a paid plan might be the most cost-effective decision you make.

- Scalability Matters: Think about where you want your business to be in a year or two. Will your chosen software grow with you? A platform like Zoho Books or Odoo offers a clear upgrade path within a wider ecosystem, preventing the future headache of a major migration.

Your Actionable Next Steps

Feeling ready to make a move? Don't just pick one and hope for the best. Follow this simple process to land on the right tool with confidence.

- Create a Shortlist: Based on our reviews, pick two or three contenders that seem to fit your business type. If you're a sole trader needing simple invoicing, maybe that's Pandle and ZipBooks. If you're a growing business with an eye on CRM, perhaps it's Zoho Books and Odoo.

- Run a Test Drive: Sign up for the free accounts on your shortlist. Don't just poke around; use them for real tasks. Create a test client, send a sample invoice, and try to reconcile a few transactions. See which interface feels more intuitive and less like a chore.

- Check Your Integrations: Consider the other tools you rely on. Does the software connect easily with your bank? Your payment processor (like Stripe or PayPal)? Your e-commerce platform? A smooth workflow between tools is a massive time-saver.

- Trust Your Gut: Ultimately, you're the one who will be using this software day in and day out. Choose the one that clicks, the one that makes you feel empowered and in control of your finances, not confused by them.

Choosing the best free accounting software for your small business is a foundational step toward financial clarity and sustainable growth. It transforms bookkeeping from a dreaded task into a powerful source of insight, helping you make smarter decisions and build the business you've always envisioned. You've got the information, now it's time to take control.

Tired of manually entering receipt data into your new accounting software? Receipt Router connects directly to tools like FreeAgent, automatically extracting data from your receipts and creating perfectly categorised transactions, saving you hours every month. Give it a try and put your expense management on autopilot at Receipt Router.